The expense of the rich: Some humor for a Sunday

I am off to revisit Gillette Ridge today, a unique golf community and golf course in Bloomfield, CT. The course threads its way through an office complex that includes the CIGNA and MetLife insurance companies. The Arnold Palmer course is a tester, but nothing like it was when it first opened a decade ago. It was virtually unplayable, with a stretch of holes that only a PGA professional could love (or endure). But with Billy Casper Management guiding the way, the course was softened a few years ago, and now is not only playable but fun. You can read my previous review here.

In the meantime, as I noted here a few days ago, high-end homes of the formerly rich are being sold at auctions for small percentages of their former values (and a lot less than most experts believe they are worth today). I referenced John McAfee, the software inventor who has gone from uber rich to just rich, disposing of millions of dollars of his real estate along the way. Today, in the Hartford Courant, humorist Colin McEnroe writes about these tough times for the super rich. For readers of this site who have dreamed of owning a big home they could not afford, now may be the time. You can read McEnroe's column by clicking here.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Numbers vs logic in the housing reports

Home sales defied gravity in the run-up to the crash of 2006/07. Now it seems they are defying logic. Or are they?

On the face of it, the home sales report today by the National Association of Realtors (NAR) that home sales have increased for the fourth month in a row seems at odds with what we know statistically about unemployment figures (not good news) and anecdotally about home prices -- that folks suffering double-digit percentage losses in their home values are holding fast for higher-than-market prices.

Home prices are down more than 15% from July last year; the inventory of unsold homes is still high, at nearly 10%, and doesn't take into account all those who would love to put their homes on the market, a kind of phantom inventory; and now, we are starting to learn (but not, of course, from the NAR) that many middle-class homeowners with conventional loans, not sub-prime, are in payment distress because of job loss. Oh, yes, and home prices are not increasing with sales (on the contrary). Taken together, all those circumstances don't seem to square with the increase in home sales.

Some strength in numbers

But numbers don't lie. (Although the NAR economists have been known to paint a deep rosy wash on their numbers, as in today's pronouncement by NAR Chief Economist Lawrence Yun that, "The housing market has decisively turned for the better.") Sales of homes of the single-family and condo varieties increased in July virtually in every region. And of special interest to those of us contemplating a move south, home sales in the southern U.S. were double those in the north (1.95 million vs. 900,000). The only region in which sales were lower in July than the month prior was the West.

Homes in golf communities like Laurel Ridge near Waynesville, NC will start to see much more interest if the housing market is truly bottoming (or is perceived to be).

What does it all mean? The bet here is that the U.S. housing market is devolving into three separate market segments -- low, middle and high (how is that for originality?) -- with less movement between them than in prior years because of tenuous job situations, less employee transfer, and general economic uncertainty. Define "low" roughly as homes well under the median national price of $178,000, say $150,000; the middle from that point up to around $600,000 or so; and the high end from over $600K to Donald Trump territory. The low end is attracting speculators because the prices are so low and first time buyers attracted by the $8,000 government stipend as well as by the American dream of home ownership (rumors of its death are greatly exaggerated). But unemployment issues and strict lending rules, at least for a few years, will keep most low end homeowners from trading up into the middle range.

Sayonara to big homes?

For those wealthy couples who buck the trend toward smaller homes, a growing inventory of unsold McMansions will well satisfy their needs, and at bargain prices. My brother Bob sent me a note today about an oceanfront home in Hawaii that repeats stories I am reading about big homes. This house is on more than 5 acres and sold for $1.5 million, many multiples less than it was worth just a few years ago. I told Bob it would have made a nice family compound (snicker) if we had only known ahead of the auction. The house was auctioned at a distress sale in behalf of the founder of McAfee software, who was worth well over $100 million just a few years ago but is essentially bankrupt now. This is a tough time for rich people, and the market at the high end is showing it.

