Reader comments on Charleston area golf community prices

"Larry," Elliot wrote, "I've been enjoying your recent and spot-on articles regarding the price shifts, opportunities and pitfalls in second-home purchases throughout the south, in general,

My response to Elliot:

You ask a great question about Charleston. Overall, Charleston market prices are down about 6% or so year over year, depending on whose charts you are looking at; that is one of the most stable performances in the nation. So, yes, there is a little insulation market wide. The top end of the market is typically the last segment to suffer price erosion. Given all the headlines, we can sometimes lose sight of the fact that many, many people made a lot of money in the equities markets run-up before the crash, and many of those were as smart about conserving their money as they were in making it. They weren't the ones who got caught up in the irrational exuberance thing and bought three or four spec condos in Miami with loans they could not pay back if prices leveled off, let alone dropped.

So, one response is that there is still some money out there chasing a few choice properties, some of which are in the Charleston Magazine listings you reference. I do know that

That leaves the vacation homeowner a little vulnerable to local real estate agent "puffing," a term of art in the industry. It means real estate agents tend to paint a better picture of a property than it deserves. So these agents, who are scrambling for listings more than ever in this ugly market, are pitching over-inflated prices to these potential clients to win them over. (Note: I wrote a piece a few months ago about taking the middle of three estimates when it comes time to sell my own house.) The second homeowners don't understand the local market as well as the local agents do, so they trust the estimates. I think this may be inflating those listing prices in Charleston Magazine as well, and keeping the properties from selling.

If my assumptions about the high end of the Charleston market are correct, then the key

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Blinded by the light: NAR economist pumps artificial sunshine into dark situation

We should have figured that it would not be long before factions within

Now, we should not fault the homebuilders too much for the housing crisis; they were feeding demand, not creating it. But pushing right behind them for a handout now is the more culpable Lawrence Yun, chief mouthpiece cum economist at the National Association of Realtors (NAR), who pumped enough sunshine into the housing market even after the solar eclipse began that unsuspecting realtors and investors nationwide were burnt (literally) in the glare.

For a housing market economist, Mr. Yun does not seem to know very much about his own market's basics. In trying to run his jive by the government, Yun has

You don't need to take a real estate course or Econ 101 to understand that the housing market is driven by supply and demand. Sorry for the basics, but when demand is up and supply down, prices rise. And when supply is way up, as it is now in spades, and demand way down, then prices drop precipitously.

You can manipulate supply in some ways, including by stopping the building of homes and by dropping prices radically on the vast supply of homes on the market. Foreclosure pricing accomplishes some of that, although there are prices below which even banks are reluctant to go. But on the demand side, you cannot force people to buy a home no matter how many incentives you build in, financial or otherwise. Despite the sub-prime mess, most people do know that, at the end of the day, they have to pay back their loans, and those who don't know it are about to find out when they are forced out of their homes.

In short, no matter how many incentives you throw at them, those who fear for their jobs and income are not going to buy a home now. They've read the stories about Detroit and Lehman Brothers and Fidelity and Boeing and so many other companies that are cutting staff. Those who are calling to work on the supply side first, by keeping people in homes that otherwise might make it to the market via foreclosure, have it right. Lawrence "Pollyanna" Yun isn't one of them.

Home sights: Views from planned community courses run the gamut from ugh to ahh

Bear Lake Reserve's nine holes by Nicklaus Design covers the community's mountaintop, with home sites set well back.

Bear Lake Reserve's nine holes by Nicklaus Design covers the community's mountaintop, with home sites set well back.

Before my first trip to Paris many years ago, a friend told me, "There is only one problem with Paris. Too many Frenchmen." It didn't ruin the experience for me; Paris remains among my favorite international cities.

