Value plays: Forbes names southern cities among “best bang for the buck”

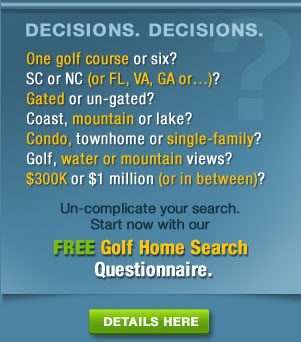

We all want value for our money, and never more so than for the biggest-ticket items. No item is more big ticket than a house, and as millions of baby boomers consider whether to take advantage of low sale prices, developer and private home sellers’ concessions, and near historically low interest rates, there are no shortage of formulas for determining what constitutes “value.”

Forbes.com recently posted its take on value with their ranking of “America’s Best Bang for the Buck Cities.” By combining city rankings on such criteria as real estate taxes, unemployment, home price forecasts, commuting time and housing affordability, Forbes determined which cities provide residents and future buyers with the best value.

The Omaha (NE)/Council Bluffs (IA) area led the nation in bang for the buck, largely on its #1 Rank

Weather in the #2 ranked Little Rock, AR, area can be unpredictable in the winter months, but there is nothing unpredictable about the comparatively low cost of living there. According to Forbes, the area around Little Rock ranks 8th best in real estate taxes, as well as 4th best in unemployment rate. The jobs forecast looks good too. The largest gated golf community in America is located just an hour from Little Rock at Hot Springs Village. The community features nine golf courses, eight of them open to the public, 26,000 acres and 9,000 homes (single-family and town homes). With 33,000 property owners and 14,000 residents, many lots are available. My real estate contact in Hot Springs wrote me that some owners in the Diamante neighborhood, site of the Village’s private club, have sold their lots recently for $1 to avoid monthly dues, and even paid the required $5,000 transfer fee. That implies bargain prices for those who intend to move to and build in Hot Springs Village.

The 17th hole at the Cortez course at Hot Springs Village, one of nine clubs in the largest gated community in America. Photo courtesy of

Donna Bigg, Challenging Designs Inc..

I can’t say I have visited the #3 ranked Jackson, MS, area, but I plan to. I count more than a dozen golf courses within 15 miles of the city, some of them highly ranked. Jackson’s bang for the buck rating is substantially the result of its low real estate tax rate, rapid commuting times and low home foreclosure rates.

The second-most easily commutable city in the nation is Augusta, GA, home to The Masters golf event and just across the river from one of my favorite cities, Aiken, SC (Forbes ranks only the top 100 metro areas, which does not include Aiken). Augusta’s real estate taxes are also among the lowest in the nation, but those contemplating a job in the area may want to keep an eye on the local unemployment rate, which ranked 56th out of the 100 cities. Just 14 miles from the center of Augusta, Champions Retreat features 27 holes of unique golf, 9 each designed by Arnold Palmer, Jack Nicklaus and Gary Player, the only course in the world designed by the three, according to the community's web site. Owners of golf bungalows in Champions Retreat are able to rent them out during Masters week, with the developer taking only a 10% fee, quite low as such rentals go.

Chattanooga, TN, doesn’t knock the ball out of the park in any one category, but its 50th or lower rank across all categories puts it in the overall 8th position nationally.

I was pleased to see that Columbia, SC, ranked #12 on the list, primarily on the basis of its low real

Florida, with all its real estate problems, contributes one metro area to the Forbes rankings. The Palm Bay/Melbourne/Titusville area weighs in at #18, with housing affordability and travel time ranking among the top 10 nationally, and the home price forecast at an impressive #15, despite pretty dismal rankings for foreclosures and unemployment. Those are anomalies that anyone considering the area might look into more closely.

The Greenville,SC, area rounds out the top 20, on the basis of a top 10 ranking in real estate taxes. I think that Greenville is underappreciated as a golf retirement destination, living in the shadow of the more hyped Asheville, also a great place to live but without the strong industrial base of the Greenville area, which is home to BMW America and all the necessary smaller companies that have popped up to support it. Golf quality is unquestioned in the area, with such offerings as The Thornblade Club, Chanticleer, and a few of The Cliffs Communities courses within a short drive.

