Blind trust: Developers live by amenities, and some die by them

Most golf community developments are successful. Of course, at a time of ascending real estate prices, virtually all of them were successful. But now, as the landscape literally (and figuratively) changes, we see more and more of these communities in trouble, especially those opened in the last year or two. Their problems remind us that, in essence, each of them is built on something of a pyramid.

In its simplest terms, Madoff's illusion started when he engaged a group of initial investors to put up $17 billion, with the promise of

Of necessity, a golf community is built on a similar pyramid. A developer borrows money from one or more lending institutions -- like Bernard Madoff's earliest investors -- on the basis of plans to sell home sites and build homes. Those bank loans help the developer prepare the land and, perhaps, set up a sales office, hire staff, create plans for the on-site amenities and hire a golf architect. In many cases, the developer plans to also build the golf course early as a way to encourage purchases of property ("dirt," as developers refer to home sites). All this is done with an eye to engaging additional "investors."

The bank loans support these early expenses, but the developer must sell properties to continue to build the amenities, such as a community center,

In the worst case, you get a death spiral, as at Grey Rock, a mountain community in North Carolina that not only never built its promised amenities but also found a way to sell more than 400 home sites over a couple of years to people who never built on a single lot (the developers themselves built one of those Southern Living showcase houses to help sell a few properties). That is a clear signal that these were mostly speculators trying to catch a continuing up-tick in an irrationally exuberant real estate market. One day, Grey Rock's developers just picked up stakes, left the site (and a few of their other holdings in similar shape) and declared Chapter 11.

So what can we learn about the Madoff debacle and the lesson of Grey Rock when shopping for a golf community property? Madoff promised consistent returns, no matter the

It is good to know something about your fellow investors in a community. Are they speculators or serious about building a home there? You don't want to be one of the few property owners interested in living in the community. That is not only bad from an investment standpoint, but ultimately not too healthy for your social life. If a community has been overrun with speculators, you will probably notice it by the paucity of homes built and the lack of amenities, a deadly combination. Steer clear, no matter how good the deal seems.

Look for promised amenities at least under construction or, better yet, completed and being used. Check with the homeowners association to

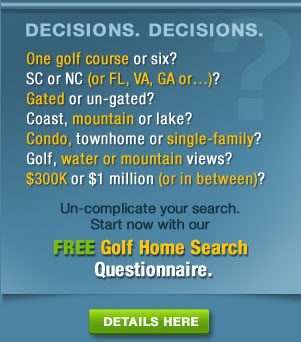

In the current environment, there are great bargains in new homes but also great bargains in re-sales that just might fill the bill for you. All things being equal, if I had a choice between a new house at $400,000 in a community with amenities still to be built, and a $500,000 home that is six years old but in a fully built-out community, I would likely give the nod to the latter on the basis of lower risk. Of course, that assumes you are buying a place to live in rather than as an investment. If you choose to make a pure investment in real estate in the current environment, all I can provide you are my best wishes.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Florida, Long Island golf club members bilked big time

Fitzgerald: "The rich are different from you and me."

Hemingway: "Yes, they have more money."

Such a conversation probably took place before the Great Depression and before many of the Roaring Twenties rich lost everything. Today, as Yogi Berra would say, the wealthy are suffering "déjà vu all over again." In that regard, they are no different than the rest of us.

The latest story of the rich getting poorer lands at the top of page 1 of the Wall Street Journal today, in an article about a huge default by a private investment firm led by Wall Street legend Bernard Madoff. His investors, all of them high-wealth individuals, may have lost upwards of $50 billion in what Madoff confided to his sons -- a day before they turned him in, according to the Journal -- was a giant "Ponzi scheme."

