Hot fun in the summertime: National Father & Son Team Classic set for July 2010

I have two vivid memories of golf competition in my 50 years of playing the game. The first was a 45-foot uphill, curling putt I sank on the last hole of a 63-hole four-ball event at my home course in 1987 to beat Dick McAuliffe and his teammate; McAuliffe, a former professional baseball player with World Series experience, was a tenacious competitor, which made my stroke of good fortune even sweeter. My putt vaulted our team from 3rd to 1st Place and earned us some nice prize money.

The other event, a four-ball as well, was at the Father & Son Team Classic in Myrtle Beach in 2000. My then 11-year

Many of you who read this blog have passed on the love of golf to your sons, daughters and, in some cases, your grandchildren. Competition with one of them by your side is both fun and a bonding experience. There is no bigger stage for that experience than the annual Father & Son Team Classic in Myrtle Beach, SC, held annually in late July. The three-day event, played on a dozen or so area golf courses, attracts as many as 1,400 players. The combinations of fathers and sons, sons-in law or grandsons are broken out into flights based on handicaps. Each flight holds about 18 teams and carries the names of famous golfers. (We've played in the Els, Floyd, and Nicklaus flights). The competition is best ball on day one, followed by alternate shot and then the scramble (or captain's choice). It is all great fun playing with and against teams of the same levels as you and your son (or father).

The tournament is played over more than a dozen of Myrtle Beach's most popular courses, including the Barefoort Resort, Pine Lakes International, Grande Dunes and The Thistle Club (course assignments are random). Because steamy July is actually the off-season for golf in Myrtle Beach (bring sunscreen and drink plenty of fluids), some of the resorts away from the beach offer substantial discounts for Father & Son competitors. The team entry fee, which next year will be $1,175 ($225 off for previous competitors), includes breakfasts, an awards barbecue, all green fees and carts for the event, and $400 in credit at Martin's Golf Superstore, plus a few gifts.

I don't know of any national father/daughter event, but a Father/Daughter International event will be held at the Greg Norman-designed Doonbeg golf resort in Ireland next July. Last year's winners were from The Cliffs Communities in North Carolina.

For more information about next year's Father & Son event, visit FatherSonGolf.com.

The Thistle Golf Club, north of Myrtle Beach, is one of the courses in the Father/Son Team Championship rotation.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Realty bites: REALTORS waking to trade association's misinformation

I didn't think anything could get me to watch even 10 seconds of the Glenn Beck show again. How ironic that it was a Beck rant about misinformation that compelled me to undergo visual root canal just one more time.

Beck did a four-minute piece on his TV show in 2008 that charts National Association of Realtors predictions about the housing market against reality. It is well-handled and must watching for any REALTOR, and interesting for the rest of us. In short -- and you can watch it for yourself here -- Beck's timeline shows clearly that when an NAR chief economist pours forth words of optimism, the market tanks. A few times is a mistake; a long pattern of mistakes is something more than stupidity.

First it was David Lereah, who may have been more selfish than stupid, since he was hyping the market through the NAR

Most of the 1.3 million REALTORs have acted like loyal Moonies to the monolithic NAR, regardless of how obvious the economic jive has been. Dues in the hundreds of dollars give agents permission to use capital letters in their titles. The REALTOR designation, they believe, brings a certain luster that puts them at an advantage over non-affiliated agents like your editor, who would rather spend the money on a round of golf at Pebble Beach (although not until the market stabilizes).

Now, finally, REALTORS and those who watch the industry are calling for the NAR to get REAL. One Connecticut

NAR rakes in from its members well over $300 million in revenues each year. That buys a lot of influence in Washington and state legislatures, but the organization should put a little aside to purchase an honest economist. Its members deserve at least that.

No pain, no gain: Homeowners exercised by workout specialist

Yesterday's New York Times carried an interesting article about Norman Radow, a "workout specialist" called in by real estate investment firms to fix bankrupt communities. One of his clients, TriLyn, a Greenwich, CT, real estate investor, owns the troubled Balsam Mountain Preserve near Waynesville, NC. Balsam Mountain (see my review here) features a mountaintop Arnold Palmer golf course and 400 home sites, only 280 of which have been sold. Property owners have been trying to raise enough money to come up with $20 million in loan payments. Developers Chaffin & Light, whose other high-end developments had remained trouble free, are trying to stay involved at Balsam, but given Radow's reputation for tough measures, that does not seem likely.

Radow and his company, Radco Development Solutions, offer tough medicine to communities on the brink of collapse. Needless to say, Radow's healthy compensation includes unhealthy words from disappointed owners who thought they were buying into stable communities and suddenly are faced with plunging property values, big assessments, a cutback in amenities (such as clubhouse restaurants) and a private golf club that may have to, ugh, permit some public play.

