Course corrections: In Myrtle Beach, golf course survival means consolidation

I’m not a big fan of the Survivor television series, but I know enough to understand that, until the very end, the competitors survive by forming allegiances. That is true of the rest of the animal kingdom. In the jungle, only the strong survive, and they typically do it by consolidating their efforts.

So it is in the supermarket of golf, Myrtle Beach, SC, where a current recession has collided with previous irrational exuberance to put independent golf course operators into survival mode. Those who don’t consolidate just might be thrown off the island.

My, how times have changed.

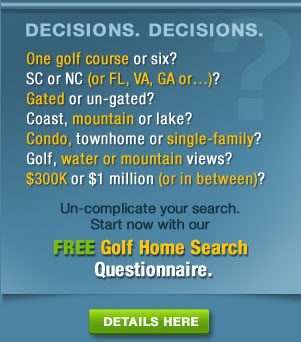

When I first visited the Grand Strand in 1969, I had a choice of 19 golf courses a short distance from the beach. I thought I was in heaven. Today, that number has grown to just over 100, which is actually down from 120 last decade. Total annual rounds fell more than 15% last year, and despite aggressive discounting this past winter, no one expects a dramatic turnaround soon. There are just too many golf courses to support local and vacation golfers, and too much competition from places like Pinehurst and the balmier Florida destinations, also hurting from the recession and offering hard to beat bargains.

The Thistle Club joined with other Brunswick County (NC) golf courses to form the Brunswick Isles Golf Trail. The move helps coordinate marketing activities.

A survival instinct has emerged among Myrtle Beach’s golf operators, forcing them into each other’s arms –- or into the arms of white knights from outside the area. A few multi-operator agreements have helped spread marketing costs. For example, courses on the south end of the Strand formed the Waccamaw Trail a few years ago, basically a way to entice package golfers to stay at Pawleys Plantation or Litchfield Beach for easiest access to the famed Caledonia Golf & Fish Club, True Blue or other local tracks. Likewise, a group of courses in Brunswick County (NC) formed the Brunswick Isles Golf Trail, which includes such excellent tracks as Oyster Bay, Tidewater, The Thistle Club and even Bald Head Island Golf Links, which is closer to Wilmington than to Myrtle Beach.

These arrangements are good for all, but provide only incremental improvements to cash flow. Relatively speaking, they are nibbles. More boldly, some local operators are using the current recession to corner a few wounded golf courses (just to extend the jungle metaphor). Late last year, Myrtle Beach National, which already operated 11 local courses, took over the 27 holes at Wild Wing. (Before the recession, Wild Wing included three 18-hole courses but owners sold half the golf holes to a real estate developer.) Myrtle Beach National, which owns or manages the largest number of courses on the Grand Strand, is in negotiations with the owner of Pawleys Plantation to add that well regarded south Strand course to its portfolio. Also last year, Signature Golf acquired River Oaks, bringing to nine the number of courses it owns or manages in the area. Burroughs & Chapin, Myrtle Beach’s largest residential and commercial developer, owns or manages 10 courses of its own.

current recession to corner a few wounded golf courses (just to extend the jungle metaphor). Late last year, Myrtle Beach National, which already operated 11 local courses, took over the 27 holes at Wild Wing. (Before the recession, Wild Wing included three 18-hole courses but owners sold half the golf holes to a real estate developer.) Myrtle Beach National, which owns or manages the largest number of courses on the Grand Strand, is in negotiations with the owner of Pawleys Plantation to add that well regarded south Strand course to its portfolio. Also last year, Signature Golf acquired River Oaks, bringing to nine the number of courses it owns or manages in the area. Burroughs & Chapin, Myrtle Beach’s largest residential and commercial developer, owns or manages 10 courses of its own.

Even golf resorts have gotten into the act. The Legends Golf Resort decided in the last few years to bracket geographically its three core courses in Myrtle Beach with Oyster Bay, in Sunset Beach, NC, and Heritage Club, on the southern end in Pawleys Island.