But to borrow a page from my friend's line, the only problem with planned-community golf courses is too many darn houses. Put another way, I have not yet met the golfer who prefers lining up shots toward a gable on the

I have played community courses where it was hard to keep an occasional shot from bouncing off a roof, and others where it was hard to spot a roof. At Castle Bay, a Scottish links style course north of Wilmington, NC, that was designed by its developer, the memory of a surprisingly entertaining round was pretty much neutralized by a string of homes packed against each other along the 18th hole. That is not the kind of last (or lasting) image any golfer wants from a round. At my own vacation home course at Pawleys Plantation, a couple of years ago the developer built a string of condos not more than 30 yards from the edge of the 15th fairway. Because the hole is a dogleg left, the aiming line from the tee is at the second-floor bedroom deck in Unit #1 down the right side. Slightly pushed shots wind up out of bounds right or, potentially, into the screen fronting one of the condos' porches. Jack Nicklaus certainly did not have that in mind when he designed the otherwise splendid course in the late 1980s.

More often than not, though, the name designers (and developers) get it right, justifying their six- and seven-figure fees. Tom Fazio is among the best,

Cuscowilla, the Coore/Crenshaw course in rural Georgia that shows up perennially on best residential golf course lists, also does an excellent job of keeping its houses at a few hundred yards distance (one of the reasons it rates so highly). Other, more recently developed mountain communities seem to be increasingly sensitive to the yin and yang of homes and course layouts. Balsam Mountain Preserve (Palmer) and Bright's Creek (Fazio), for example, two North Carolina communities I visited a couple of months ago, have set their home sites up and away from their golf courses. Ditto Bear Lake Reserve, whose nine-hole Nicklaus Design course occupies top of the mountain status in the Tuckasegee, NC, community, its few adjacent home sites tucked behind trees and well away from the field of play.

Pete Dye also seems particularly adept at separating fairways from hulking mansions. At his Oconee Course at Ford Plantation, south of Savannah,

Generally speaking, golf communities with the most expensive properties and golf fees, like the Carolinas' Cliffs Communities, put a safe distance between fairways and homes. If you are going to pay $150,000 for initiation fees, more than $600 a month in club dues, and upwards of $1 million for a home site, you should expect the views from the course to be as luscious as the views from your home.

At Ford Plantation, Pete Dye and the developers used natural elements, like ponds, to separate homes from the course.

Temperature checks: Near perfect golf weather in the south tomorrow

16th hole, Longpoint Golf Club, Amelia Island, FL (63)

16th hole, Longpoint Golf Club, Amelia Island, FL (63)

They are pulling the flagsticks out of the greens on many of the courses near my home in Connecticut. With temperatures today in the 20s, some courses are caving in before the traditional after Thanksgiving shutdown. But a few gas tanks drive away, tomorrow is going to be a beautiful day for golf, with no rain in sight in virtually all parts of the southern U.S. and temperatures ranging from chilly to balmy.

If you are dreaming about or seriously contemplating a move south, here are tomorrow's expected high temperatures at a few choice golf courses, most of them in or near golf communities, in the southern U.S. (golf course, location and expected high temperature indicated).

18th hole, Dunes West, Mt. Pleasant, SC (58)

6th hole, Avery Ranch Golf Club, Austin, TX (74, am showers)

Chapel Ridge Golf Club, Chapel Hill, NC (53)

4th hole, Oxmoor Valley, Birmingham, AL (60)

18th hole, Governors Land, Williamsburg, VA (49)

3rd hole, Fox Den Golf Club, Farragut, TN (54)

Did Coldwell Banker promotion make customers pay?

Coldwell prepared for the promotion by conducting a survey of its

In announcing the promotion, CEO Jim Gillespie said "we believe it is critical for Coldwell Banker, as an industry leader, to help serve the needs of those listing homes with a Coldwell Banker broker and to help move the U.S. real estate market in the right direction."

Let's be clear; there is no way that a fraction of 25,000 homes in a market with hundreds of thousands of homes in foreclosure was going to move

Second, any real estate agent who considers his customer's asking price too high is making an admission that he -- the agent -- did a lousy job of communicating up front. It is the agent's job to use reasoned logic to guide the client toward a reasonable price. But in this market, you can imagine that the pressure to acquire a listing is intense, and that thousands of times across the land, agents begging for a listing are saying things like, "Sure, Mrs. Jones, we can get that price even in this tough market." Then a few weeks later, "Mrs. Jones, we never expected the market to be this bad, so let's take advantage of the company's promotion and drop the price 10%." That is as icky as it sounds, the real estate equivalent of bait and switch.