Other southern cities of note that rank favorably include Raleigh/Cary, NC (#21), Knoxville, TN (#22), Charleston, SC (27), Birmingham, AL (28), and Greensboro/High Point, NC (30). Residents of Chicago, New York, Miami and Los Angeles, which ranked 97th through 100th respectively, do not need any list to tell them what they already know about bang for the buck.

You can review the Forbes list of 100 cities on their bang for the buck list by clicking here.

Despite the failure of Ginn Resorts to build a clubhouse and deliver on other promises to disappointed residents of Cobblestone Park, the interesting golf course remains in nice shape.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Lazy Wally's take on golf lessons

I read only one cartoon strip on a daily basis, the brilliant “Dilbert” by Scott Adams. I was first attracted to Dilbert during my career as a corporate executive. It was comforting to know that someone out there understood so perfectly the odd behavior of a few of my fellow execs, as well as one or two bosses whose peculiarities were the stuff of cartoons. Dilbert helped me laugh to keep from crying (except, of course, when I recognized a little of my own behavior in the strip; then it was just crying).

Now almost seven years beyond early retirement -– my choice, in case you are wondering –- I still read the column every day. It is funny how the things that annoyed you up close and personally are a source of great mirth once you put some distance and time between you and a former career.

Cartoonist Adams spares no one or no thing in Dilbert, and today he got around to the game of golf.

Wally, who is the laziest person on the staff –- he celebrates his sloth –- announces today that he wants to expand his uselessness beyond the workweek. “I decided to take up golf,” he tells Dilbert and fellow staffer Anok, “so I can be useless on the weekends too.”

But when Dilbert asks Wally, “Are you going to take lessons?” the idiot savant’s response is unerring in its insight into the game most of us love to hate.

“You get to hit the ball more,” says Wally, “if you don’t.”

Today’s comic strip is available at http://www.dilbert.com.

*

The large estate house dominates Keswick Estate near Charlottesville, VA, and almost puts Arnold Palmer's monstrous bunkers in their place.

Keswick Estate is sited on one of the most beautiful pieces of property in central Virginia, just east of Charlottesville, and at its core, sitting high above the Arnold Palmer golf course and the rest of the property, is a large estate house now used as both a resort and clubhouse for Keswick’s members. When I played the golf course a few years ago, I thought Palmer’s layout was out of character with the rest of the estate, lacking a certain consistency and refinement. Some holes were straightforward, almost boring, and others were overwrought, with huge bunkers carved into steep hills that would have presented enough challenge without the scarring sand traps.

Homes in the community are large, generally on two-acre lots and expensive. Current listings show the lowest priced home at $1.7 million, but it does boast more than 6,000 square feet, 6 BRs, 5 ½ BAs and frontage on the 4th fairway of the golf course. Nearby Charlottesville is a wonderful town to visit and live in, with much American history and Thomas Jefferson’s inspiration, the University of Virginia, at its heart. The downtown mall, closed to vehicular traffic and rife with interesting shops and restaurants, as well as a popular amphitheater for concerts, shows that city planners were able to think out of the box more than a decade ago.

Contact me if you would like to learn more about Keswick Estate or the other interesting, and lower-priced golf communities in the Charlottesville area.

*

Last year, I bought a used set of Ping Eye Two irons I thought would help me straighten out my longer approach shots. This morning, I thought I was dumb lucky when I read in the Wall Street Journal that old Ping Eye Two irons with U-Grooves are exempt from a ban the USGA imposed on PGA golfers this year and on us amateurs in 14 years. As a result of a 1990 court case, the USGA had agreed that the Ping Eye Twos would conform in “perpetuity.” For that reason, golfers like John Daly will be able to continue to use their Pings, which generate more backspin out of the rough, even though their competitors will be using clubs with new, less active grooves.