A few singly owned courses remain on the Strand, but like the Meg Ryan character in “You’ve Got Mail” whose small neighborhood bookstore was put out of business by Tom Hanks’ conglomerate, they may be dying a noble death. Georgetown, SC’s Wedgefield Plantation, the most southerly course of all on the Grand Strand, went belly up at the end of 2008 only to be rescued by new owners last year. Despite an interesting Porter Gibson/Bob Toski layout, Wedgefield has a steep climb in order to survive; it is 10 miles beyond the next nearest course, the Founders Club in Pawleys Island, and doesn’t have the juice to attract enough package players. Its future may rely almost exclusively on local play. Georgetown, however, has an unemployment rate above the national average.

Private clubs are in just as fragile a position as public courses in Myrtle Beach, in some cases more so. A few years ago, I played the Surf Golf Club in North Myrtle Beach, which had made an atypical move from public to private course. (Myrtle Beach has only a half dozen strictly private courses.) I called today and asked if they were still private. “Oh, yes, the nice young lady answered, but we do accept outside play.” At a time when revenue is scarce, you can be sure Surf Club members do not mind the green fee players.

We have reported as recently as yesterday about The Reserve Club of Litchfield Beach, whose members voted overwhelmingly last year to throw themselves into the arms of a white knight, the McConnell Group, for just $1 in exchange for promises of course improvements and remaining private for the next decade. Those plans were tossed into a cocked hat when former members sued to get a portion of their equity payments back, which the bylaws stipulated but which current members and McConnell agreed would not be part of their deal.

Yesterday in a Charleston court, a bankruptcy judge decided he needed more information before a planned auction could proceed. The McConnell Group was the only registered bidder but today’s Myrtle Beach Sun News indicates that another local group, led by developer and course designer Larry Young, is interested in vying for The Reserve.

The judge says he will rule next week, but the clock is tolling for The Reserve…and other Myrtle Beach courses desperately seeking a white knight or another way out.

Pawleys Plantation (16th hole shown) is reportedly in the final stages of a sale to the Myrtle Beach National Group.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Full court press: Fate of The Reserve at Litchfield Beach before judge

A Charleston, SC, bankruptcy judge will soon decide if one of Myrtle Beach’s few private golf courses can go ahead with a reorganization plan that includes a sale to a North Carolina course operator. Three hundred members of The Reserve at Litchfield Beach voted overwhelmingly more than a year ago to turn the club over to the McConnell Group, which had promised more than $1 million in renovations and to keep the club private for at least 10 years.

The Group, led by founder John McConnell, had planned to add the

The major point of contention was raised by resigned and inactive members who would lose the chance to get back most of their initiation fees. Under the Reserve’s bylaws, a former member can receive up to 90% of his or her equity payment when four new members join. The deal with McConnell, who would pay $1 for the club plus its debts to secured creditors, would not include payment to the former members. The 175 resigned members have hired a lawyer to argue their case before the Charleston judge.

After five hours of testimony yesterday, according to the Myrtle Beach Sun News, the case was continued until today. We will keep our eye on the story.

Bankrupt Richmond club fights with bank

Things at The Federal Club, a financially beleaguered Arnold Palmer designed golf course just outside Richmond, VA, are going from bad to worse. The former private club in a planned golf community, whose course cost $9 million to build, was considered one of the most promising projects in the area just five years ago.

But after trying just about everything, including opening up for public play and declaring bankruptcy for the purpose of reorganization, The Federal Club is once again on the ropes, according to the Richmond Times-Dispatch. Its major creditor, Essex Bank, is asking the court to remove the club from protection in order that the bank may take it over. The bank charges that the club’s owners have used cash from the club’s meager operations to pay other creditors.

The owners say the bank had a plan from the moment bankruptcy was filed to take over the club. They say they have added 20 new members recently by offering joint club membership with another local course. The court will rule later this month.

Coasting through March: Myrtle Beach, Jekyll Island, Camp Lejeune on itinerary

I am taking requests for the month of March. Having landed last night in Pawleys Island, SC, just south of Myrtle Beach, I am ready to take care of business -- and a little relaxation -- for the next few weeks. My scheduled travels will take me to Jekyll Island, GA, for a collegiate golf tournament the weekend after next, and then to the Marine Corps base at Camp Lejeune in Jacksonville, NC the last weekend of the month for another college golf tournament (my son is scheduled to compete). I'll be checking out a few golf communities along the way.

