High-end resorts giving a little

Some of the nation's premier golf resorts are starting to feel the pinch of the economy. In good times they could name their own prices; now, they are still commanding high prices but they are giving a little on other requirements (such as mandatory lodging on site). Our friends at Golf Vacation Insider conducted a survey of a few of the best known golf resorts. For their report, and some follow-up comments from readers, click here.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Something for nothing in a tough economy

I was watching the World Series last night when Josh Bartlett of the Tampa Bay Rays stole second base and, immediately, the network announced that anyone could visit a Taco Bell next Tuesday between 2 p.m. and 6 p.m. for a free taco.

In theory, Taco Bell could be out a couple hundred million tacos next week. However, if my teenage daughter is any indication, the chain need not worry. After Bartlett stole the base, I "congratulated" her. "What for?" she asked, turning from her math book. "You won a taco next week," and I explained the promotion. "Big deal," she sniffed, rolling her eyes as teenage girls are wont to do, and turned back to her homework.

Those of us who rely on income from sources other than our parents think free stuff is nothing to sniff at, although I can think of a million free

Today, one of my agent contacts in the southeast wrote me that prices in coastal North Carolina have now reached 2003 levels.

"A few years ago," he wrote, "the market was GREAT for sellers and HORRIBLE for buyers. Now the market is GREAT for buyers.

"Why don't people refer to this as a great real estate market?"

I am hearing the same thing from across the south. If you are among the fortunate whose resources give you the wherewithal to look in this great

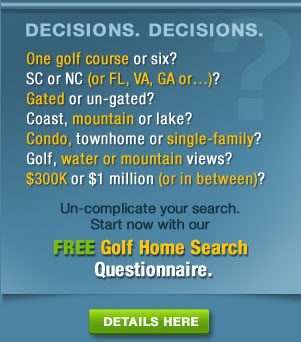

My process is simple, free and comes with no obligation. Contact me (click here or use the Contact Us button at the top of the page) and indicate that you are interested in property in the southern U.S. I don't care about your time horizon; it could be next week or in 10 years, but it is smart to start preparing now. I will get back in touch with you by email (or, if you prefer, by phone) and ask a few basic questions to best understand your criteria. From there, I will do research and make some contacts with real estate agents and golf communities for the latest updates on prices and inventory in places that best match your criteria. After that, I will report back to you with a suggested list of places you might consider.

You can choose to follow up with visits at your convenience. I can help make arrangements for lodging and golf; in many cases, I will be able to secure discount lodging and golf and, in some cases, arrange for the fees to be waived (this varies from community to community, but developers are hungry at the moment and, therefore, accommodations -- pardon the pun -- can be made).

All of this is without obligation or cost to you. I guarantee that it will be worth a lot more than a taco...and healthier. In this dynamic housing market, there are some significant opportunities, but no one should go it alone.

Thanks for considering my proposal.

Top communities facing high-end dilemmas

One privately owned home at Connestee Falls in the mountains of North Carolina was reduced recently by more than $500,000.

The most expensive golf communities in the southern U.S. have reached a "Morton's Fork" in pricing their unsold inventories of properties. They can reduce prices and alienate their existing property owners whose values will instantly erode; or they can ride out the storm and conserve cash yet risk alienating those same homeowners who counted on a certain roster of amenities within a certain time period. We know that some developers, like Land Resource and Ginn Resorts, have not been able to finesse their way through this dilemma. Others may follow, so we advise caution and the use of a qualified real estate agent to help you separate the wheat from the chaff. (Contact me if you would like a suggestion.)

Developers: Difficult choices

The term Morton's Fork is derived from the chancellor under King Henry VII of England, Cardinal Morton, who developed a rationale to extract taxes from the wealthy no matter their lifestyle. If the merchants spent money obviously, he reasoned that they had sufficient income to spare for the king.

Developers who have only partially sold their inventory of properties face being hoisted onto Morton's Fork. This was obvious to me over the last few days as I corresponded with one of our readers who had conserved cash before the financial crisis with an eye toward buying a piece of property in a luxe, partially developed golf community near Asheville. The golf course, one of the best in the Carolinas, is built and in full operation, as are the other promised amenities, but an inventory of developer lots remains. Our reader, who is working with a real estate agent, has his eye on a re-sale lot and is headed to the Asheville area this weekend to make an offer of 50% off the listed price; his real estate agent thinks he has a shot at scoring the bargain price, he says. (I don't want to jinx it or signal his strategy by naming the community.)