I don’t notice much action out of the rough with my Ping Eye Twos, but I don't generate John Daly like clubhead speed (I can't take the club back that far). After reading the article this morning, I thought maybe I could sell my relics to another PGA tour player. But alas, when I checked with Ping, I found out that my irons are circa 1993, too late to be grandfathered in.

Public option: Bankrupt Richmond club opens its tee sheet

The private golf club landscape, especially in golf communities, continues to change as the pressure on clubs to pay their bills mounts. More than 500 golf clubs closed in the U.S. the last three years, and this year is expected to bring more of the same. Faced with bills of their own, many upper middle class golfers and families who would have thought nothing of plunking down a few thousand dollars in initiation fees just six or seven years ago, have put golf club membership at the bottom of their expenditure lists. If they have to play golf, they will be doing so until further notice at the local daily fee track.

Every week, these private club prospects have more and more choices as private clubs opt to open

The three-year old Federal Club, which until its October bankruptcy filing charged member fees in the low five-figure range, now will charge green fees to all comers for as low as $65, cart included. To throw a little bone to its current members, who of course thought they were joining a members-only group, The Federal Club has developed a reciprocal member arrangement with the nearby Spring Creek. That is not likely to mollify most of the members. The new public fee model, Federal Club officials hope, will help the club break even by the end of the year in the face of monthly losses of $75,000, to say nothing of starting to chip away at more than $14 million they owe creditors.

Three local friends conceived the Federal Club 10 years ago, when golf community sales were booming along with the economy and Tiger

Bankrupt golf clubs don’t typically emerge from debt as deep as The Federal Club’s, and the key to this one’s survival will be some forgiving, if not forgetting, creditors and a full tee sheet 10 months of the year in 2010. That may be a tall order. During bankruptcy proceedings last week, and after saying most golfers he knew thought the Arnold Palmer design for the Federal Club was one of The King’s best, he added it was “a back-handed compliment,” according to an account at RichmondBizSense.com, “because most golfers aren’t particularly fond of Palmer layouts.

The Arnold Palmer Design Group is suing The Federal Club for an outstanding balance of $600,000.Hidden in plain sight: Edwards concubine was stashed in NC golf community

The Governors Club in Chapel Hill, NC, is as refined as any golf community of the hundreds I’ve visited in the southern U.S., with a 27-hole Jack Nicklaus Signature layout at its core and a group of involved residents at its heart. Aside from the occasional minor dust-up about a golf bet (happens everywhere), you would not expect a hint of controversy in The Governors Club. But for a few weeks last year, Governors Club unwittingly played host to a bit part in a huge political scandal.

Excerpts from the new best selling book Game Change, which started hitting the airwaves and

The Edwardses are the subject of a long excerpt from Game Change that ran in this week’s New York Magazine. In the piece, authors John Heilemann and Mark Halperin write about how Edwards’ girlfriend, Rielle Hunter, was stashed near The Governors Club home of Andrew Young, an Edwards aide. When confronted by the National Enquirer on Governors Club property, according to the magazine excerpt, “[Young] first denied his identity and knowing Hunter -– this despite the fact that the car she was driving was registered in his name -– before announcing the next day through his attorney that he was the sire of [Hunter’s] unborn baby.”

We now know that Young was covering for his boss who was forced out of the Presidential race a few months later.

According to my own local sources, Governors Club residents first

Most Governors Club denizens must have uttered “Good riddance.”

Island retreat could make swift comeback in wake of bankruptcy sale

If I had a choice of a pure getaway place -– one with excellent golf and a relaxation ethic –- I’d be hard pressed to look any place but Daufuskie Island, SC. Daufuskie, reached by ferry only, is without vehicular traffic, except for a few utility trucks. Homes inside the island's two golf communities are generally spaced well apart, and where they aren’t, the hardy live oak trees make them feel as if they are. The golf on Daufuskie is superb, with 29 holes at the private Rees Jones-designed Haig Point enclave and 36 holes by Jack Nicklaus (Melrose Club) and Tom Weiskopf & Jay Moorish (Bloody Point) at the Daufuskie Island Resort, a 10-minute golf cart ride away.

