The Beautiful & The Dammed: Timberlake, other golf communities rise after water falls

The list is actually longer than that and includes Badin Lake and its golf community of Uwharrie Point about 45 minutes from Pinehurst; Lake Lure about 45 minutes from Asheville and home to a few resorts and golf communities; and the Lake Marion Golf Resort in South Carolina.

The period that resulted in all these manmade lakes may be the greatest example of eminent domain in our nation’s history. In the name of progress and hydroelectric power, dammed

Everything along the shores of Lake Murray and the Timberlake golf community is manmade -- including the shores themselves.

Many of those whose homes were taken in the name of progress held out long enough to receive shoreline property in trade rather than a cash payment from the government. That turned out to be a smart move in many cases since those families sold their land to consolidators who eventually sold to developers who eventually built some of the more interesting and highest quality golf communities in the southeast.

We wrote recently about a visit to Savannah Lakes, in the rural stretches along Lake Thurmond, about 45 minutes from Augusta, GA. The fairways were covered with snow due to unusually low temperatures, even though in a normal winter, golf is played most days. On our way to Savannah Lakes, we stopped at the unheralded but nicely configured golf community called Timberlake, on Lake Murray. The 24-year old Timberlake’s identity suffers somewhat from a lack of an organized marketing effort, the result of a history that includes bankruptcies and a development parceled out to a different local builders each competing with the other for sales.

Johnny Oswald, a resident of Timberlake and, along with his wife Kit, one of the most successful real estate agents handling property in the community, was kind to meet with me on short notice. We met in the newly completed clubhouse (opened last June).

“Our clubhouse,” Oswald noted, “was two trailers after the developer’s bankruptcy in 1990,” when the savings and loan debacle sent the economy and real estate developments like the 561-acre Timberlake into a temporary tailspin. Only 300 lots of a total 2,000 had been sold before the S&L crisis.

It took almost two decades for Timberlake to hit its stride again and for local builders to become confident enough to build 40 spec homes in the community. That, unfortunately, was just before the 2008 crash in the wake of the Lehman Brothers collapse. Thankfully, for the builders and the community, just three of those homes remain unsold. The crash did have a silver lining as it gave some residents and club members the opportunity to purchase the golf club in 2008 and put the club’s destiny in their own hands.

spec homes in the community. That, unfortunately, was just before the 2008 crash in the wake of the Lehman Brothers collapse. Thankfully, for the builders and the community, just three of those homes remain unsold. The crash did have a silver lining as it gave some residents and club members the opportunity to purchase the golf club in 2008 and put the club’s destiny in their own hands.

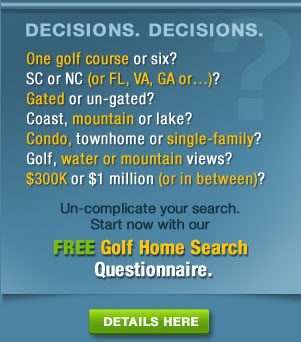

For a golf community centered around a lake and within a short drive of a major U.S. university, the University of South Carolina, Timberlake’s properties seem quite reasonably priced. There are currently about 50 unimproved properties on the market in Timberlake. Wooded lots, including those with views of the Willard Byrd golf course, range from $20,000 to $60,000, although Oswald says those lots are moving more slowly than the waterfront lots, which range from $125,000 to $450,000. Oswald cites construction costs of between $110 and $150 per square foot, a little less than we have seen in other parts of the southeast. Resale homes range from the $200s to $1.5 million for a McMansion on the lake.

Residents are an almost equal mix of retirees and families with children, the latter working in state government or university jobs, as well as professional positions. We were especially impressed that the clubhouse is open virtually every night for dinner, unusual for golf clubhouses these days (Thursday through Saturday is more typical). Monthly dues are on the lowest end at $140 per month, and $40 of that is dedicated to meals (use it or lose it).

Because of the snow, I did not get to play the golf course, but

If life in a golf community on a scenic lake not far from the culture and entertainment opportunities associated with a major university appeals to you, contact me for more information about Timberlake and to arrange a visit.