Deep price cuts by homeowners

My real estate contacts in the southeast report that other desperate private sellers are taking desperate measures, cutting prices tens of thousands of dollars. Just this morning, C.B. Johnson in Wilmington, NC, sent me a listing for a French Country Victorian home on the Intra-coastal Waterway now priced at $899,000, down from an original

Elaine VonCannon in Williamsburg, VA, reports that a home listed at $1.2 million was reduced recently to just below $1 million, but more indicative may be the recent "short sale" in Ford's Colony, a $566,000 listing that sold at $399,000. (Note: In a short sale, a homeowner who owes more on a house than he can sell it for gets the bank's permission to sell it for less than he owes, turns over the proceeds to the bank and then negotiates some reasonable payment to make up at least some of the difference.) Elaine says she is seeing more and more such short sales in local golf communities such as Kingsmill, Stonehouse and Brickshire. All my agent contacts report at least one or two foreclosures in the local golf communities as well.

Reduced prices, reduced reputation

These desperate property owners strapped for cash are selling at huge discounts, making the developers' lots seem overpriced by comparison. A developer can drop prices to match, but that immediately reduces the value of properties in the rest of the community, causing a downward spiral

Yet if the developer decides to hold the line on prices, he must offer impressive financial incentives (closing costs, liberal financing terms), expensive extra custom features, or a waiver of membership fees in the golf club (which then alienates members who paid tens of thousands of dollars). Every dollar the developers spend to provide incentives to purchase a property at "full retail" is money they cannot spend on new amenities or the maintenance of facilities, including the golf course.

Cash is king

The big winners in all this chaos are buyers with cash and bargain-hunters' mindsets. They can almost name their own prices. But be wary if you find yourself in this happy group, and make sure you have a professional along for the ride, someone who knows the developers as well as the developments. The biggest potential bargains are in the communities with the largest inventories of unsold properties, but those can also be the riskiest if the developers do not have deep enough pockets to survive the next couple of years. I advise those looking for a vacation or retirement home to include mature, fully built communities in the mix, those in which the developers have moved on and the operations have been turned over to the homeowners. Association and club dues may be a little higher than at developer-subsidized communities, but the track record is more obvious. Examples of such well-tended communities include The Landings on Skidaway Island near Savannah, Champion Hills in Hendersonville, NC, and Governor's Club in Chapel Hill, NC, all of which I have visited. These communities and others that are completed face their own thorny challenges in the current environment, but their re-sale markets are less complicated and easier to negotiate -- in more ways than one -- than partially built communities, even if the bargains are not as obvious.

Time to fork it over?

In summary, developers in this current environment are confronted with Morton's Fork. But buyers with cash have tremendous leverage and might do well to observe something we will call Berra's Fork. As the great philosopher Yogi Berra once said: "When you come to a fork in the road, take it."

Real estate agents in the south are starting to see more "short sales" in established golf communities like Williamsburg, VA's Kingsmill Resort, and a few foreclosures as well.

Real estate agents in the south are starting to see more "short sales" in established golf communities like Williamsburg, VA's Kingsmill Resort, and a few foreclosures as well.

Luck can ruin your golf score

One collegiate golfer pushed his luck after driving into the trees on the right at the par 4 4th hole at Piney Branch.

I followed a threesome of collegiate golfers around the well-groomed and challenging Piney Branch Golf Club course in Hampstead, MD, on Monday. One of them was my son, Tim, a sophomore at Washington & Lee University.

One of Tim's playing partners looked terrific, hitting the ball long off the tee and straight and leaving himself reasonable birdie putts on each of the first three holes. His team was tied with Washington & Lee for the lead going into the final round. On the fourth hole, he pushed his drive into a grove of trees down the

He made a good swing and hit the ball solidly, but it clipped the pine needles of one of the trees and wound up in the rough just short of the green. Stupid play, but what he said out loud revealed an attitude that can kill a game. "Why don't I have any luck?" he moaned, and I knew at that point he was done. Sure, an inch lower and he might have flown the ball to the green, but an inch higher and he would have hit a branch straight on and stayed in the trees.

His uphill approach from the rough to a tight pin bounded 30 feet beyond the hole, leaving him a slick downhill putt. He took three to get down from there, putting up a double bogey on his way to a 41 on the first nine and an 82 for the day. His team finished four strokes out of first place.

Luck plays little or no part in golf. When we start to think that some force other than our backswings, follow throughs and focus determines our scores, then we might as well repair to the casino and pull on a one-armed bandit.