Some real estate industry observers see Coldwell's promotion as less

Coldwell missed reconciling a key ingredient of the promotion, buyers. Many of their listing clients are in competition with the hundreds of thousands of properties in foreclosure, and a 10% cut doesn't begin to approach the prices at which the banks are willing to unload their own inventories of distressed homes. And many real estate agents, Coldwell's included, are conducting "short sales" for which the sales price is less than the amount remaining on the owner's mortgage. Those, of course, drag down market prices as well. In short, the relatively few buyers able to finance a purchase with cash or to qualify for a loan have many, many low-priced alternatives.

And, finally, there are the dismal unemployment numbers, which will continue to get worse before they get better. We may be headed toward a 10% national figure if the auto industry restructures, which seems inevitable. Those without a job not only won't be buying houses soon, they also may be putting theirs on the market, priced to move quickly. That will just add to the immense pricing pressure.

Coldwell Banker had hoped that a defibrillator was just what the doctor ordered to move properties listed by its 25,000 customers and help move the housing market forward. Judging by the latest housing figures, the patient is still on life support.

All in one: Play golf and look for a home at the same time

The Coore/Crenshaw layout at Cuscowilla in Eatonton, GA, is consistently ranked in the top 3 of Golfweek's "Best Residential Courses" list.

By Christmas time, we golfers north of the Mason-Dixon Line will be about two months past prime golf season and starting to shiver at the prospect of another three or four months of no golf. We can ease our pain by going online and checking out some of the vacation bargains southern golf resorts and hotels offer between Christmas and New Year's. Some golf communities actually offer even bigger bargains, as long as you will sit still for a couple of hours of a real estate tour. The so-called "discovery packages" are good ways to learn about a community first hand and to check out their golf courses up close.

I have personally visited the following communities and can recommend them as worthy of consideration. I would be happy to put you in touch with a representative of any of these communities to arrange your discovery package.

Albemarle Plantation, Hertford, NC.

The Plantation's package might be the best bargain in America, just $79 per couple for two nights in the community's Marina Villas. One round of golf for two on the Dan Maples designed Sound Golf Links and breakfast each morning is included. The only requirement is that you meet with a real estate agent and take a tour of the Plantation. Full use of pool, fitness facility and tennis courts are also included.

River Landing, Wallace, NC.

Located just off I-40 between Wilmington and Raleigh, River Landing is easy to reach by car but still out in the country. The community includes 36 holes of Clyde Johnston designed golf. A round of golf for two is included in the two-night stay (Friday to Sunday or Tuesday to Thursday), along with golf lessons and a tour of the community. Cost is $139.

St. James Plantation, Southport, NC

St. James offers as much golf as any community between Wilmington and Myrtle Beach, 81 holes of golf in all, although the Plantation Preview Package will make you choose your one round of golf from among three of the courses. The price is $199 per couple and includes two nights in an on-site condo and access to the private beach club (a few miles away), tennis and all amenities. Of course, you are required to take the customary real estate tour.

Cuscowilla Golf Club, Eatonton, GA

Cuscowilla, a golf resort and residential community on the shores of Lake Oconee, does not offer a discovery package per se, but its winter golf package for two amounts to essentially that (without the mandatory real estate tour). The $245 per night package (plus tax) includes golf for two on the terrific Coore/Crenshaw course and lodging in one of the community's Lodge Villa Suites. Cuscowilla is just about an hour from Atlanta International Airport.

Woodside Plantation, Aiken, SC

Woodside provides lodging at a choice of area inns, with prices running between $145 and $189 for a two-night stay in the town of Aiken. That's a good thing because Aiken is a charming town. Included is a round of golf for two on Woodside's Nicklaus Design course, dinner for two in the clubhouse and a $50 pro shop credit. The required real estate tour takes about two hours.

Osprey Cove, St. Marys, GA

Local boy Mark McCumber designed the course and your "stay and play" package includes a room overlooking his 18th hole, as well as a round of golf for two, access to the pool, hot tub and fitness center. The $99 per night package also provides access to dining and shopping in the pro shop. Guests have the option of foregoing golf and instead taking a boat excursion to Cumberland Island where the wild horses roam. Just leave a little time for the real estate tour.