The healthiest activity will likely be in that middle group, spurred by Baby Boomers cashing in the equity in their primary homes and downsizing into smaller homes in more attractive climates. Baby Boomers, who have always been inclined to act in their own self-interests, are not going to defer their plans much longer, especially if the housing market stabilizes. If the sales numbers continue to trend in the upward direction, look for increasing waves of 50- and 60-somethings to start heading south (again), causing prices of properties there to stabilize if not increase. And if companies start to hire and relocate employees again, making homes up north more attractive, that wave could become a tsunami. Millions are poised to make the move if it seems economically feasible.

Let's make a deal: Private club pain may work to your advantage

A month ago, for example, the golf rich Landings on Skidaway Island announced an initiation fee reduction from $55,000 to $30,000. Divide its well-kept and diverse roster of six courses and three clubhouses by the new initiation fee, and the charge appears quite reasonable for private clubs (about $5,000 per course). The Landings, which is a mature, decades-old community has virtually no unsold properties remaining, but club members are residents who understand that their home values depend on a brisk resale market. The lower initiation fees will encourage sales activity.

Just last week, the elegant, 900-acre enclave of Briar's Creek, on Johns Island just south of Charleston, announced it was dropping its fees from $160,000 to $100,000 -- and an additional $30,000 for those who purchase a home site from the developer's relatively large remaining inventory. Incentives are the common currency of developers pressured to move "dirt," as unsold lots are termed, but a price reduction of nearly 60%, especially at such a refined club with a wonderful Rees Jones layout, is unprecedented in my experience, except for a number of courses that are eliminating fees altogether.

For private club members, big reductions in new member initiation fees are less drastic than the alternative -- opening for public play. Those who have dreamed of joining a top-flight private club but couldn't afford it might look again. Golf is on sale.

No mountains of debt: Vermont avoids wild home price swings and foreclosures

Vermont is a bit too granola for many people. The state has contributed the only self-described socialist U.S. senator, Bernie Sanders, although he is listed as an “independent,” and its aggressive environmental protection laws have made commercial and residential development in the state difficult if not impossible. No one can argue about the overall beauty of the state; they don’t call it the Green Mountain State for nothing.

Goldilocks lending practices

Yet liberal Vermont is a conservative’s dream when it comes to financial planning, according to an interesting Page 1 article yesterday in the Wall Street Journal

Those who enjoy both skiing and golf, and those seeking to flee the hot summers of the deep south, will feel right at home in Vermont, no matter their political persuasion. I am planning extensive travel this fall throughout the state and the rest of New England, with stops for reviews at the region’s best golf communities and resorts (in New England, many resorts are communities as well). I will be looking at these communities with two types of buyers in mind: Those who love the game enough to own homes north and south; and those for whom one home adjacent to ski slopes and golf courses is the perfect combination.

Visitors to Vermont clog the local roadways and golf courses in the fall for views like this from the famed Equinox golf course. (Photo courtesy of The Equinox)

My roster of potential visits in Vermont includes some of the most recognizable resorts in the travel industry, including: The Equinox (Walter Travis, 1926); The Woodstock Inn (R. T. Jones, Sr., 1961); Queechee Country Club (36 holes, G. Cornish 1970 & Cornish/Robinson, 1975); Stratton Mountain Country Club (27 holes, Cornish/Robinson, 1969); Sugarbush Golf Club (R. T. Jones, Sr., 1961); Killington Golf Club (Cornish, 1983); Mount Snow (Cornish, 1967); Green Mountain National Golf Club (Bates/Durkee, 1996); and The Essex, Vermont’s Culinary Resort & Spa (Links at Lang Farm, 18 holes executive, M. Asmundson, 2002; Vermont National Country Club, Nicklaus Design, 1998).

Most underrated golf architect?