Willard Byrd borrowed a little water from Lake Murray to place a pond in front of one of the greens at Timberlake. The fairway snow typically lasts just a day in winter, but not this winter. Play was halted in upstate SC for almost a week in January.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Another net loss of U.S. golf courses in 2010

The National Golf Foundation has reported that for the fifth straight year, the U.S. suffered a net loss of golf courses. According to the NGF’s 2011 Golf Facilities in the U.S. report, 107 18-hole-equivalent courses closed in 2010 compared with 46 new course openings; the report does not count courses that are being renovated. The net loss in 2010 of 61 golf courses brings to 220 the total net loss over the last five years, or 1.5% of the total inventory of 18-hole courses.

Other interesting data from the report:

- Golf courses opened in a total of 29 states.

- 60% of the new golf courses were daily fee

- 80 golf courses are currently in construction (excluding renovations)

- Pennsylvania, Illinois, Florida, North Carolina and Texas opened the most courses.

- With 16.5 courses, the South Atlantic region had the most openings.

- At the end of the year, the 15,890 golf courses (18 & 9 holes courses) in the U.S. was just 167 less than the all-time high in 2004. The number of 18-hole equivalents stands at 14,904.5.

Despite some encouraging signs that the U.S. economy might be coming out of its deep freeze, albeit

Of course, bad news for someone always spells opportunity for someone else, and lately I have received inquiries from readers curious about some golf courses for sale and from others who wonder if a golf course in trouble but likely to be purchased by members or some other entity might offer a special opportunity for discount club membership or even lower real estate prices in the surrounding neighborhoods.

The answer is “maybe,” but never forget that every reward has risk attached. Do your homework, ask a lot of questions, insist on seeing financials…in short, trust but verify without putting in any investment up front. This can mean a trial membership in the golf club or renting a home in the community adjacent to the golf course before you buy. In this environment, if pays to kick the tires hard.

Trying to catch some Orlando magic

But I cannot ignore Orlando anymore. I head there on Sunday for the National Golf Industry Show, which runs

No one, no matter what level of interest he has for the business, can possibly spend five straight days in an exhibition hall (in this case, the Orange County Convention Center and a local hotel’s ballroom and meeting rooms). I have already booked a visit to Bella Collina, the former Bobby Ginn palace of excess that is now under the management of Reynolds, which just publicly announced some financial difficulties of its own (see our report yesterday, February 3). It seems Bella Collina cannot catch a break, but the Nick Faldo designed golf course has received rave reviews, and the mansions that are up for sale in the adjacent golf community seem fairly priced, albeit priced mostly in seven figures. My curiosity has the better of me.

I am also slated to play the Bill Coore/Ben Crenshaw designed Sugarloaf Mountain course in Clermont, about 15 minutes from Disney World. Sugarloaf has had a run of bad luck itself. The course opened to rave reviews in 2008, but the surrounding real estate, developed by the troubled Landmar company, was whipsawed by the economy and is languishing. Those who played the golf course early last year were universal in their comments -– wonderful layout, awful conditions with no grass to speak of on the fairways.

“If you can tolerate horrible turf, you’ll enjoy the routing, the setting, and the serenity,” wrote the editors of Golf Odyssey in their latest newsletter. Golf Odyssey played the course in December. But recent reports indicate the greens have been over-seeded and the fairways are recovering.

“In 2009,” wrote Bryan Izatt at GolfClubAtlas.com of his round last week, “the greens were a mess of granulated sand. Today, they are fully filled in with overseed and run smooth, albeit slowly. The rest of the course is over-seeded and still a little scruffy.” No one questions the Sugarloaf layout, which is characteriistic of the designers' do-no-harm-to-the-land approach and spans some of the highest altitude land in the state. I am looking forward to playing the only Coore/Crenshaw course in Florida.

If you have your eye on a particular golf community in the Orlando area, contact me and I will do my best to stop by and give it the twice over -– once for the golf course and once for the surrounding real estate.

Legendary Reynolds amenities up for sale

Possible purchasers for the Reynolds amenities, according to the letter, are Reynolds property owners –- either the property owners association or a smaller group of owners –- and a third-party buyer whom the company says has already tendered an offer.