Many of the bilked are members of elite country clubs in Florida and on Long Island (NY). There is no telling what percentage of their net worth they invested with Madoff nor what effect, if any, these huge losses might have on membership rolls at the Palm Beach Country Club, Fresh Meadows Country Club on Long Island and the other clubs whose members considered big investments in Madoff's fund an emblem of status. But we can be sure that other golf clubs in Florida, struggling just to survive under the weight of the housing and economic crises, will be eager to offer deep discounts to those who may no longer be able to bear the expense of keeping up with the Joneses, or the Trumps.

What a 4.5% mortgage rate would cost you

A mountain home in the Connestee Falls golf community in North Carolina is currently on the market for $530,000. With a 20% down payment, monthly principle and interest on a 4.5% loan would be $2,148.41.

As part of its smorgasbord of ideas to get the U.S. economy moving again, or at least to stop tanking, the U.S. government has revealed a plan to tamp down mortgage interest rates by a point or more, to 4.5%. The almost unprecedented low rate will be available only to those with good credit ratings and who are purchasing a new home. The rates will not be available for refinancing existing mortgages, and a 20% minimum down payment will be required.

Given the plummet in home prices across the land, this is actually a scheme that could work. The combination of low interest rate and low home prices could drag some people from off the sidelines, especially those with cash or bullet-proof pension incomes.

I took a look at the mortgage factor tables to determine the monthly principal and interest payments on 30-year loans at a range of amounts. These do not include charges for taxes, club dues, homeowner association fees, utility costs and other charges, which will vary from town to town and community to community.

Loan amount Monthly Principle & Interest

200,000 1,013.40

300,000 1,520.10

400,000 2,026.80

500,000 2,533.50

600,000 3,040.20

1,000,000 5,067.00

If you want to calculate the payment for loan amounts not listed, simply multiply by a factor of 5.067 for every $1,000 borrowed.

Cool house-hunting app for iPhone

When I accessed the iPhone app store to explore these, I found dozens of other applications for download, including Home Finder. Using large real estate related data bases, including one by Google that stores MLS (multiple listing service) information, Home Finder can access millions of homes for sale. Plug in a zip code for the location of the home you are seeking, a price range, some basic data on number of bedrooms and square footage, and in a few seconds, all homes that fit your parameters are listed.

I tested Home Finder with a search of homes within five miles of Pawleys Island, SC, where we own a vacation home. I set the price between $500,000 and $750,000, the bedrooms at 3+ and the square footage at 4,000. Home Finder kicked out a couple dozen listings (including the same house twice, at two different prices, which indicates that records may not be edited quickly). Many did not include a street address but do include a link to the listing agent's web site, where many more details about the house are available.

Such an application would have saved my wife and me many hours of investigation when we first started looking at properties 20 years ago during vacations along the South Carolina coast. Back then, we relied mostly on the listings in those real estate books you find in racks outside restaurants and in driving around the area. We would stop in golf communities whose front entrances looked attractive or whose golf courses had been well reviewed. Sometimes we hit, and sometimes we missed.

I much prefer the modern app-roach.

Listings of homes for sale at Tennessee National

Yesterday, I reported here about a "holiday" home sale at Tennessee National (see article immediately below). You can view some of the homes for sale, at prices beginning at $349,000, by clicking here. This is for informational purposes only and not an endorsement of purchasing in the community, but it may be of interest to see what a handsome group of cottages is fetching in terms of price in the current environment.

When I visited the community in its early stages a few years ago, I was impressed with the layout of the golf course (by Greg Norman) and the apparent quality of workmanship of the first few homes. The setting along the Tennessee River was also attractive. However, most of the promised amenities are still not built as of today, a cautionary note if you are looking to buy in any golf community. That said, the developer, Norman's Medallist Company, probably would not be reducing prices significantly without a pressing need to move some real estate.

If you have any questions, please do not hesitate to contact me.

Tennessee National real estate on sale

Greg Norman's golf course at the community he is developing, Tennessee National, features many bunkers with stacked sod faces reminiscent of some of his favorite courses in the British Open rotation. The par 3 12th hole bumps up against the Tennessee River. The golf course is the only major amenity built to date at the fledgling community about 20 minutes from Knoxville.