Still, as mother told us, sometimes you have to take the bitter medicine in order to feel better. Of course, she also said an ounce of prevention is better than a pound of cure. Before you consider a purchase of a home in unfamiliar territory, engage the services of a reputable and experienced real estate agent. I have worked with and interviewed many of them and can help you make an informed choice. Please contact me for more information.

The New York Times article is available here. If you cannot access it, please contact me and I will email it to you.

Balsam Mountain's breathtaking golf course closed after the developers defaulted on loan payments. Property owners and a workout specialist hired by the controlling investment firm are attempting to reorganize things.

Strategic planning: One way to choose a private golf club

An article in Business Week a few weeks ago discussed what many of us who belong to private golf clubs know: Our clubs are hurting. Members are bailing out every week or changing the level of their memberships to save money. Membership rolls are the lifeblood of any club, and below a certain level of membership -- whether 200, 250 or 300 -- proper maintenance of the club and services to members cannot be supported. As membership rolls erode, funds to keep things shipshape dry up and the club starts to look like the public course down the street (or worse). Those clubs that can't stem the outflows go into a death spiral from which there is no escape without the pain of assessments or a drastic change in the club's status.

The problems with the private club industry are the same problems with the real estate industry. Supply and demand rule

Today we have way more private club supply than demand, and initiation fees are downward along with home prices, or vaporizing altogether. One thing clubs cannot reduce, however, are dues, because below a certain point, you can't maintain your golf course and services without a steady flow of cash. If membership rolls and, therefore, dues drop below a certain critical point, desperate measures are needed. For clubs with a few deep-pockets members, that can mean large assessments on top of dues. In other cases, private courses offer themselves for sale to an investor who pledges to keep things the way they are...at least for a few years. And in a few other cases, the once unthinkable occurs; the course opens for public play. Once club owners taste the fruit of a steady stream of green fees, it is hard to go private again.

It is in the natural selection of things that some clubs will go out of business in the next few years. Their members who can

I hope folks do a better job of research this next time around, and identify those private clubs that will be prepared for any future blips in the economy. In my many years of visiting and researching dozens of private golf clubs, I know of only two that have engaged in serious, corporate-style strategic planning. One is Champion Hills in Hendersonville, NC, and the other is Governor's Club in Chapel Hill. Governor's Club's strategic planning session included an offsite session with an outside facilitator. Club membership, according to a friend who lives there, "is off only slightly in the past couple of years." The best news, he wrote, "is that we have not had an operating assessment in the last few years," and they don't expect one this year.

I'm sure other clubs engaged in contingency planning, but Champion Hills and Governor's Club were proud and upfront about their efforts when I spoke with them. If you are considering buying a home in a golf community and adding club membership, ask about the club's contingency planning efforts. Their plans for the future may tell you a lot about what kind of club they are today

You can find the Business Week article by clicking here.

Bunker Mentality: If markets go south, maybe you should too

My brother Bob, the portfolio manager, wrote the following to me the other day after a triple-digit rise in the Dow Jones Industrials: "OK, now I'm at least unlocking the door of the doom bunker, so I can be ready to dash in."

I asked him to hold the door for me. This current stock market is defying the laws of gravity in an environment of massive national debt, double-digit unemployment and a housing market that, despite what the National Association of Realtors tries to tell us, will stumble around for at least a few more years.

I am not an investment expert, nor do I play one at this blog site. But I do have some skin in the game. This stock market is

I also don't feel any strong optimism about the housing market in the near term. There are just too many foreclosures on the horizon and not nearly enough new employment prospects. But for those who have deferred their dreams of moving to that golf course home (or any place in the southern U.S.), now may be a good time to relocate, assuming you are above water in your current home. Moving now could actually be a hedge against any badness that ensues.

My wife and I, for example, are going to sell our primary home in Connecticut in 2011 or early 2012, a year after our daughter

We bought our Connecticut house in the early ‘90s and saw its value increase steadily until 2006. We didn't use the cash in the house as an ATM; we took out a home equity loan along the way, but paid it off in just a couple of years. Like many Americans who bought their homes pre-2000, we are ahead of the game, with some equity to put to work in our next home.

We also know that our house is worth what someone will pay for it, not what the Joneses two doors away got for their house in 2007. (We really do have neighbors named Jones, but we do not try to keep up with them.) If the average of three appraisals we get on our house comes in at ‘X,' we will expect to get ‘X' as the selling price, no more and, we hope, no less. As in the stock market, pigs get slaughtered in the housing market.

It may not seem like much, but the government would give us a $6,500 tax credit if we bought a new primary home before

Also, for those who have good credit ratings and a desire to finance some portion of their dream home, mortgage rates are still as low as 5%, assuming a 20% down payment. We don't plan to add any debt to our portfolio, but for others, low rates could spell the difference between their dream home or nothing.