''With this downturn we found ourselves in the position of having acquired more real estate, and debt, for Reynolds Plantation than

One could assume that, in the wake of last year’s loan of $60 million by Cliffs Communities owners to its developer, Reynolds might have engaged in some quiet negotiations with their own residents before going public with such shattering news. Reports are that rumors about bankruptcy circulating through the community in recent weeks may have forced the owners to make a declaration of a different sort. That is too bad; now that blood is in the water, the sharks will be looking for bargains.

Although we have not visited Reynolds yet, we know people who have, and they were favorably impressed –- some were wowed –- by the golf courses and community. The seven golf courses include designs by Pete Dye, Jack Nicklaus, Tom Fazio and Rees Jones. As with golf communities like The Cliffs and Balsam Mountain Preserve, which worked through their own financial difficulties, give Reynolds a little time to settle down and for the news to work its way into property pricing there. We will keep an eye on who winds up with the family jewels, and at what cost.Cliffs developer stands by his man

All you have to do is call,

And I'll be there, yes I will,

You've got a friend. -– James Taylor

The sky above Tiger Woods turned dark and full of clouds this week. Mere hours after the former best golfer in the world finished tied for 44th at San Diego’s Torrey Pines, one of his favorite golf venues, the developers of the first Woods-designed golf course in the world, in Dubai, announced that project had been shelved. Then on Tuesday, Brendan Steele, Woods’ playing partner for the final round in San Diego, told an online blogger that Tiger had given it less than his best effort on Sunday, and the insult went viral. Say what you will, Tiger Woods is fiercely proud of his game, if not his reputation. Tabloid revelations are one thing, but such open criticism about his golf game is a major slap -- and from a rookie, no less. So much for the fear factor Tiger once inspired.

People can be so cold, but Tiger may take some small comfort that he continues to attract the fierce loyalty of Cliffs Communities’ developer Jim Anthony, even if his statements of support for Woods have some scratching their heads. Anthony told the Asheville (NC) Citizen-Times on Monday that construction on Woods’ first American golf design, The Cliffs at High Carolina, which was suspended in December, would recommence in April. The problem is that Anthony’s chief of sales told Citizen-Times reporters a significantly different story.

Sales Director Mac Triplett: “We're looking at the pace of construction being tied into how sales are going.”

Jim Anthony: “That's not exactly correct.”

Besides the embarrassment of a public disagreement with a member of your senior staff, Anthony’s prediction

Since the High Carolina project has not sold a single property since August, according to the Citizen-Times, the lender group (called ClubCo) issued a letter in December saying that work would be stopped on the Woods golf course because sales were too slow to justify going ahead (at least for now).

We wonder what has changed in a matter of weeks to make Anthony so optimistic about an April re-start. Cliffs members might be wondering too. When we reported on the letter here in December (click to read), one of the Cliffs members told us he believed High Carolina “an unnecessary addition to the Cliffs formula” and that "a split off of High Carolina [is] something I view as inevitable, and hopefully before it destroys value [in] the rest of the Cliffs.” That from one of the lenders.

While Jim Anthony is doing all he can to save face for his friend Tiger Woods, public kerfuffles will do little to influence potential buyers to plop down hundreds of thousands of dollars for a lot -- or to inspire his on-site benefactors with confidence in the investments they have made.

Name Confusion: A second Urbana poised to invade SC golf community market

We were excited to learn recently that Urbana was negotiating to purchase hundreds of unsold and undeveloped lots at the sprawling yet remote Savannah Lakes golf community in rural McCormick, as well as the on-site resort hotel on the manmade 70,000 acre Lake Thurmond, which features 1,200 miles of shoreline. A Texas-invasion of South Carolina would give us golf community junkies something to write about for weeks to come. But, alas, these are two different Urbanas with what appear to be slightly different intentions. Whereas Urbana Communities of Texas appear to be in it for the long haul at The Cliffs, the company known as Urbana Realty Advisors and headquartered in Atlanta has a shorter timeframe.

“Urbana emphasizes the renovation and redevelopment of real estate properties that are not typically the focus of institutional or local entrepreneurial buyers,” says the company’s web site. “Once Urbana has completed the development or redevelopment process, the projects are better suited for a more passive investor such as a pension fund, REIT or insurance company.”

Lipstick for a white elephant?

