Fragile golf economy claims another victim

“Hey Buddy, wanna buy a golf course?” These days, most any of us could afford to buy one of the dozens of distressed golf courses that are on the block. Private club members and municipalities alike would like nothing more than to unload them –- even for the nominal price of a dollar -– as long as the new buyers will pay to operate them.

Therein, of course, is the rub. Golf courses are expensive to operate

It was not so long ago that golf seemed like a no-lose proposition (like real estate, eh?), a way to attract residents to a golf community or even a town. To hype sales, the most aggressive developers built their designer courses before the first houses were in. Towns like Buena Vista, VA, used a similar model, commissioning some darn nice courses on cheaply acquired (or even donated) land in an effort to not only attract new residents but also to keep happy the ones they had.

Unfortunately for Buena Vista, the town opened its course, Vista Links, in 2004; the timing could not have been worse, coming shortly before the economy tanked. The town borrowed more than $9 million to build the course and set up the infrastructure, such as sewers and roads, for a proposed adjacent neighborhood.

Vista Links is an attractive sprawling links-style golf course on farmland at the foot of the Blue Ridge Mountains. The course serves as a practice facility for Washington & Lee University’s golf team and features

Rick Jacobsen, who trained in the Jack Nicklaus shop, designed Vista Links. Tim Gavrich, a rising senior on the W&L golf team, reviewed the golf course in this space in July 2007. Click here for that review.

As of this writing, Vista Links’ fate is unclear. The town’s police station and main administration building are in foreclosure as well. If you should be passing through Lexington, VA, on Interstate 81 in the near future, Vista Links is definitely worth a play. Just make sure you call first ((540) 261-GOLF).

The short par 4 4th hole at Vista Links gives a good sense of the character of the former farmland, and it includes the old barn as backdrop.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

States of Play: Sex and politics are par for the course in the Carolinas

If you are considering South Carolina as your golf retirement destination but are concerned that the notoriously conservative state may be a little too boring, recent headlines might bring some comfort. First, Governor Mark Sanford went for a hike on the Appalachian Trail, took a wrong turn and wound up in Argentina. He was caught on his return by a reporter at the Atlanta airport and was forced to admit that he had misled both his wife and staff about his whereabouts. Former wife Jenny filed for divorce and published a book, in that order.

That kind of scandal should be enough for any one state, at least for a few years, but apparently it was just a

The Palmetto State, which also contributed the Tourette-like Congressman Joe "You Lie" Wilson, does not have the market cornered in the Carolinas for those who kiss-up and tell. (Mr. Folks had been a key component in Mrs. Haley’s campaign and also a former aide to Governor Sanford.) Despite his dedication to his boss, John Edwards, former aide Andrew Young felt a higher responsibility to spill the beans about the Presidential candidate’s peccadilloes. Young had helped stash Edwards’ mistress at the upscale Governors Club in Chapel Hill, NC, to avoid the unrelenting snoops from the National Enquirer. They found her anyway, and that was that.

We can vouch for the high quality of golf in the Carolinas. Their politicians are another story.

Don't overplay hurricane threat when looking for golf community home

In the 40 years I have been vacationing in the Myrtle Beach, SC, area, only one serious hurricane has threatened that part of the eastern seaboard. Hurricane Hugo in 1989 walloped Charleston, about an hour and a half south of the Grand Strand, utterly changing the landscape of that city (some would say for the better, since many of the old but shaky buildings were swept away, literally). Residual winds toppled trees south of Myrtle Beach but damage was minimal (unlike in Charleston). The Hugo headlines, combined with the extreme coverage spawned by Katrina in 2005, have caused some folks to limit their choices of golf community homes. They have literally headed for the hills around Asheville and other mountain areas.

That’s a shame because chances are remote that any current retirees moving to a particular area on the coast will endure a major hurricane in their lifetimes. As real estate observer Toby Tobin writes about the Palm Coast of Florida and the illusory threat of a serious hurricane there, “According to NOAA [National Oceanic and Atmospheric Administration], a Category 5 hurricane will come within 87 miles of Palm Coast every 220 years on average. I'm 66 years old. Do the math.”

Toby’s article can be found at GoToby.com.