For those unfamiliar with the designs of Geoffrey Cornish, you are in for a treat if you like the classics. At 95, Mr. Cornish is the grand old man of golf course architecture, with more than 200 golf courses in his portfolio of completed projects. He has long been acknowledged as the architect most knowledgeable about turf grass, having studied the science at the University of Massachusetts. His many course designs may not be the best known but they are well regarded by architects and players alike. Mr. Cornish designed my home course of 23 years, Hop Meadow Country Club in Simsbury, CT, a long and undulating layout I have seen echoed in other of his designs I have tackled. They are all fun and challenging, and I am looking forward to a few more in the mountains of Vermont this fall.

the grand old man of golf course architecture, with more than 200 golf courses in his portfolio of completed projects. He has long been acknowledged as the architect most knowledgeable about turf grass, having studied the science at the University of Massachusetts. His many course designs may not be the best known but they are well regarded by architects and players alike. Mr. Cornish designed my home course of 23 years, Hop Meadow Country Club in Simsbury, CT, a long and undulating layout I have seen echoed in other of his designs I have tackled. They are all fun and challenging, and I am looking forward to a few more in the mountains of Vermont this fall.

If a particular Vermont course or community is of interest to you, please let me know and I will do all I can to put it on my schedule and review it here.

Vermont National Golf Club was designed by the Nicklaus Design group. (Photo courtesy of Stowe Area Association).

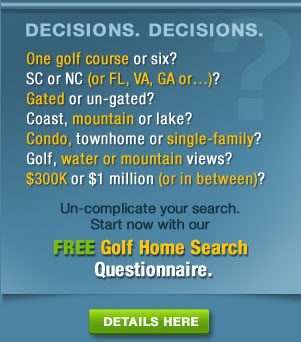

Prices in best mid-level golf communities stabilizing; here are a few of the most stable

Anyone waiting for history to repeat itself in the housing market -- a recession-created bust followed by a strong boom -- may have a long wait. The nation has never quite seen a housing crisis like the one we are trying to get through now. Foreclosures are savaging the bottom end of the market and leaking into both the middle and top end; one home we know in a terrific and stable golf community in the western North Carolina mountains is offered by a local bank for nearly half its former asking price of $2.2 million. Prices don't seem as if they can go any lower (but course, they can), and combined with still-low interest rates, the table would seem to be set for a nice rebound...if only sellers could find buyers with the security of strong reserves of savings and/or jobs they are certain they will have a couple of months down the road. Good luck.

Within the maelstrom, however, are a few oases where the business of real estate transactions may soon return to something approaching normalcy. Although it may seem self-serving for someone who counts on interest in golf communities, I do think a certain class of "leisure" residential community will do just fine in the next couple of years. These communities have a "sweet spot" of home prices in the mid-six figures, have all their key amenities (golf course, clubhouse) in place, and are located in or near magnet-towns for retirees. They were among the most attractive locations before 2006, and they have remained fairly stable during the housing crisis (although prices have dropped an average 20% or so even in the best communities).

Tom Fazio has a great knack for "burying" cart paths out of view. At Champion Hills in Hendersonville, NC, he pulls the same trick with the surrounding homes, which are tucked away above the course and in the trees.

The assumption here is that many of the leading-edge baby boomers who have deferred their retirement dreams waiting for the prices of their primary homes to return to 2006 levels have lost patience with the waiting. Now that their kids are off to college and their careers are coming to a close, most of these boomers will be downsizing anyway, trading their large, high-value homes in the north for more modestly sized and priced homes in the south. Insurance, tax, utility and general overall homeowner expenses are also likely to decrease when the move. As long as they have enough equity in their homes to help pay for their new homes on the course, look for them to start to head south. That will firm up prices in the best-regarded communities in the best-regarded areas.

This is by no means a complete list, but below are some of the golf communities in the southeastern U.S. that fit the category, that I have visited and can recommend, and that I think will benefit from the "re-migration" south. I have excellent real estate contacts at each of these if you would like more information:

The Landings at Skidaway Island, Savannah, GA

Large community with few thousand residents and six excellent golf courses by Fazio, Hills and Palmer to accommodate them. Sheer size of the place, with all amenities built and prices that did not plummet during crisis, provide stable future. Range of neighborhoods within the gates, some needing TLC (and therefore extreme bargains). Distinguishing features: Downtown Savannah is just 15 minutes from the front gates, and the city is essentially hurricane proof (click here for more on Savannah and hurricanes). Club membership just reduced from $55,000 to $30,000 for all six courses and multiple clubhouses.