I will also have time in the Myrtle Beach area to play a little golf and visit golf communities in which my readers may be interested. Just contact me and let me know if I can put a community through the paces for you. I’ll also be talking with a few local real estate agents about the state of the market along the South Carolina coast, and will report here what I learn.How to live in two homes but own just one: Sign up for March newsletter

Our March issue of Home On The Course details how one golf-community homeowner and his wife manage to spend three months a year in a “second home” without paying taxes or any of the other upkeep associated with vacation home ownership. Instead, with lots of research (fun for them) and a little bit of bargaining, they wind up renting $2 million dollar homes for less per night than they would pay at a Holiday Inn Express. Learn the details in our March edition, coming in a few days. We also list a few homes currently for rent in some of our favorite golf communities.

Signing up to receive our free monthly newsletter is easy. Just fill in your name and email address at the top left of this page; then confirm your subscription when you receive an automated message (we do that to protect against spam).

That’s all there is to it. In a few days, you will know what other subscribers do; how to live in two homes during the year while owning just one.

Confusion reigns: Trulia data on Landfall goes haywire

I was conducting a little research for a client today on Landfall, an expansive and well-established golf community near Wilmington, NC. The community features 45 holes of golf, including 18 holes by Pete Dye and 27 by Jack Nicklaus. Homes there are expensive, relative to most other golf communities I have visited and surveyed.

Notes about Landfall at the popular real estate site Trulia.com stopped me in my tracks. Here is what Trulia said about Landfall sales:

“The median sales price for homes in Landfall…for Nov 09 to Jan 10 was $287,500 based on 28 sales. Compared to the same period one year ago, the median sales price decreased 63.5%, or $500,000, and the number of sales increased 75%. Average price per square foot for Landfall was $171, a decrease of 35% compared to the same period last year.”

Residents of Landfall would be shocked to learn that their homes had lost so much value so quickly. The fact is, they haven’t. Homes generally sell in the mid- to high-six figures in the community. And Trulia’s own following words contradict their earlier data about Landfall.

“The average listing price for homes for sale in Landfall was $1,060,317 for the week ending Feb 24, which represents an increase of 6.3%, or $62,926, compared to the prior week.” Against a median sales price of less than $300,000, you can bet Landfall owners would not be listing their homes for over $1 million.

Confusing indeed.

Morton’s Fork in road bedevils Cliffs owners

Owners at The Cliffs are on the horns of a dilemma or, more aptly, on the tines of Morton’s Fork. Sir John Morton, Lord Chancellor of England in the late 15th Century, figured out a diabolically brilliant rationale for collecting taxes from everyone in the kingdom. Subjects who lived in apparent luxury, Morton decided, obviously had the means to pay their taxes. On the other hand, all subjects who did not spend much money and appeared to live frugally, Morton reasoned, should have saved enough to pay their taxes. The term Morton’s Fork emerged to define those situations in which you have two choices, both bad.

I thought of Morton’s Fork today as I considered the dilemma Cliffs Communities property owners face. Founder and developer

Owners could be forgiven for thinking they might get skewered no matter what they decide. If they deny Anthony the loan, he has indicated he will go to “Wall Street” to borrow it at much higher interest rates. In the case of a default on the loan, the bankers would own The Cliffs, and you don’t have to be a visionary to understand what that could do to property values. Anthony’s case to the owners is that if they lend him the money and he defaults, the property owners’ will acquire a rich consolation prize, direct ownership of The Cliffs’ amenities.

Not to mix our metaphors, but becoming the owners of those lush and expensive amenities would be a Pyrrhic victory if ever

The Cliffs property owners are smart people -- I know some of them personally -- but even they will have trouble choosing between the two alternatives their developer has presented. They are on the horns of a dilemma, between the devil and the deep blue sea, and in a predicament of which only Sir John Morton could be proud.

States of Anxiety: Pension liabilities may be another reason to head south

New England is often referred to as “The Land of Steady Habits.” Apparently one steady habit in the northeast states is to commit to government employee pensions without the means to pay for them.