Tennessee National, the community near Knoxville that is being developed by Greg Norman's Medallist organization, is running a real estate sale for the holidays. Some homes are being marked down by up to 20% for the rest of the month. A sample includes a 3 BR, 3 BA golf cottage that was formerly $537,000 and is now $449,000.

After waiting a couple of weeks for someone at the community to respond to a request for information, one of their sales representatives contacted me to announce the holiday sale. I asked her how those who previously bought golf cottages at "list" prices felt about the instant depreciation of their homes, given these December sale prices.

"They just want more neighbors coming in," she said cheerily.

Robert Stevenson is the new golf membership manager at the golf club. The recent graduate of the highly

The current golf club initiation fee at Tennessee National is $30,000 but with only 150 members out of a goal of 400, expect that fee to be somewhat negotiable with the purchase of property. Membership is essentially of the equity type; upon resignation, members receive 100% of their deposits or 80% of the then-prevailing membership fee, whichever is higher. However, as is customary in many new private clubs without a full roster of members, four new members must sign up before a refund can be granted to the person at the top of the refund list.

In recognition of the economy, Tennessee National is permitting its new members to pay off the $30,000 over four years with no interest charges. For the moment, club dues are reasonable at $385 but as the promised amenities, including a community center and pool, are opened, expect dues to increase. And, as always, there is a relationship between the price of real estate and the amenities. Once the latter are in place, the price of properties will be higher than if the amenities are simply on the drawing board. I think that is a "problem" Tennessee National and many other golf communities are looking forward to.

For now, exercise caution, and if you would like more information about Tennessee National or any other golf community, let me know.

General Motors CEO's ultimate getaway home

It made me wonder where a guy like the GM chief might go to rest his weary, outstretched arm and a psyche bruised by the relentless badgering of folks who know as much about auto manufacturing as they do about credit default swaps.

And then it hit me: I know where Mr. Wagoner goes to relax, and it is an ironic hoot. Three years ago, during a tour of the golf community of Haig Point on Daufuskie Island, SC, my real estate agent guide pointed to a vacation home under construction and told me Mr. Wagoner owned it. I checked today and the property, which has an assessed value over $2 million, was built in 2003 and is in Mr. Wagoner's wife's name, according to public records in Beaufort County.

Here's the irony: Daufuskie is a true island, reached only by ferry (or helicopter). No cars are permitted on the island, which should come as blessed relief to Mr. Wagoner once he has time to get away for a vacation.

Turning cart wheels to save money

But today, pressed by concerns about the environment and the high cost of energy, more and more golf communities and municipalities are giving the green light to golf carts on their streets. If you find yourself in one of those communities, here are some things to consider in choosing the right kind of cart.

You have two basic choices in carts, gasoline powered or electric. Depending on battery capacity, electric

carts, quiet and odor free, typically achieve a range of 20 miles to 55 miles. Their batteries require a minimum of six hours recharging (best overnight). Some observers estimate that the electric cart costs about 3 cents per mile to run, based on 20 cents per kilowatt in electrical charges (the carts can be charged via a typical 110-volt home outlet).

carts, quiet and odor free, typically achieve a range of 20 miles to 55 miles. Their batteries require a minimum of six hours recharging (best overnight). Some observers estimate that the electric cart costs about 3 cents per mile to run, based on 20 cents per kilowatt in electrical charges (the carts can be charged via a typical 110-volt home outlet). Gas carts, on the other hand, get up to 30 miles per gallon; at $2 per gallon, the cost of operation is about 7 cents per mile. They are loud and smell funny and tend to lurch forward if not tuned properly. However, gasoline powered carts are priced at about half the cost of comparably sized electric carts.