Sample of current listing: 3 BR, 3.5 BA, 2,759 square foot California ranch style home in excellent condition. Renovated in the last couple of years. Pool, lots of hardwood floors, large kitchen. Wet bar that serves inside & pool area. Part of patio covered. Listed at $495,000

Champion Hills, Hendersonville, NC

Mature, well managed by residents, Fazio golf course just rated #5 in the golf rich state (Fazio grew up in the area and maintains property at Champion Hills). Some homes at significant elevations with views to match. Town of Hendersonville provides all necessary services, but Asheville is still just half hour away. Distinguishing feature: Residents are savvy business people who have ensured financial reserves to keep the community out of harms way.

Current home for sale: 3 BR, 3 BA, 2,000 square foot cottage on cul-de-sac, 14-years old, wraparound porch, property taxes just $1,868 annually. Listed at $495,000.

Porters Neck, Wilmington, NC

Stable, established community of well-kept homes cosseted among vast array of huge live oaks and surrounding classic Fazio course, renovated to its original layout in recent years. Club is semi-private but feels private. Wilmington a short drive, but daily needs (groceries, doctors, etc.) satisfied a few minutes from front gate. Most real estate sold, built on.

Current home for sale: 3 BR, 3 ½ BA, 3,000 square feet overlooking full stretch of 2nd hole. Master suite downstairs, family room with Brunswick Heritage pool table, club membership ($30,000) negotiable. Listed at $529,900.

Thornblade Club, Greer, SC

Private golf club inside un-gated neighborhood, not planned community. Surrounding homes do not detract from classic nature of early Fazio course, site of final round of annual BMW Charity Pro-AM. (Note: Some BMW of America execs from nearby corporate HQ live in Thornblade, along with pro golfers Jay Haas and Dottie Pepper.) Without cost burden of extra amenities of planned community, home in non-planned community can be better deal. Distinguishing feature: U.S. Open champ Lucas Glover cut his teeth at Thornblade.

Current home for sale: 4 BR, 3 ½ BA, 3,600 square feet. Butler/wet bar with built in china cabinets. Granite counters, gas stove, double wall ovens, recessed lighting and built in desk area in kitchen with master suite on first floor. Listed at $583,650.

Thornblade's clubhouse is host to pro golfers and members Jay Haas, Lucas Glover and Dottie Pepper and, once a year, to the best players on the Nationwide Tour during the BMW Charity Pro-Am.

Cedar Creek, Aiken, SC

Not the most upscale golf community in charming horse town of Aiken -- Mount Vintage and Woodside more upscale and, of course, more expensive -- but Cedar Creek is stable and popular with brainiest folks in the area (Ph.Ds from Savannah River Project nearby). Creative Arthur Hills layout gets much outside play, but resident-members do not seem to mind the mingling. Course condition issues of a few years ago have been resolved. Believe it or not, there are people who prefer a location neither in mountains nor near beach; Aiken fills the bill for them. Oh, yes, if you can score tickets to the Masters, Cedar Creek is just a half hour from Augusta National.

3 BR, 2 ½ BA, 2,460 square feet, classic brick home on 10th fairway. With homes in $200s to $700s at Cedar Creek, this one is priced in middle of the range at $474,900.

Amelia Island Plantation, Amelia Island, FL

Spend your life on vacation, but that also means sharing some facilities, like the golf courses, with resort guests. But for those who like to be near the beach and near a city -- in this case Jacksonville -- Amelia is well situated. The historic, charming beach town of Fernandina Beach at the north end of the island is a bonus. A well marketed, thriving golf resort may attract some golfers who don't repair their ball marks, but their green fees ensure cash flow is available for course maintenance.

3 BR, 3 BA, 2,788 square feet, 25-year old home on 15th fairway of the Pete Dye Oak Marsh course (temporarily closed for renovations) and with views of lagoon from deck along back of home. Master suite has private balcony, guest bedroom has private deck and bathroom. Listed at $450,000.