Relaxing though the island may be, homeowners have endured much stress the last five years, and especially in the last year. Trouble came to paradise a year ago when owners of the Daufuskie Island Resort and Breathe Spa could not make payments on their loans, and the property went into bankruptcy. The Nicklaus course, The Melrose Club, closed for a time but reopened a few months later, but the Bloody Point Club has remained closed, although property owners there have done their best to provide ongoing maintenance.

Jack Nicklaus' Melrose Club course on Daufuskie Island has remained open after its accompanying resort went into bankruptcy. The course presents some typical Golden Bear touches, like the tree in the middle of the fairway at the finishing hole along the Calibogue Sound.

Now, it seems, there is renewed hope for the island dwellers and their real estate values. Two weeks ago in bankruptcy court, a North Carolina group was granted the rights to the property for $49.5 million. Although creditors are kicking up a fuss about the proceeds from the sale, most observers in the area expect the new owners will close on the property in the next week or two. This is good news for homeowners, and possibly for investors looking for island property at depressed prices. The window of opportunity may be closing if the new owners say and do the right things to restore confidence.

I really enjoyed my round at the Melrose Course three years ago; I did not play the Bloody Point course. The Calibogue Sound and the Hilton Head lighthouse beyond is in view from some of Melrose’s holes, especially the finishers, and where it isn’t, marsh and live oaks dominate the scene. The circa 1987 layout is Nicklaus post-apprenticeship with Pete Dye, and the course certainly shows some of his mentor’s influences (a few railroad ties here and there) but it is more interesting for the hints it gives of the later Nicklaus design traits. Chief among them is a tree in the middle of the 18th fairway that provides a safe but longer route left and trouble (the Atlantic Ocean) along the shorter route to the right.

Daufuskie Island is a “niche” living situation, certainly not for everyone but appealing to both ends of the “intrepid” spectrum; that is, those who love the adventure of ferrying back and forth to civilization, and those who just want to plop themselves down as far away from civilization as they can get. Daufuskie is a great place to be a well-cosseted hermit.

those who love the adventure of ferrying back and forth to civilization, and those who just want to plop themselves down as far away from civilization as they can get. Daufuskie is a great place to be a well-cosseted hermit.

In the best of times, the market for vacation and permanent homes on Daufuskie is small; in the bad times, it just about dries up. At Haig Point, where carrying costs are high because the residents subsidize their own ferry and lavish attention on their over-sized golf course, you can purchase a nicely appointed three- or four-bedroom home for under $600,000, and the owners will throw in the $65,000 golf club initiation fees as well.

At the Daufuskie Island Resort, the anxieties of the resort’s default

These are tempting prices for beautiful properties on an island that seems far from the demands of the real world. And if things proceed well with the new resort owners, and Haig Point and the Daufuskie Island Resort marketing can once again widen the market for island living, today’s prices may look awfully good a couple of years down the road.

If I were considering Haig Point or the resort for a vacation or permanent residence, I’d be inclined toward buying a home rather than a lot. Building costs on Daufuskie are two to three times those on the mainland, owing to the expense of ferrying-in materials and labor, as much as $400 per square foot. At current prices for homes in Haig Point, the cost per square foot, land included, is somewhere between $200 and $300 per foot. I know a few professional agents in the area who specialize in Daufuskie Island properties. If you’d like more information about the island or specific homes for sale, contact me and I will put you in touch with an expert.

*

The famous Bloody Point Lighthouse served as the pro shop in the course's early days. When it came up for sale, a couple who lived at Haig Point jumped at the chance to own it. It is an interesting story that you can read at the lighthouse owner’s web site, WeBeBloggin.com.

With uncertainty about the adjacent resort, the future in the community surrounding the Melrose Club was anything but rosy. But news of a buyer for the property has homeowners feeling in the pink again.