I found online a slick-looking electric cart with the capacity to handle two golf bags; it was priced at $5,200 and claimed a range of 55 miles for each full battery charge. A Yamaha gas powered cart, not quite as fancy as the electric one, was listed for $2,200. Golf carts are in plentiful supply, both new and used, and for those of us handymen who don't mind doing the occasional tune-up, bargains are available. One man in the St. Louis area operates a 20-year-old electric cart for just $30. He can go 20 miles, or the equivalent of at least three rounds of golf, on a 10-hour charge.

For some, now may be a good time to buy a home, not an investment

No need to weep for me, if you feel tempted to do so. After all, I made a few dollars. The underlying point in all this is that you don't go poor making money. Which brings me around to the current real estate market and whether

I understand the psychology of the moment for many homeowners; I am none too happy that the market value of my primary home in Connecticut is down at least 15% in the last 18 months or so. But we bought the house 16 years ago, and put a nice chunk of money down. If it weren't for a daughter still in high school, we would be having a serious discussion about taking what the market gives and moving to our second home in South Carolina. As it is, we are slowly starting to identify things to take to the dump or consider listing things on eBay.

Fast forward a few years, with our kids off to school, and it makes no sense to stay in a too-large house for two people, with all the attendant costs, no matter how much market value has been taken from us by this dreadful economy. The housing issues stretch across the nation and, with only rare exceptions, every real estate market is down -- the ones we live in and the ones we would move to. Chances are that if our home has lost 15% of its value, the next one we move to will have lost something of that magnitude as well.

Conclusion: It doesn't really matter if the fair (i.e. market) price you can get for your house doesn't meet your notion of what it is truly worth. It is worth only what someone else will pay for it (blindingly obvious point that). The person you buy your next home from, whether a developer or private owner, is going to be suffering some of the same pangs, and if they must sell -- either to keep their company afloat or because some life situation forces them to -- you will get a better deal than the people buying your primary home.

This is a long way around to say what I have said here before: If you have equity in your home and no other financial impediments to selling, and your dream is to have a home on the golf course (or near it), there is no better time than today...or yesterday...or tomorrow. Just consider it your home, not an investment.

Not so fast: Redemption laws could vaporize that great foreclosure deal

Some homes in golf communities, like Southbridge, near Savannah, are starting to make the foreclosure lists. Georgia does not have a right to redemption law but, in some states, an owner who has defaulted on a loan could retake the property.

More and more pre-foreclosure sales are popping up in golf communities. I noted one today in Southbridge, a nice community 15 minutes from Savannah that features a Rees Jones designed golf course (semi-private). The 3 BR, 2 ½ BA two-story home is listed at $379,900 in a golf community whose homes average a couple of hundred thousand dollars more. When I played the course a few years ago, I thought its condition left something to be desired, but the layout was a joy and with a little care, the course could hold its own against the upscale local competition. Southbridge also includes a large and active spa in its expansive clubhouse.

If that Southbridge home doesn't sell in the coming weeks, it will go to a foreclosure auction at which some lucky bidder will pick it up for less. One extra piece of luck for the winning bidder is that the state of Georgia has no right of redemption.

Until I attended a New Principles and Practices in Real Estate course, I did not realize that if you purchase

If the borrower (known also as a mortgagor) can raise the necessary funds to pay off all the debts to the lender within a statutory period of time, then the borrower can retake possession free and clear. The lengths of the statutory periods vary from state to state, and in some states, like my own Connecticut, the right of redemption applies only to tax defaults, not mortgage defaults. In other words, if a municipality in Connecticut forecloses on your home and sells it at a foreclosure auction, you have six months to settle your tax debt (plus costs) and retake the home -- even if the purchaser is living in it. In Alabama, the mortgagor has up to a year to clear all property-related debts and redeem his property. At the other end of the scale, Georgia, Texas and a few other states provide no statutory rights of redemption.

Anyone who purchases a foreclosed property needs to be mindful of the state statute in which they are buying and should not commit to any expensive renovations until the period of redemption has passed. In effect, once you own the foreclosed property, you may not in fact own it for a period of months.