Plane fact: Southwest Airline service should boost Greenville, Charleston

Airline service can make or break a local economy, especially one that relies heavily on tourism. For example, Myrtle Beach’s economy, which is almost totally reliant on visiting golfers and beachgoers, is forever courting airlines to fill the gates at its international airport (international because of a few flights from Canada). Convenient airline service between north and south is also a spur to vacation home sales in southern communities. And for retirees with children and friends up north, good north/south airline service can tilt the decision to buy a golf community home in one area or another.

Greenville, SC, took a big step forward in that regard when Southwest Airlines, arguably the most stable and reliable of all airlines, announced that it would begin flying into the city’s airport in 2011. The airline also announced new service to Charleston as well.

This is good news for your editor who currently lives in Connecticut and flies out of Bradley International Airport (international because of a flight to and from Toronto). Virtually every flight south involves a change of planes in Charlotte or some other airport and fares of more than 4300. Soutwest should put some competitive downward pressure on prices.

Greenville is one of the most attractive towns in the south, with a full range of services without the atmosphere of a big city. Golf communities in the area include The Cliffs Communities, Bright’s Creek, Greenville Country Club and the neighborhood surrounding the fine Thornblade Club in Greer. The large BMW plant in Spartanburg and all the subcontractors that support it add stability to the area’s economy. Southwest Airlines service will add a dose of that as well.

New airline service for Greenville, SC, should help golf communities like Bright's Creek in Mill Spring.

Big developer emerging from bankruptcy

Arnold Palmer's design at North Hampton, near Jacksonville, is among his best. North Hampton's developer, Landmar, has just emerged from bankruptcy with its parent company, Crescent Resources.

Golf communities owned by Crescent Resources and its subsidiary, Landmar, have been among the nicest I have visited over the last five years. But the recent history of Crescent is a reminder to us all that looks aren’t everything and good looks may be inversely proportional to good management.

Crescent was a joint venture of two stellar names in American business, Duke Energy and Morgan Stanley

What’s left, though, are some impressive golf communities, 16 in all, a few of which we have visited. Osprey Cove in the charming St. Mary’s, GA, for example, features a neat Mark McCumber layout that traverses a handsome stretch of marshland within reasonable driving distance of Jacksonville, FL. Closer to Jacksonville, the Landmar North Hampton community’s Arnold Palmer designed North Hampton Golf Club was a bit of a revelation, the first course we had played with The King’s name on it that did not overplay its hand (no huge and ill-placed bunkers, for example). Instead, the course’s natural grasses and clever routing hid well the inherent challenges of the layout.

Oldfield, in Okatie, SC, whose residents can choose between the twin pursuits of horse riding and golf on

We haven’t made it to Bluffton, SC’s Palmetto Bluff, but its Jack Nicklaus designed May River Golf Club shows up on most top 5 lists of South Carolina’s courses, which is saying something in that golf-rich state. Crescent purchased the development in 2000, during the halcyon days of irrational exuberance about the housing market. Home prices in Palmetto Bluff begin above $1 million.

The word “bankruptcy” has scary connotations for those looking for a golf community home, but a developer who has emerged from bankruptcy with new management and financing in place can offer some extreme bargains. We will keep an eye on Crescent as it manages its rehabbed organization with half its former employees and a stripped down budget. If you have questions or an interest in any particular Crescent or Landmar community, contact us and we will ask the tough questions for you.

The majority of homes at Cresecent Resources' Oldfield community include separate garages with rooms above.

Tampering With The Fitness: Treadmills are a good run spoiled

In the rush to attract as many potential buyers as possible, most mid-level to high-end golf communities offer such add-ons as tennis courts, Olympic-sized swimming pools and fitness centers with equipment that would make the New York Athletic Club jealous. Developers know that many of us baby boomers lust for the fitness of our youth and plan to do something about it once we get out of the rat race of careers and into our golden years. The reality is, however, that most of us will opt for a round of golf rather than 90 minutes on the cardio machine.