The saviors of golf...in a photo caption?

As we have all read, rounds of golf are down nationally, more golf courses have closed than have opened in recent years and young wage earners

Promoting golf with 24x7 hero worship of Tiger is not, by itself, going to save the game (although it will bring out more idiots yelling, "GO IN THE HOLE!!!" on 170-yard approach shots). Campaigns like the PGA Tour's "These Guys are Good" do not encourage people to take up the game as much as it encourages us to watch golf tournaments on TV or attend them in person. The key to golf's future popularity is not how potential golfers relate to those who play the game but rather how they can relate to the game itself.

The caption in one of the photos that accompanies the article provides the best evidence that golf may have an eager market of millions of new golfers over the coming years. In the photo, four would-be golfers are

Those conjuring ways to increase the popularity of golf should take note. A few multi-lingual billboards and newspaper ads, more promotion of players from the European and Asian golf tours and more creative exploration of what golf can do for both body and soul may ultimately prove that rumors of the death of golf are greatly exaggerated.

You can read Bill Weir's article at courant.com.

Shaq's house sold, but other Miami celebs still waiting

No longer a player for the Miami Heat after a trade to the Phoenix Suns, NBA behemoth Shaquille O'Neal put his 20,000 square foot palace on the market for $22 million but accepted $16 million, the difference more or less a rounding error on his income from basketball and his commercial ventures. Other celebrity homeowners in Miami are either less wisely invested or less flexible about what they will accept in the current market. Former Miami Dolphins quarterback Dan Marino, almost as much a presence in TV ads as O'Neal, has had his 10 bedroom, 12 ½ bath home listed for $13.5 million for a few months. The price includes more than $1 million in furniture and the promise of a signed football by the former quarterback star.

Singer Ricky Martin, known for his flexible stage moves as well as energetic voice, may not be flexible enough when it comes to pricing his home. He might follow Shaq's lead and drop his own $22 million asking price a bit. By comparison, local boy Alex Rodriquez' home is modest at both 8,300 square feet and an asking price of $10 million. Now that he is a single guy, a big glitzy apartment in the city -- or more than one city -- will probably suit his lifestyle better.

The king of real estate holders in Miami is Alan Potamkin, a car dealer whose home is on the market for a hair under $50 million. It sits on the best piece of property in the best (i.e. most expensive) neighborhood in the Miami area. The 12-camera security system aims to keep it that way.

If you would like to see how the other halves live, Alex Shay's web site is a hoot. Find it at http://www.alexshay.com

Free online real estate aids: Sometimes you get what you pay for

Here's an example: I received a listing via email from Michael Kuss

of Daufuskie Properties Realty for a big, beautiful home on Daufuskie Island; the house is located at 27 South Range Overlook (click on photo for larger image). The asking price is $2.2 million, which despite the water views, walk to the beach, pool and gourmet kitchen in the well-appointed 4,400-square-foot home, seemed at first blush a little out of proportion to the current market conditions. Homes a little smaller had been listed recently at substantially lower prices. The surrounding community of Haig Point, lovely and peaceful, is nevertheless a ferry ride from anywhere, and that ferry adds substantially to homeowner fees. Free membership for the club and its terrific 29-hole Rees Jones golf course is counterbalanced by the substantial dues payments to live and play at Haig Point (the ferry adds atypical costs). On the other hand, those who covet their privacy or are allergic to fossil fuel pollution will find the atmosphere on Daufuskie priceless; no private cars are permitted on the island.