Whether owners at Savannah Lakes will be comforted by the in-again-out-again approach remains to be seen, but it sure beats the current situation. Ownership at Savannah Lakes is a bit of a mixed bag: Although the Savannah Lakes property owners association owns the community’s amenities, the 80-room lodge next door is owned by a family of developers who shuttered it last year. That white elephant doesn’t inspire confidence in potential purchasers of lots at Savannah Lakes; nor do the 1,500 lots the same family owns throughout the community, lots that have languished despite their reasonable list prices. It is a safe bet that the roughly 2,000 Savannah Lakes residents are keeping their fingers crossed that the deal with Urbana goes through and helps resuscitate the golf community’s fortunes. Last year, less than a dozen properties inside the 4,000-acre Savannah Lakes changed hands compared with an average 60 in previous years. Reportedly, the property owner’s association has already agreed to provide one seat on its board to an Urbana executive when the deal closes.

The 4th green on the Monticello course at Savannah Lakes.

All photos courtesy of Savannah Lakes.

In 2005, the Trupp family of St. Simons, GA, purchased the 1,500 lots at the 22-year-old golf community for a reported few thousand dollars each. The family also purchased the hotel and surrounding cottages, which they were forced to close last March. Today, 600 of the Trupp lots are listed at $19,900 each but they are not moving, even though locals say Trupp has been willing to accept much lower offers. In all, 4,000 of Savannah Lakes’ total of 5,000 lots do not have structures on them.

Originally opened in 1989 by Cooper Land Development, the same company that developed the huge Tellico Lakes golf community in eastern Tennessee and Hot Springs Village in Arkansas, Savannah Lakes has struggled a bit to identify itself in the crowded golf community market in the upstate, lake-dominated region of South Carolina. The development will never be confused with The Cliffs Communities, which is good news for those looking for a quality lake and golfing lifestyle without stratospheric costs. Well-outfitted homes inside Savannah Lakes –- there are 110 on the market currently -- start under $150,000, sporting granite counters, hardwood floors and similar accoutrements. At an estimated $130 per square foot to build, a retiring couple could create a very nice 2,000-square-foot home on a third of an acre for under $300,000, including the cost of one of those aforementioned $19,900 lots. (Note: Lots on the two golf courses run to about one acre and are priced from $40,000, and lakefront lots run between $100,000 and $300,000 on as much as an acre, including a dock permit (an extra $14,000 for a 24-foot covered dock)). Duplex homes at the community’s marina may be the best buys of all for those looking to visit Savannah Lakes part-time; they are priced in the $150s and are ideal as rent-generating properties. (Since 95% of Savannah Lakes’ residents live there permanently, consider all those grandchildren and their parents visiting in the summers.) For those with a Cliffs Communities type budget, a few large $1 million homes are available in the community’s two upscale sections with the best views of the lake.

The 9th green, lakeside, on the Tara course at Savannah Lakes.

Two golf courses, member-owned free and clear

The community’s two golf courses are open year round, yet during my mid-January visit, the fairways were covered with snow during an unusual period of low temperatures. Most winters, snow is rare and snow covered fairways for more than a day or two rarer still. The community’s Monticello course features plenty of water and sand (on all holes but one par 3). The Tara 18 is considered by members to be a little more genteel, its hazards found more in the woods that line the generous fairways than in the water or sand (although there are still enough of those to make things interesting). Thomas Clark of the well-regarded golf architecture firm Ault-Clark designed both courses, which were previously members only but were made available for public play beginning five years ago. The property owners association owns and manages the golf courses and their clubhouses which, according to club officials, carry no debt. In these perilous times, member ownership seems a more secure proposition than ownership by someone else. Membership is free with the purchase of a lot and the payment of the ridiculously reasonable POA fees of $84 per month, but green fees are required now for everyone (reduced fees for members).