Baby boomer hard bodies (and wannabes) are a small minority of golf community residents, but that hasn’t

It’s the treadmills that get me (as well as the TVs). I don’t begrudge a fellow boomer his or her exercise, and I wish I had the discipline to join them, but there is something ironic about treadmills in a planned community’s fitness center. Isn’t it the “treadmill” aspects of our lives that we are trying to escape by moving to a place of beauty and tranquility (and golf)? Isn’t it just as beneficial physically, but much more mentally rewarding, to walk or run through our coastal community, past marsh and live oak trees dripping with Spanish moss, or across the highest point in our Blue Ridge community with its 50-mile long mountain vistas, than pounding a strip of vulcanized rubber at the same boring pace, over and over, with CNN on the wall, reminding of us of how much our stock portfolio has lost or how many lives have been ruined by the latest unnatural disaster?

Dear Developers: Lose the treadmills and dedicate the space to mental fitness centers. Some of us could use it…before and after our rounds of golf.

The 3,000-acre community of Spring Island, near Beaufort, SC, has opened a $5 million, 12,000-square-foot Sports Complex to complement its outstanding Arnold Palmer Design golf course, Old Tabby Links. The new complex includes tennis courts, a large pool, croquet court and fitness center, as well as an Outfitter Center where residents and their guests can pick up fishing and kayaking equipment. At eventual full build out, Spring Island will be home to just 410 families.

Photo courtesy of Spring Island.

Ninety-two economists can’t be wrong about housing prices…can they?

A group of economists who take part in a monthly survey about the U.S. housing market believes prices will begin to rise nationally in 2011 and will increase 12.4% between 2010 and 2014. The responses from the Macro Markets Panel also indicated that home prices have risen nearly 5% in the year that ended in March, but that they have fallen in the most recent quarter. The conclusions reflect the input of 92 of the group of 100 Macro Markets participants, who are economists and housing market analysts and strategists.

Any significant near-term rise in home prices could have a significant effect on the migration of baby

The northern U.S. is not the only source of emigration to the Carolinas and other popular retirement and vacation spots in the southeast. Floridians tired of increased insurance prices, the threat of hurricanes, a crumbling infrastructure and beastly summer heat are heading to the cooler Carolinas; and many Californians, who saw their home values skyrocket before the crash but still have considerable equity in them post-crisis are also looking east.

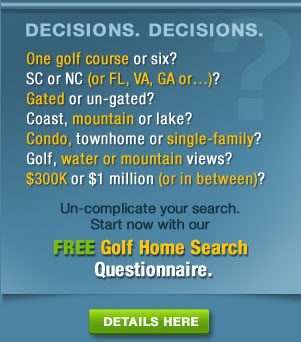

I am currently working with a dozen couples looking for their dream homes on the course in the southern U.S., and I would be happy to supply others with the benefits of my experience and hundreds of visits to golf communities. Simply contact me via email and I will respond promptly. There is never a fee for my advice or assistance.

Macro Markets was founded by Yale economics professor Robert Shiller who predicted the major stock market and housing bubbles of the last decade. Shiller is also the co-founder of the Case-Shiller index, which tracks home prices in 20 major U.S. markets. A Wall Street Journal article about the latest Macro Markets survey is available by clicking here.

Former bank CEO bailing out of beautiful South Carolina golf community home

The Old Tabby Links is one of the most handsome courses in the southeast. Former B of A CEO Ken Lewis is selling his vacation home nearby in the Spring Island, SC, community.

A lot has happened in the housing market, as well as the financial markets, since former Bank of America CEO Ken Lewis purchased one of the premiere homes inside the enclave of Spring Island, SC. According to the Wall Street Journal, Lewis and his wife, who are also shedding their primary home in Charlotte, purchased the Spring Island house in 2002 in partnership with another couple.

The current asking price of $2.995 million is roughly what the Lewises and their friends paid eight years ago, before the housing crisis, another reminder that no matter what happens to their customers or shareowners, or what decisions they make (Lewis engineered the purchase of Merrill Lynch), top bankers always seem to make out considerably better than the rest of us.

The home for sale by Ken Lewis (top) is not the best situated home on Spring Island. That distinction may go to the homes that have views of the 17th hole and an adjacent wildlife pond.

Beaufort, SC, golf communities reasonably priced, but one golf course is in ruins

Beaufort is a source of some confusion to those looking for a charming Carolinas coastal community to visit or to live in (or near). There are two Beauforts, each charming in its own way, each with golf communities within a reasonable drive but both pronounced differently. The North Carolina Beaufort is pronounced “Bow-furt.” The South Carolina town is known as Byoo-furt.”