Cooper's Point, Shellman Bluff, GA

You will have to pay for your golf, but when I played a few years ago, it was something like $40. The discovery package does include a night's stay in either a luxury hotel in Savannah or a bed and breakfast inn in nearby Darien, as well as dinner for two at one of the local seafood restaurants (Shellman Bluff is a tiny fishing port and nearby Brunswick is the unofficial shrimp capital of the east coast). Total cost is $199 for 1 night and $299 for 2 nights, real estate tour (of course) included.

The Landings, Skidaway Island, GA

At $325 for two nights and $450 for three nights, the discovery package at The Landings near Savannah is a little more expensive than the others, but with six golf courses on site and unlimited access to everything, including dining in the four clubhouses, the value is there. One of your fellow readers purchased a home in the Landings and could not be happier, and I was impressed with the help he and his wife received from an on-site agent. If you would like to talk with that agent or an agent at any of these communities, please let me know and I will make it happen.

The Arthur Hills designed Palmetto golf course at The Landings is one of six immaculately groomed courses in the 4,500 acre community near Savannah.

Haig Point agent weighs in

I am gratified when readers send me their opinions about things I write or add important information. Bea Wray, a real estate agent who lives in Haig Point on Daufuskie Island, wrote the following about the article immediately below. I am happy to put any of our readers in touch with Bea.

I built our house for $210 per square foot. Several wonderful builders have their own bunk houses on the island, so crews spend the week here, appreciate the steady work, and put out a full day. Of course, this drives costs down. [Editor's note: And speaking of driving costs, they are almost non-existent since no cars are permitted on the island; everyone uses golf carts.]

Plus, since the community already has over 250 residents, there is a staff of bellmen, luggage carts, trailers, etc. in place for very easy delivery to your door. So, whether I order items for my home, groceries, even a late night sump pump, the cost is dramatically less than it would be if I lived in nearby Sea Pines on Hilton Head.

A $7,900 lot in a great golf community? Yes, but...

The Rees Jones course at Haig Point plays to 29 holes, the extra two providing two alternate par 3 routings.

Haig Point on Daufuskie Island, SC, is one of the most peaceful communities I have visited, and it includes a terrific 29 holes of Rees Jones marshland golf, first built in 1986 and renovated last year. The 29-hole layout includes two additional par 3s where members have a choice of straight-on shots or carries over the marsh.

Coastal property prices had remained pretty steady through the first few months of the housing crisis. Living within Frisbee-throwing distance of a beach is a turn-on for those who can afford the privilege, but now even in prized coastal properties like Haig Point, inventories are up and, consequently, prices are dropping.

Still, $7,900 for a wooded lot in Haig Point, even a small one, was a surprise. How could that be?

After doing some research, it seems the low price is a function of

Those who had already built the few homes in Haig Point under the IP plan were offered the unsold lots at ridiculously low prices. One local agent told me they basically "gave them away." The $7,900 lot is a remnant of that time.

I won't belabor the obvious point that the housing crisis is having a savaging effect on prices across all manner of properties. Beautiful and peaceful though it may be, Daufuskie's isolation appeals only to a small niche of intrepid souls. And whereas people commute via frequent ferry service from the islands that dot Puget Sound to Seattle, the ferry from Haig Point travels to Hilton Head, not exactly an urban business center. Residents of Haig Point, therefore, tend to be those relatively few who willingly trade modern and convenient services for splendid isolation. That is not a broad market.

Three modern high-speed ferries run between Haig Point and Hilton Head. They are expensive to maintain, and when you throw in the golf course

What of the home one might build on this bargain-priced lot? Because you cannot get labor or construction materials onto the island without using the ferry or a helicopter, construction costs are among the highest anywhere, an estimated $400 to $500 per square foot. That modest cottage, say 2,000 square feet, could approach $1 million in costs. By way of comparison, a 3 BR, 3 ½ BA Craftsman style cottage at Haig Point that overlooks the 10th fairway is on the market currently for just $489,900, golf membership included. And there are plenty of other bargains just like it.