Those who want a little extra golf course variety can drive literally across the road from the Savannah Lakes entrance and tee it up at Hickory Knob, located in the state park of the same name. The Tom Jackson designed layout opened in 1982 and is crowded

30 miles to Walmart, 45 to Augusta National

Those looking for an away-from-it-all lifestyle will not be disappointed in Savannah Lakes, which attracts most of its residents from the Midwestern states. As one commenter to a news story about Savannah Lakes wrote online: “…if you go there, you have to really want to get away from society.” My own calibration of a golf community’s remoteness is distance to a Walmart. Anything over, say, 15 miles to the local discount retailer I consider remote since Walmart is executing a Chicken Man style expansion program. (HE’S EVERYWHERE! HE’S EVERYWHERE!) Savannah Lakes is more than 30 miles from the nearest Walmart, located just outside Augusta, GA (and just 45 miles from Augusta National). Atlanta is a good 2½ hours away, a little too far for regular jaunts to find fine dining. As for dining options in the McCormick area, I didn’t get to eat in one of the Savannah Lakes clubhouses but I noted the dining rooms were crowded for Sunday brunch. Was that, I thought, a consequence of good food or no competition in the area? During my hunt for a meal in the town of McCormick, I noticed only a few options and, on Sunday, the only option was a small Chinese food place (it wasn’t bad, actually). If I were building a home in Savannah Lakes, I’d add another $15 or so per square foot and build a mighty fine kitchen.

For those self-sufficient retirees who are community centered, there is plenty to do on site, including a 23,000 square foot health and fitness center with outdoor and heated indoor pools; and even more to do if the Urbana deal goes through and additional entertainment options open in and around the hotel and marina. For two well-regarded golf courses on site, a lake-oriented lifestyle and property owner costs about as low as you will find anywhere in the southeast, Savannah Lakes is worth a look. If you would like to arrange a visit, please contact me and I will put you in touch with the community’s top-selling real estate agent who actually sold the first property in Savannah Lakes in 1988 and probably knows more about the community’s history and charms than anyone in the area.

The 5th hole at Savannah Lakes' Monticello course.

Myrtle Beach private clubs dropping fees, welcoming outsiders

“Without an influx of funding,” writes Blondin, “some private clubs are in danger of failing.”

For some of those clubs, the situation is dire, and only short-term fixes will help them survive. They’ve looked at the balance

The other short-term financial mechanism of current favor is to cut out initiation fees altogether and, in some cases, chop dues. First, that doesn’t exactly endear you to your existing members who paid five-figure initiation fees; justifiably, that may seem like a slap in the face to those who have kept the club afloat through hard times. But even if a club can overcome the frayed relationships with its existing members, the reduction in income is unsustainable over the long haul. Raise the fees in a few years and the newer members will feel caught in a bait and switch. But if you don’t raise the additional revenues, how do you pay for the new landscaping equipment, the workers who maintain the course, and the new irrigation systems that need replacing? You can only defer maintenance for so long; eventually, special assessments will be necessary, creating more membership issues. And should another recession hit, consider how well many clubs have managed this last one. Golf club operators, trained to be good communicators with their memberships and boards, weren't schooled in the kind of creative marketing approaches that are needed to address the new realities of the golf industry.

The private golf clubs that make it past the current stresses are going to be those that combine a little bit of financial creativity with a lot of

There are plenty of other ideas private clubs have not explored. The creative clubs will start thinking outside the box. The others won’t survive, at least not as private clubs as we have known them.

You can read the Myrtle Beach Sun News article by clicking here.

To sustain their viability over the long term, the Myrtle Beach area's few private golf clubs, like the Tom Fazio designed Wachesaw Plantation (5th hole shown above), will need to do more than just cut initiation fees and dues.

Despite guarded gate, almost $2 million home trashed in California golf community

We first learned of the destruction from GoToby.com. Not only does the entire interior look like a war zone, but apparently ripped out toilets and other fixtures were stolen, proving that security gates, even those guarded 24 hours a day, can do just so much.

You can read the article originally posted at the Orange County Register’s web site in its Huntington Homes section (click here). Warning: Some photographs of the destruction may be disturbing to impressionable homeowners who respect property and the rule of law.

Review: Bulls Bay Golf Club, Awendaw, SC

by Tim Gavrich

Tim Gavrich is a senior at Washington & Lee University and a four-year starter on the school’s golf team. He has written frequently on golf architecture and other golf issues at this site and at Examiner.com, where he is editor of the magazine’s Hartford (CT) golf edition.