We have a place in South Carolina already, but we plan to live in a city as well. We are going to rent a city apartment for a while, confirm that we like whatever neighborhood we choose, and keep an eye on real estate prices. If we see a bargain, we will buy it. That same approach will work for many people considering a home in a golf community or in any neighborhood in a golf rich area. Some homeowners in southern communities are now desperate enough that they are willing to take the monthly cash flow from a low rent in lieu of a ridiculously low sale price (or foreclosure).

Most of us entering our leisure years are going to downsize our living space. All things being equal, that means our next

And that can certainly help you keep up with the Joneses.

If you are contemplating a move to a golf rich area and want some ideas or a referral to a highly qualified real estate professional, contact me and I will respond promptly.

Those moving from many areas in the north to southern communities, like Belfair in Bluffton, SC, will save tens of thousands of dollars in cost of living expenses each year.

What's the right course for you?

Our next Home On The Course newsletter is on the tee and ready to be launched. This month we consider the benefits -- and the costs -- of private and semi-private club memberships. With both types of clubs struggling to balance their books, deals are everywhere. Golfers looking for a place to belong are the big winners.

This month's issue of Home On The Course also looks at the exploding auction market for houses. If you have the smarts and the stomach to buy a home at auction, you could win big. But is it worth the risk? We put ourselves on the block in this month's issue.

Home On The Course is unique, reliable and free. We do not promote the golf courses and communities we visit, and our observations about golf real estate and related issues are honest, objective and provocative.

Signing up for the newsletter could not be easier or more secure. (We never share personal information about our subscribers, ever!) Just fill in the box at the top left on this page and confirm your subscription after you receive an email from us. It's as easy as a three-foot -- err, make that two-foot -- putt.

Don't miss an issue. Sign up for Home On The Course now. And welcome Home.

Unfinished business: Gary Player home ready at Cliffs, but his golf course must wait

With typical Cliffs Community fanfare, developer Jim Anthony and Gary Player announced in 2006 that not only would the legendary golfer design the golf course at The Cliffs in Mountain Park, but also that he would move his business and family to the South Carolina community. Next month, Player's 8,000 square foot $5 million home at The Cliffs at Mountain Park will be completed -- at least two years before his course is.

The course was initially slated to have been completed by now, but local environmental groups have thwarted progress. To date, just three holes are built while Cliffs owner Jim Anthony and his lawyers try to negotiate a

Golf course completion is now expected to be in 2011, assuming agreements are reached.

Mountain Park is not the only environmental battle Anthony and The Cliffs face. The developer's much-ballyhooed High Mountain project, where Tiger Woods is making his American design debut, is also being assailed by local groups for its plan to bury hundreds of feet of the headwaters of trout streams underground. Some concerned citizens believe such an action will alter water quality downstream.

Meanwhile, Gary Player and his family are undeterred by the local imbroglios and could spend the upcoming holidays in their new home. Marc Player, son and CEO of his dad's company, led a local TV station on a tour of the almost-finished home a few weeks ago. If you want a look, click here.

News notes for November 14

Toughest golf course in the world

In case you missed it, CNN carried a charming story about the only golf course in Afghanistan and its indefatigable owner, Mohammed Afzal Abdul (and, on some days, its only player). The course, just outside of Kabul, is all hardscrabble and sand, with a little oil mixed in for the putting surfaces. It has survived challenges no golf course in America has ever had to face, including the Russian and Taliban armies.

Words of advice to the owner of the course, now that he has been on CNN worldwide: Copyright and put your "Kabul Golf Club" cap up for sale on eBay. You'll make enough to plant grass greens. Watch the CNN piece by clicking here. Read a related article at CNN's web site (click here).

*

The 6th hole of the Ocean Course is one of 72 fine golf holes at the Amelia Island Resort.

Another golf resort files Chapter 11

Amelia Island Resort, a perfectly nice golf and ocean resort near Jacksonville, FL, never garnered quite the attention as a buddy golf destination as did its northern competitors of Hilton Head Island and Myrtle Beach, nor the upscale cachet of a Kiawah or Sea Island. When I visited the resort, I thought its golf courses well designed and laid out, but their turf pockmarked by uncaring traveling golfers who fixed neither divots nor ball marks. I also thought the service around the bag drop was chaotic, the attitudes of the staff a bit brusque and the practice green between the clubhouse and first tee at one of the courses a joke -- enough room there for about four golfers at a time.

When times are good and golf resorts crowded, such niggling criticisms don't much affect the revenue stream. But that has changed since 2006, and this week, Amelia Island Resort's owners ran out of time, at least under its current organization. The group filed for Chapter 11 bankruptcy, which gives it some breathing room to reorganize. A local investor group reportedly is injecting money into the venture. Here's hoping Amelia comes back healthy and stronger after a bit of pruning.