Piney Branch, Hampstead, MD

I am following the final round of a college golf tournament today. It is being played at the Piney Branch Golf Club in rural Maryland (Hampstead). I won't be able to post anything today other than this photo of one of the par 3s at Piney Branch, which is located about 45 minutes west of Baltimore. I'll have more to say about this fine private golf club later in the week.

Shares alike: Housing stocks in basement

"The outlook for homebuilders is miserable, so it's time to buy these beaten-down issues before others sniff a recovery."

At the time, the stock prices of such major national homebuilders as Toll Brothers, Ryland and Pulte Homes had been beaten down by the emergent problems in Florida, Las Vegas and Phoenix. Ryland, for example, was selling at about $54 per share, Toll at $33 and Pulte at $34.

If you had followed the columnist's advice - okay, it was Jon Markman - your portfolio would be in worse shape than others who had the good luck not to read Markman's column or take his advice.

As you may have read, housing starts are down 31.1% year over year and homebuilder confidence has dropped to new lows. And amid all this carnage, the stock prices of the major homebuilders have plummeted as well. Below are comparisons of October 2007 with closing prices on Friday. Of course, at these prices, the survivors, whomever they are, might be bargains.

October 2007 - 2008 share prices

Pulte Homes 18.93 - 14.30

Beazer Homes 12.50 - 3.36

Toll Brothers 28.00 - 15.49

Centex 30.29 - 8.58

Lennar 23.21 - 5.29

D.R. Horton 17.95 - 6.47

Hovnanian 13.50 - 4.06

Ryland Group 37.85 - 16.51

J'ville community reduces prices to pre 2007

From both a visual and shotmaking standpoint, Arnold Palmer's design at North Hampton is one of his best.

A builder at the North Hampton Club, a community on the outskirts of Jacksonville, FL, is rolling back prices to pre-2007 levels. The email I received from ICI Homes Express indicates savings are as much as $70,000, or 35%.

North Hampton is part of the portfolio of LandMar communities, which includes Osprey Cove in St. Mary's, GA, Sugarloaf Mountain in Florida, and a number of others. If you own a home and golf membership in one LandMar golf community, you have access to the other LandMar courses, as well as those in the Crescent Communities group.

North Hampton, which I visited a couple of years ago, includes a fine Arnold Palmer links style course, one of the best Palmer courses I have played. Click here for a previous article about the golf course and community. In addition to the reduced prices, North Hampton is offering free initiation fees for the golf club (a $6,000 value) and help with closing costs. Some lake, golf and marsh view home sites are still available.

If you want more information or a contact at North Hampton, send me an email (use the Contact Us button above) and I will respond quickly.

Housing affordability, by the book

I am taking a real estate licensing course in Connecticut. The textbook, published just two years ago, is Modern Real Estate Practice, and last night we covered Chapter 3 entitled "Concepts of Home Ownership."

One sentence sent a chill through me. It read: "Because more homeowners mean more business opportunities, real estate and related industry groups have a vital interest in ensuring affordable housing for all segments of the population."

There, in a nutshell, is the housing and economic mess. The culpability of mortgage lenders, investment bankers and Wall Street brokers has been well covered if not largely understood. From the couples who knew they were borrowing more money than they could afford to the Countrywide salesmen who preyed on others who could not afford their loans, the story is one of greed up and down the line.

It is generally understood that the housing crisis triggered the overall

Over the last two years, I have written here often about the hyperactive optimism coming from the economists at the National Association of Realtors. Abetted by the media, David Lareah and Lawrence Yun, the NAR's spinmeisters, defied all logic and proper warnings from smart people like Yale economics professor Robert Shiller. They kept pumping out sunshine about how home prices would continue to defy gravity, no matter the strong evidence to the contrary. Shiller, you might recall, wrote the book "Irrational Exuberance" about the stock market, and he saw the housing market in just the same light, warning that home prices and loans were out of balance with the incomes necessary to pay off the loans.

I'm more Joe Six Pack than economist, but last December 30, after yet another Pollyanna prediction by the NAR, even I figured out that the NAR economists were selling snake oil. I wrote here that, "Asking the National Association of Realtors about the real estate market is like asking McDonalds about obesity. You are never going to get a straight (read ‘honest') answer."

And yet the media continued to serve up the NAR's Kool Aid, and the NAR's members continued to raise their glasses in a toast to exuberance. Whether it was true or not, it sounded good. Well, the band on the Titanic sounded good too, but the ship was still clearly going to sink.

In my class, we have only covered half the real estate textbook, but I have thumbed through the rest of its pages. There is no chapter on logic. There should be.