of Daufuskie Properties Realty for a big, beautiful home on Daufuskie Island; the house is located at 27 South Range Overlook (click on photo for larger image). The asking price is $2.2 million, which despite the water views, walk to the beach, pool and gourmet kitchen in the well-appointed 4,400-square-foot home, seemed at first blush a little out of proportion to the current market conditions. Homes a little smaller had been listed recently at substantially lower prices. The surrounding community of Haig Point, lovely and peaceful, is nevertheless a ferry ride from anywhere, and that ferry adds substantially to homeowner fees. Free membership for the club and its terrific 29-hole Rees Jones golf course is counterbalanced by the substantial dues payments to live and play at Haig Point (the ferry adds atypical costs). On the other hand, those who covet their privacy or are allergic to fossil fuel pollution will find the atmosphere on Daufuskie priceless; no private cars are permitted on the island.I visited Zillow.com for an estimate of the home's value. Zillow, which claimed to have updated the home's value a couple of days ago, indicates the market value at $1.409 million, or a whopping 36% below the asking price. Although the web site provides a possible range of $1.535 million on the high side and just a little over $900,000 on the low side, the difference between the asking price and Zillow's estimate is a head-scratcher.

I contacted Daufuskie Properties' Mike Kuss. Mike is a grounded guy,

Unique homes on a private island may just be too much for Zillow's algorithms to handle. The lesson here is not to rely on such general pricing tools but rather to do your homework on the market you are considering buying into with the help of a well-qualified buyer's agent. I know many of them in the southern U.S., so if you are in the market for a retirement or vacation home, please contact me. Remember, the agent who represents you as the buyer is paid from the commission on the sale of the home, not by you. Sometimes the best things in life are free.

Underrated Parkland course a highlight at Myrtle Beach's Legends Resort

by Tim Gavrich

The three golf courses at Myrtle Beach's Legends Resort -- in addition to the clubhouse and many of the condominiums on-site -- exemplify British-inspired golf course design principles in a Low Country setting. Although there is no true linksland in the area that would completely mimic what you find at St. Andrews or St. George's, all three courses feature some of the boldest contouring from tee to green on the Grand Strand.

Whereas the sister Heathland and Moorland courses sit on more open tracts of land and make reference to the great links courses of Great Britain, the par-72 Parkland course, true to its name, occupies a more wooded site that is typical of most other area golf courses. But Parkland is not "just another Myrtle Beach course." It is a bold, thinking-player's golf course that bucks the notion that many hold of Grand Strand courses being "buffet golf."

Bunkers are the pits

Unlike its older siblings, the Parkland course has a somewhat checkered design history. After early involvement by the noted architect Tom Doak (designer of the Heathland course) and international designer Gil Hanse, local developer Larry Young and the late Mike Strantz (whom Grand Strand golfers have to thank for both Caledonia and True Blue) finished the design of The Parkland. Despite the involvement of many hands, no holes seem out of place in terms of style. It is a bold golf course with dramatic features, where bunkers catch players' eyes (and shots) throughout the round. They are deep, with sharp edges and sheer faces. Both alongside fairways and next to greens, the bunkers at the Parkland course are true hazards. Only the most fortunate players will be able to reach a green from more than 100 yards out of one of these pits.

According to the scorecard, Parkland kicks off with a fairly straightforward par 4 that plays to 380 yards from the Gold tees. However, from the tee box, the path to the green is partially obscured by clever mounding and bunkers. The best line off the tee is just right of the last fairway bunker on the left. The closer the drive comes to any of the left fairway bunkers, the better the view of the green, which is pushed up such that it is difficult to divine exactly where the pin is located. It is a beguiling opening hole, an augur for what is to come throughout the round.

The approach to the 7th hole at Legends Parkland

Water behind

By the time players reach the 5th tee, hopefully they have settled into a good rhythm and frame of mind for the round, perhaps having taken advantage of the relatively easy par 5 4th hole with a birdie. That is because the tee shot on the 200 yard 5th is the most exacting on the course to that point. Golfers used to ponds short, left, or right of greens may be taken aback by a hazard directly behind. Water lurks behind the 5th green and wraps around to the right; given the long-and-narrow nature of the green, a low, running long iron is the preferred shot. Designing trouble beyond the green is a great protection for the hole against lower handicappers, who may feel bolder and more confident with a 4 or 5-iron in their hands than a bogey golfer does. There is room to miss a bit short and left, leaving a reasonably straightforward pitch shot. It is a lovely hole that allows players to choose how aggressive they wish to be and punishes foolish shots adequately.