*

One rock forward, hundreds back

We

wrote here a few days ago about a recent rockslide near Asheville, NC, that

took out a portion of Interstate 40.

As if on cue, work crews in Tennessee were removing one large boulder from Highway 64

this week, and videotaping their work, when tons more of rocks and trees slid onto the roadway. Fortunately, no one was hurt, and the

boulder crushing machine was safely removed before it was pulverized. It makes for compelling video, which

you can watch by clicking here.

When a big deal in a golf community is no deal at all

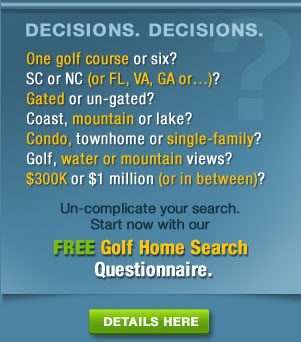

The Internet is the most efficient way to gather information about golf community homes. Done properly, online research provides a lot of basic information about golf communities before you visit. Pricing information, of course, is most helpful; if you can't afford to live in a place, then why waste your time with further investigation, no matter how great the golf community looks or how good the golf course seems?

I

scan golf community related websites often and subscribe to some newsletters

that provide information about golf communities. One I particularly like is the Golf Course Home Network, but

I take what I read there with a lump of salt. Like virtually all media devoted to golf communities, Golf

Course Home Network promotes its clients' developments. Every reference to them is great, and

they all sound like paradise and great investments. Of course, in reality, none are perfect. (Note: We have chosen a different model here, never charging fees

to anyone -- developer or homebuyer -- in order to maintain our

objectivity. We go so far as to

pay our green fees when we play a community's golf course.)

to golf communities, Golf

Course Home Network promotes its clients' developments. Every reference to them is great, and

they all sound like paradise and great investments. Of course, in reality, none are perfect. (Note: We have chosen a different model here, never charging fees

to anyone -- developer or homebuyer -- in order to maintain our

objectivity. We go so far as to

pay our green fees when we play a community's golf course.)

Golf Course Home Network, which provides specific information about communities and wraps it all in a positive package, is typically accurate and timely. I was surprised, therefore, to note last week an unusual faux pas. The Network's newsletter and website announced that an upscale condo development in Charleston, SC, called Reverie on the Ashley River, was offering, with the purchase of some of its condos, free golf memberships at the exclusive and expensive Briar's Creek on nearby John's Island. I visited Briar's Creek earlier this year and was impressed with the course, the clubhouse and the elegant but understated nature of the place. Briar's Creek had just dropped its initiation fees to a still robust $100,000, so my curiosity was piqued by the Reverie offer.

But when I went to the Reverie website, I saw no mention of the offer. I love a good investigation, and I decided to conduct a Google search for further information. I found an August press release announcing the free membership deal -- that expired nine days before the Golf Course Home Network newsletter arrived in my inbox. Alas, too good to be true.

As Emily Latella of Saturday Night Live fame used to say after being advised of a malaprop, "Never mind."

Rees Jones' sleek design for Briar's Creek takes advantage of the Low Country's landscape, marshes and live oaks.

When a big deal in a golf community is no deal at all

I scan golf community related websites often and subscribe to some newsletters that provide information about golf communities. One I particularly like is the Golf Course Home Network, but I take what I read there with a lump of salt. Like virtually all media devoted to golf communities, Golf Course Home Network shamelessly promotes its clients' developments. Every reference to them is great, and they all sound like paradise and great investments. Of course, in reality, none are perfect. (Note: We have chosen a different model here, never charging fees to anyone -- developer or homebuyer -- in order to maintain our objectivity. We go so far as to pay our green fees when we play a golf community course.)

Golf Course Home Network, which provides specific information about communities and wraps it all in a positive package, is typically accurate and timely. I was surprised, therefore, to note last week an unusual faux pas. The Network's newsletter and website announced that an upscale condo development in Charleston, SC, called Reverie on the Ashley River, was offering, with the purchase of some of its condos, free golf memberships at the exclusive and expensive Briar's Creek on nearby John's Island. I visited Briar's Creek earlier this year and was impressed with the course, the clubhouse and the elegant but understated nature of the place. Briar's Creek had just dropped its initiation fees to a still robust $100,000, so my curiosity was piqued by the Reverie offer.

But when I went to the Reverie website, I saw no mention of the offer. I love a good investigation, and I decided to conduct a Google search for further information. I found an August press release announcing the free membership deal -- that expired nine days before the Golf Course Home Network newsletter arrived in my inbox. Alas, too good to be true.

As Emily Latella of Saturday Night Live fame used to say after being advised of a malaprop, "Never mind."