You can't put a price on a dream

The driving range at the newly opened Bear Lake Reserve golf course in the mountains near Sylva, NC, received the same attention to quality as the rest of the community. Many such communities are on sale right now across the southern U.S.

Many years ago when I worked in retailing, a clothing buyer told me that, during a recession, people boost their spirits by spending on fancy cheap items. That is why he always stocked up on fancy socks during times of economic stress; even expensive socks didn't top $10 at the time. Cosmetic sales also typically don't suffer during recessions for similar reasons. Ditto casinos, where you can spend a few hours of escape with just a few dollars.

With the stock markets roiling and our economy surely headed for an official recession, few among us are contemplating the purchase of a vacation home

Over the last few years, I have traveled throughout the south, visiting scores of golf communities and courses. Although I can recommend most of those communities -- a few were clunkers -- they vary widely in terms of the quality of the golf, their other amenities, the variety and quality of the houses, and, of course, prices. I have taken lots of notes and made many fine contacts that I can call on for additional information in your behalf.

Send me a note, and I will go to work on your dream.

What $600,000 buys in the south

Prices on some homes inside St. James Plantation have been cut as much as $350,000, says a local realtor. Some current homes for sale include full golf membership in the price.

The message is the same from my real estate contacts throughout the southern U.S.: Home prices are dropping at double-digit percentages. This is a fairly new phenomenon for the vacation home and retirement

"I have seen houses drop more than $350K, and lots in some areas are down by a third," wrote Jerry Jones, an agent serving Brunswick County in coastal North Carolina. In past years, homes selling for as much as $2 million or more seemed immune from any discounts, let alone such big ones, but now agents are seeing those kinds of reductions on homes listed for barely more than $1 million.

This is not just anecdotal evidence. The respected Case-Shiller home price index shows homes in the nation's major markets have dropped 18% from their top levels in early 2006. The typically more conservative National Association of Realtors numbers are 12% off peak.

As an exercise, I conducted a scan of homes in some of the finest communities in the southern U.S., places I have visited over the last three years. I set a price of $599,000 which, a few years ago, would have landed a modest three bedroom, two or 2 ½ bath home. My observation now is that, for the same price, you can add a bedroom or two and a bath, plus other options tough to find at that price point a couple of years ago.

All the following are listed at $599,000, except as indicated. Note that if you are interested in any of these properties or communities, please let me know and I will be happy to put you in touch with a qualified realtor:

Champion Hills, Hendersonville, NC. 3 BR, 3 BA, 2,384 square feet on 1 acre in wooded setting. Open floor plan, fireplace, 2 BRs on main level, Master on top floor. Golf course is outstanding Tom Fazio design.

Pawleys Plantation, Pawleys Island, SC. 4 BR, 3 BA, square footage/acreage not listed. Brick home on Jack Nicklaus golf course; great room with fireplace; heart pine floors; MBR suite opens onto patio.

Woodside Plantation, Aiken, SC. 4 BR, 3 ½ BA, 4,200 square feet on ½ acre. Two-story French Country style stucco home in community with three courses (Nicklaus Design, Rees Jones, Bob Cupp). Hardwood floors, cast stone fireplace, 5 cedar closets, two offices.

Governors Club, Chapel Hill, NC. 4 BR, 3 ½ BA, 3,492 square feet on 1/3 acre. Seven year old French Provincial cedar and stone home in Chapel Hill's most upscale golf community, with 27 holes of Nicklaus golf. Fireplace and MBR downstairs.

Governors Land, Williamsburg, VA. 4 BR, 2 ½ BA, 2,960 square feet on 4/10 acre lot. Ten-year-old brick Federal style home with unfinished room on 2nd floor (with roughed-in bath). Nice Tom Fazio designed course.

Porters Neck, Wilmington, NC. 4 BR, 4 ½ BA, 3,995 square feet on 6/10 acre. Brick home with glass walled room and deck that overlooks 11th hole on classic Tom Fazio course. MBR downstairs, 3 BRs upstairs, boat ramp, price reduced $150,000 (trade and/or owner financing available).

St. James Plantation, Southport, NC. ($579,500) 4 BR, 2 ½ BA, 3,350 square feet on 2/3 acre. Eleven-year-old builder's home has view over pond to 15th hole on Founders Course. Price includes premier golf membership, a $28,000 value. Five golf courses in all.

The short but windblown 13th at Jack Nicklaus' Pawleys Plantation Golf Club features one of the smallest island greens anywhere in the southeastern U.S. The community also features a mix of single family homes, condos and golf villas.