If a player gets off to a rough start over the first seven holes, the stretch of holes 8 through 11 affords four excellent birdie chances, with two par 5s and two short par 4s. The standout hole among these four is the 9th, which is listed at 340 yards from the Gold tees but is less than 300 yards as the crow flies. It is a wonderful place to take a chance and hit a tee shot pin-high to the left of the green, avoiding some nasty bunkers left and right. The multi-level green contains some bold slopes that can be used to move the ball on non-linear paths toward certain hole locations. There is a severe drop-off over the back of the green that will kick balls out of bounds, providing no mercy for players who are overly aggressive. Players who are tactful, however, will find an excellent birdie opportunity at number 9.

Desire for replay

Much of the back nine at Parkland weaves through a forest setting. Although homes and condos are often visible, they do not interfere with the holes themselves. The golf course rears up with its toughest challenge at the marvelous par 3 16th hole. Measuring 235 yards from the back tee, the hole can play at more than 250 yards when the pin is in the back portion of the 50-yard deep green. With a cluster of six bunkers flanking the left part of the angled green, the ideal shot is a right-to-left curling fairway wood or long iron. A swale bisects the green, making lengthy putts a challenge as well. A par at 16 is something to be cherished.

The Parkland course closes with two attractive par fours - the 395-yard 17th and the 465-yard 18th, which offers a wide vista that overlooks Legends' 30-plus acre practice facility and stately clubhouse. As I finished my round, I had the urge to head back to Parkland's 1st tee and go again. That is always a good sign.

Editor's note: Real estate at the large Legends Resort runs the gamut from condos to single-family homes with prices ranging from the low $100s to high six figures, with many choices in between. One piece of property currently for sale at $137,900 has an outstanding view of the par 3 13th holes on the Parkland. Many of the communities homes are rented to visiting golfers, and anyone wanting to check out the golf and homes at The Legends can stay and play for a reasonable fee. If you would like me to help you make arrangements to visit, just contact me.

The Parkland Course at The Legends Resort, designers Tom Doak & Larry Young; Gold Tees: 7,215 yards/74.9 rating/136 slope; Blue, 6,834/72.6/133; White, 6,396/71.3/130; Red, 5,351/71.0/125. Two other courses adjacent: The Heathland and The Moorland.

The finishing hole at Legends Parkland, with a slight echo of the Old Sod.

PGA signs up to play Classic at a classic

What a wild year for the Greenbrier, the legendary resort in the West Virginia mountains; first a declaration of bankruptcy, then a sale to a family corporation named Justice that had previously purchased the adjacent resort, and now a full-fledged PGA Tour event beginning next year. The new owners have announced and begun construction of an underground casino at the resort and plan to add new restaurants and other amenities to make both the resort and The Sporting Club even more attractive.

If you missed the news last week, The Greenbrier Classic will debut in

The 6,500-acre Greenbrier Sporting Club, already a pricey vacation and permanent home location for well-resourced mountain-golf lovers, could raise its real estate prices in the wake of the news. Many private club members like the validation a PGA Tour event provides for their home club, and it also gives them a week in which to volunteer their services for the benefit of local charities (and, potentially, to host some of the less successful PGA tour players at their homes). Doing good while living well is a nice combination.

For those interested, homes at Greenbrier begin in high six-figure territory and run well into seven figures. Golf club membership, which is mandatory at the time you purchase your property, is $140,000, refundable at 80% of the prevailing level of inititation fees when you resign). Dues are $12,000 annually for the run of amenities, including The Snead Course, designed by Tom Fazio (members also have access to the famed resort courses). The Snead is named for longtime Greenbrier pro, the late Sam Snead; the course's 150-yard markers are posts with the trademark Snead fedora on top of them. Slammin' Sammy is a legend in the mountains of West Virginia, and so too is the Greenbrier.