A Mike Strantz masterpiece and legacy

The term “great” gets thrown around often and loosely. Great movie, great meal, great football game -– everyone has their own subjective definition of what constitutes greatness. With some trepidation, therefore, I define the characteristics of a great golf club as having a course, practice facility and cozy, inviting clubhouse (with tasty food) that makes members want to spend all day on-site. A well-appointed locker room certainly can’t hurt either, and neither can a friendly group of members and attentive, helpful staff.

On a miserably cold, rainy January day, my father and I found all these qualities at the private Bulls Bay Golf Club in Awendaw, SC. Bulls Bay is located about half an hour north and east of Charleston, just off Highway 17, the main coastal road that starts in Winchester, VA, and heads east before moving down the Carolinas coast, bisecting Florida and ending near Fort Myers. Although many cars pass by the Bulls Bay entrance every day, few probably notice what is behind the modest sign depicting a bull’s skull, the club’s main logo. The entrance road unwinds through trees beyond a keypad-activated gate, and as you turn out of the woods, you are greeted with a view of a man-made hill more than 60 feet high, with a clubhouse at the top and golf holes surrounding it, reminiscent of the iconic top-of-the-hill clubhouse at Shinnecock Hills Golf Club on Long Island.

The first hole gives a strong hint of designer Mike Strantz' overall theme at Bulls Bay -- generous landing areas that must be negotiated carefully to have reasonable approach shots to the imaginative green complexes. From the 1st tee, the a drive down the right center provides the short way home. Too far right, and you might be playing for a "barkie" par.

-- All photos by Larry Gavrich

The Bulls Bay bag drop and cart barn (the course would not be an impossible walk, but most players choose to ride) are located down the hill from the clubhouse, beside the sprawling practice facility. The range is wide enough to accommodate dozens of players, and the putting green is expansive as well. Short game areas lie at the other end of the range near “The Ranch,” a high-tech golf instruction pavilion available for use by the membership. Flyers posted in the clubhouse commend The Ranch’s “Most Improved Players,” a nice touch I have not seen at any other club. The clubhouse bulletin board also touts the comparatively low handicaps of its membership. The clubhouse itself is cozy and well appointed, and the locker room is highly functional without being ostentatious. The dining area, the staff, the food and drink they served us was wonderful; the Italian chicken sandwich might have been the best thing I’ve ever eaten at a golf course.

down the hill from the clubhouse, beside the sprawling practice facility. The range is wide enough to accommodate dozens of players, and the putting green is expansive as well. Short game areas lie at the other end of the range near “The Ranch,” a high-tech golf instruction pavilion available for use by the membership. Flyers posted in the clubhouse commend The Ranch’s “Most Improved Players,” a nice touch I have not seen at any other club. The clubhouse bulletin board also touts the comparatively low handicaps of its membership. The clubhouse itself is cozy and well appointed, and the locker room is highly functional without being ostentatious. The dining area, the staff, the food and drink they served us was wonderful; the Italian chicken sandwich might have been the best thing I’ve ever eaten at a golf course.

The members are easygoing too, if those who greeted us at the back of the 9th green are indicative. My father had just sunk a putt for birdie after skimming his approach over the back of the putting surface, up the hill beneath the clubhouse and then down to just 2 ½ feet from the cup. “Why didn’t you give him the putt?” one of them ribbed me. (It was cold, rainy, and we were playing our typical match, and I was down a few holes.) Then they offered us their heated golf carts for the remainder of the round as they had decided it was just too cold and wet to play. Although by that time we were used to the conditions and declined, we were more than impressed with the kindness of strangers.

Obviously, all the peripheral amenities at Bulls Bay are well in place, but the star of the show is the golf course, which opened in 2002 and was the last original design of architect Mike Strantz before he passed away in 2005 at the age of 50. In keeping with the Strantz signature, Bulls Bay has a radically different look from most other golf courses, featuring 18 holes that are as imaginative and artistic as any I’ve encountered in my dozen years of golf. Yet whereas other Strantz courses present severe and, some would say, “wild” routings -- Tobacco Road near Pinehurst and Tot Hill Farm in the Asheboro, NC, area come to mind -- Bulls Bay is more restrained though no less spectacular. And hole-to-hole, it may be the most harmonious layout in the architect’s small, but distinctive, portfolio of designs.