The Wall Street Journal a week ago ran a short little feature on Beaufort, SC; you can read it by clicking here. The story reminded of my visit a year ago to a few impressive and reasonably priced golf communities worthy of consideration in the Beaufort area. Dataw Island, for example, is a mere 10 miles away but requires a 20-minute drive to circumvent the marshland and streams around which the local roads are built. Callawassie Island and Spring Island are about a half-hour south of Beaufort, over the Port Royal Sound in Okatie.

In ruins: Spring Island's Old Tabby Links passes former plantation home.

The three span the range of mid-priced to expensive communities, all with more than one course except for Spring Island, with its exceptional 18 at Old Tabby Links, designed by Arnold Palmer and Ed Seay, which threads its way past wildlife preserves and the tabby ruins of a former plantation house. Callawassie features 27 characteristically imaginative holes by Tom Fazio, whereas Dataw Island provides 18 by Fazio and another 18 by Arthur Hills, one of your editor's favorite architects.

Five homes priced between $500,000 and $600,000, with golf course views, are currently on the market in Callawassie. Eighteen homes in the same price range are currently available in Dataw Island; a few include golf membership. (Note: There are nice selections in both communities under $500,000.) Three homes at the more expensive Spring Island, all 2 BR, 2 BA cottages, are priced below $600,000; one, at $598,500, sits on two wooded acres with a view of a pond.

I have written a number of articles and posted reviews of each of these fine communities. Use the search box at top right to find past articles. If you have specific questions or want more information on Dataw, Callawassie or Spring Island, please contact me.

A par 4 at Callawassie Island (above) gives a taste of the waste bunkers over the 27 hole layout while on Dataw Island's Arthur Hills course (below), live oaks and a greenside bunker provide most of the challenge on a par 3.

Copy Cats: Golf community marketing hyperbole insults our intelligence

Too-good-to-be-true storylines never seem to go out of fashion in marketing campaigns, and no group hyperventilates more than do real estate developers, or at least the folks they hire to advertise in their behalf. A sucker may be born every minute, but in the wake of the housing collapse and the unfulfilled promises in many of the most expensive golf communities, you would think the marketing geniuses would substitute more fact for hyperbole in current promotions.

No such luck. Even those planned communities that barely survived the meltdown are back to their old promotional ways, loading up their marketing language with the kinds of unsubstantiated pronouncements of which a Countrywide Financial sub-prime loan pusher would be proud.

I received a newsletter today from a beautiful mountain golf community that I had visited before it maneuvered past some

The newsletter describes the development as “a community that would defy all conventional logic”; it is unclear in the copy what logic it defied, but my best guess is that it is a reference to the low density of housing (one home per 12 acres) and the “park” that surrounds the community. This same community that defied all conventional logic also provides “superb amenities…of quality without pretentiousness.” When you actually have to say you are not pretentious, you are being quite pretentious.

The new president of this community may have been hired for his strong portfolio of adverbs and adjectives (emphases mine). “…we're moving forward expeditiously to complete this exceptional project in one of the country's most beautiful settings," he says of the “unique property…” (as if we are not smart enough to understand that every community is unique).

Just in case you haven’t reached for your checkbook to send a

They teach you in Golf Community Development Marketing 101 that you must always present a happy homeowner in your ads, and that you put words in his mouth that are straight out of Stepford; the more banal the better. Something like: “I think that the strongest feature of the development is the enormous feeling of community and friendship among its members.” Now that’s unique.

Call me elitist, but I have this notion that folks who are being asked to plunk down $250,000 for a piece of property and another $1 million or more to build their dream home probably have the intelligence to figure out for themselves whether this is a good time to buy or not. But some marketing copywriters and their editors don’t understand this:

“You've read the stories,” the newsletter reminds us, “seen the television specials, maybe even received a few E-Mails telling you that this moment in time is a truly historic one to be in the market for real estate. Whether you're looking for a primary home, a vacation home, or a retirement destination, everyone is rolling out the red carpet for you. Feels good for a change, doesn't it?”

Not really. What would feel good is a lot more fact and a lot less drivel.