Nationwide, states’ pension liabilities were unfunded in 2008 to the tune of about $450 billion, according to a study by the Pew

Dealing with unfunded pension liability is not the sexiest of campaign platforms for a gubernatorial candidate, but at a Connecticut fundraiser this past Sunday for Nelson “Oz” Griebel, the Republican candidate made it clear it was among his top priorities. And although there was not a wet eye in the house, at least one baby boomer in the crowd was thinking, “What if they can’t pay the bill in a few years?”

Anyone with equity in their northern home and a desire to move has lots of good reasons to head south. Climate is one obvious reason. As I’ve indicated many times before, overall cost of living improvement is another. Add to that an expectation by demographers of a continuing migration north to south, with the consequent higher price appreciations in home values in the south. But now, with the economic stress many states are enduring, state funding for such commitments as pensions becomes another good reason to consider a move south sooner rather than later. It may be unthinkable to consider a state like California or Connecticut going bankrupt, but if a state can’t pay its bills, the consequences will trickle all the way down to home values.

In the southeastern U.S., South Carolina, Alabama and Mississippi are only a notch better than the New England states cited above, with between 70% and 78% of funding accounted for pension liabilities. But Tennessee, North Carolina, Georgia and Florida are demonstrably more stable when it comes to funding their own state pensions, with 91% to 107% of their liabilities “in the bank.”

If you are contemplating a move south, even if it is years away, contact me and I will be pleased to help you consider all the criteria that are important to consider in making the move.

Ay Yi Yi of the Tiger

Since his much ballyhooed apology, Tiger Woods has faded (again) from sight, leaving those associated with him to command some of the headlines. Cliffs Communities developer Jim Anthony is still waiting for his property owners to respond to his request for up to $100 million in financing to help finish what Anthony and Woods started at High Carolina, site of the fallen star’s first American golf course design. Meanwhile, inevitable skittishness that follows a developer’s financial problems is starting to work its magic on The Cliffs’ property values; we have spotted a number of “short-sale” properties in the Cliffs at prices 40% off their original listings, and one as low as $79,000.

Then, a few days ago, Gatorade swallowed hard and severed its ties with their main spokesperson. Now today comes word via an online Business Week article that the resort that hosted Woods’ apologia has gone bankrupt. The owners of the Marriott Sawgrass Resort, which has access to more than 85% of tee times at the famed TPC Sawgrass golf course next door, have filed for Chapter 11 bankruptcy. Such filings give a firm an opportunity to reorganize but, with vacation and convention traffic not expected to rebound until next year, major debt-holder Goldman Sachs could wind up as majority owner of the resort.

The Pete Dye designed TPC Sawgrass golf course and its famed island green 17th hole is not owned by the bankrupt firm, but some golf villas, as well other resort facilities, are included in the filing. There is no word if a value has been attached to those ugly dark blue drapes that served as such an appropriately somber backdrop to Woods’ recitation.

Winter golf on Carolinas coast can defy expectations

From the back of the editor's condo in Pawleys Plantation to the 18th hole beyond in mid-February.

Winter golf in Carolinas defies expectations

I arrived at our vacation home in Pawleys Island, SC, on Friday February 12 expecting to get in either my first round of golf since last fall, or at least some practice on the Pawleys Plantation range. I awoke the next day to find five inches of snow on the ground, the most in the area south of Myrtle Beach in about two decades.

Disappointing, yes. But to adapt what Mark Twain once said of New England’s climate, “If you don’t like the winter weather on

In virtually all of the Carolinas, even in the foothills of the mountains, golf courses remain open year round, and it is possible, for those of a particularly active nature, to ski in the morning and then hustle down the mountain to get in a leisurely nine or a biathlon-type 18 holes in the afternoon. Under a heavy sweater, the golf may not be the most comfortable round you ever play, but you can just about guarantee it will be one of the fastest. The faster you grip and rip, the warmer your hands remain. And there is no better incentive on a cool day of golf than that roaring fireplace and a bracing beverage in the clubhouse at the end of the round.

Cheers.