The green at the par 3 3rd hole at Bulls Bay.

The first hole is a perfect introduction to the style of the golf course. A 465-yard par 4 from the back “Maverick” tees (rating 75.2, slope 135), the fairway is nearly 100 yards wide but plays smaller due to a lone tree that looms about 100 yards short of the green on the right. The best line off the tee is to the right half of the fairway, but venturing too far right could cause the sprawling live oak to affect the approach shot. Conversely, hitting a tee shot well out to the left lengthens the hole considerably and yields a more awkward angle of approach to the green. Such conundrums abound at Bulls Bay and make for a round that can be at times exhilarating and at others maddening.

Strantz will never be confused with Donald Ross, but at Bulls Bay at least, his wide fairways are virtues -– easily reached yet demanding appropriate positioning to set up fair approaches to the challenging green complexes. From the diminutive first green to the enormous, heaving 11th, the greens and green complexes at Bulls Bay present an enormous variety of slopes and options. The first green is the smallest and the flattest, but that makes sense as it eases the player into the round. The 11th green, by contrast, is more than 60 yards deep with an enormous ridge running through it. Many other putting surfaces contain contours that can be used to maneuver the ball around from on and off the green. I found myself thinking repeatedly, “I could spend an hour hitting putts and chip and pitch shots on and around this green.” I don’t think that at many golf courses, but at Bulls Bay, it was nearly an every-hole occurrence.

All in all, I would consider Bulls Bay to be in the very top tier of golf courses I have played, along with the Old Course at St. Andrews, Sunningdale, Pinehurst No. 2, Palmetto Golf Club (Aiken, SC), Yale, Shelter Harbor Golf Club (Charlestown, RI) and Newport Country Club. Bulls Bay deserves to be in such company.

[Editor’s note: As a member of the South Carolina Golf Rating Panel, I was invited to play the otherwise private Bulls Bay and brought along my son Tim, an unabashed fan of architect Mike Strantz. I echo Tim’s comments in his review, and would add that Bulls Bay is a great course to grow old on, by which I mean the fairways are so wide that a position player, as opposed to a long hitter, can have a most enjoyable round time and again. Even from the penultimate blue (“Skull”) tees at nearly 6,700 yards, the rating is a fair 71.6 and the slope a mere 125. And even a 70-something golfer in reasonably good shape should have no problem negotiating the white, or “Bull,” tees at 6,100 yards, a 69.1 rating and 120 slope. Membership initiation fee at Bulls Bay for Charleston area locals is $75,000; national membership is $50,000. Both “deposits” are refundable under certain conditions; see the Bulls Bay web site for details. http://www.bullsbaygolf.com. Home sites adjacent to the course are priced from the high $200s. -- Larry Gavrich]

The home hole on the front nine, a par four dogleg left, sweeps up toward the clubhouse. The high bank behind the green encourages a strong approach shot, literally.

Clarifying building costs on Daufuskie

When we visited Daufuskie Island a few years ago, a local real estate agent explained that the costs to build a home in the Haig Point golf community were around $450 per square foot. The community is served by ferry service; no vehicles are permitted on the island. The high cost of construction, our real estate contact explained, was due to the costs of shipping materials over on barges and bringing workers in by the ferry.

Although the costs of materials and labor have dropped everywhere in recent years, we assumed the costs of shipping had not decreased materially (if anything, fuel costs have risen since our initial visit to Daufuskie). But a resident of Daufuskie has written to tell us that the shipping costs add only 20% to 30% to total construction costs.

“We built @$200 a square foot with hardwood floors, soapstone counter tops, picture frame molding, marble bathroom sinks, etc,” he wrote. Such from-the-horse’s mouth testimony, confirmed by a local realtor we know, is good enough for us.

Real estate agents and developers on the mainland have been quoting us figures of $130 to $150 per square foot for upscale materials. With nicely situated properties at Haig Point selling for less than $100,000, you could build a brand new 3,000 square foot home for about $650,000, including land and club initiation fees for play on the private 27-hole Rees Jones golf course. That seems like a good deal for those intrepid souls who love the hassle-free, pollution-free island life.