If you are interested in property at Haig Point, let me know and I can put you in touch with an agent who knows the island well. While visiting, be sure to check out the Daufuskie Island Resort and its two outstanding 18-hole courses, one an early Jack Nicklaus design and the other by Tom Weiskopf and Jay Moorish.

Taking new friends at their words

New Bern, NC, is a "small town gem," and the local community of Taberna's golf course shows polish of its own.

New Bern, NC, is a "small town gem," and the local community of Taberna's golf course shows polish of its own.

One of the great things about my job is that I become friends with people from around the world without actually meeting them. They find my site, I find theirs, and we wind up exchanging chitchat about golf, golf communities, and even politics. The relationships grow without any of those icky issues of body language or the nuances of pauses or sighs that

I have made two especially interesting contacts in the last few weeks with people whose well-written and well-constructed web sites cover different territories than the one you are reading now but are excellent resources for those contemplating a relocation to a golfing area -- or who dream of such.

Jeffrey Prest is the blogmaster for CheapGolfsFinestHoles.com, a web site dedicated to exactly what the name implies. He reviews "first-rate holes on third-rate courses" whose green fees are about £30, or $50 US at the current exchange rates. It is an inspired and perfectly timed idea in the current economy, especially for those of us -- count me in the group -- who are seriously contemplating giving up their private club membership and hunting for bargains in daily fee golf. As Jeffrey grows his portfolio of golf holes, including a fair number in the U.S., his site will only get better.

As I write this, my new friend Bill Durell and his better half are driving the back roads of the U.S. south, somewhere between Mississippi and his winter home in Texas. Armed with a camera, map, notepad and sense of adventure, the Durells are stopping at as many small towns as they can along the way. Those towns that meet their strict specs (see their web site for the criteria) make the grade and get the full treatment at SmallTownGems.com. That means dozens of photos and a full description of local history and lifestyles. I admire Bill's brutal honesty; he has a "disqualified" list of towns that fall short of "gem" status and a Hall of Shame for those that fall way short.

Some of the small town gems are in great golfing areas and are worth considering if you don't necessarily require the amenities offered in many planned communities. Some golfing rich small town gems that receive a gold star from Bill include New Bern, NC, Williamsburg, VA, Jonesborough, TN, Fernandina Beach and St. Augustine, FL, and Madison and Jekyll Island, GA.

New York condo price protections: Sign of things to come in southern communities?

Real estate is all about supply and demand, and right now in New York City, as it is in most markets nationwide, there is too much of the former and

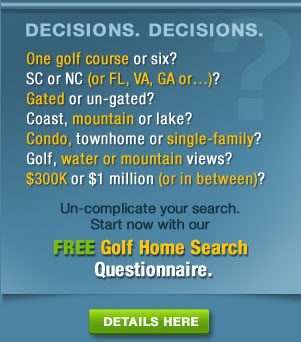

Developers holding dozens of unsold new condos have to do something more than offer a few upgrades in kitchen appliances or a part of closing costs in order to entice the nervous. According to an article in the Real Estate section of the Sunday New York Times this weekend, those developers are beginning to mimic electronics and other retailers with a series of "price protection guarantees" that anyone contemplating property in the southern U.S. might do well to consider. The way it works is straightforward and contractual: If you sign up to pay $500,000 for a unit, for example, and the same (or almost the same) unit elsewhere in the building sells for $475,000 before you close, you get the lower price.

The guarantee is a little easier to execute in a condo complex where units are essentially the same size and configuration than, say, for properties in a golf community. But if two parties to a real estate transaction agree, you can write just about anything into a contract (short of violating local zoning laws). For example, if you are interested in a lot adjacent to a golf course but want some price protection, you could negotiate a clause with the developer that would reduce your purchase price if another lot on the golf course sells for less than yours (on a dollar per acre basis). Barring that, you could try for a contingency that says if similar properties sell for less than the price you signed up for before your closing, you can back out of the deal.

If you are that relatively rare person in the market for a home or property, don't be afraid to get creative. You have all the leverage, and you would be foolish not to push for the best possible deal.