Reasons to believe: Ugly decade yields lessons, opportunities

Unless you are 105 years old or stuffed all your money in your mattress before the housing and stock markets tanked around mid-decade, the last 10 years were the most financially nerve-wracking of your life. If you owned your current home in 2005, it is worth between 15% and 50% less today. Most of us seeking a vacation or retirement home on a golf course have put those plans on hold indefinitely.

Four years after the collapse in home values, many of us wonder, “What just happened, what have we learned, and how can we apply the lessons to the coming years?” The January issue of our free Home On The Course newsletter, which will be mailed by the end of the week, provides some answers. We spell out a few “brutal truths” about the last decade and include the lessons we all should have learned about searching for a home on the course. We also share some thoughts on why some of us should pick ourselves up, dust ourselves off, and start that search for our dream home all over again.

Don’t miss out on your free copy of the January issue of Home On The Course. Sign up today at the top of this page and stay on top of the market with the only objective, unbiased observations about golf real estate.

Patio homes: The good life on smaller scale

More and more retirees and vacation home buyers are deciding that bigger is not necessarily better, but it sure is more expensive. That is why, with sales of McMansions languishing, developers are adding homes to their portfolios that are generally under 2,200 square feet, sit on lots of 1/3 acre or smaller, and do not require any exterior maintenance by their owners.

Patio homes are attractive to buyers for a number of reasons. First,

Less is more in a "Not So Big House"

During the heyday of the housing market, patio homes were sniffed at by those inclined toward McMansions. But the economy and a small-is-better philosophy blazed by such books as “The Not So Big House” have made smaller homes less unfashionable and close proximity to next-door neighbors more tolerable. (Note: I’ve visited communities of $750,000 homes in Austin, TX, that were closer to each other than most patio homes.)

There are plenty of available patio homes across the southeastern U.S. For example, a 2,100 square foot 3 bedroom, 2 bath brick home is available in Pawleys Plantation (Pawleys Island, SC) for $359,000, with a view of a pond and the expanse of the par 3 3rd hole on the Jack Nicklaus course. A 1,750 square foot home in St. James Plantation, near Southport, NC, features 3 bedrooms and 2 baths and is surrounded by a white picket fence. It is listed at $299,000.

I spoke with the developers at Cedar Creek in Aiken the other day about their own new section of patio homes called Green Hills, which opened in August. Green Hills was not in Cedar Creek’s original master plan, but changing lifestyles and habits, as well as more modest expectations brought on by the economic crisis, caused Cedar Creek to rethink its site plan.

Detached new home for the price of a condo

Green Hills sits at the very edge of the community, close by but separated from the larger single-family homes. The neighborhood includes a cluster of 27 1/3-acre lots that sell for an average $50,000 per site. Square footage for homes in Green Hills will run from 1,300 to 1,900 square feet, enough for a comfortable three-bedroom house. Four of the lots have sold and one owner has started construction. The largest house will cost a little over $300,000 total, but most will fill the $250,000 to $300,000 range. A few of the lots have views of adjacent ponds but, for the most part, they all have wooded views.

A nice Arthur Hills designed golf course wends its way through Cedar Creek, although it is not within eyeshot of Green Hills. Initiation fees are modest at $4,000, and some discounts up to 50% are available to those who purchase a home in the community. Although the course is open to the public, it attracts a lively group of Cedar Creek residents.

I visited Cedar Creek a few years ago and can recommend it as a place to consider in the Aiken area. Aiken, which is right out of central casting for southern hamlet, is a magnet for those with an interest in things equestrian. The town has been a center of horse-related activities (races, polo, shows) since the 19th Century when wealthy Charlestonians summered in Aiken to escape the heat and threat of malaria in their city. Today, with a low cost of living and proximity to Augusta, GA and Atlanta beyond, many retirees with horse sense are choosing Aiken for the next phase of their lives.

Please contact me if you would like more information about Aiken, Cedar Creek or any other of the excellent golf communities I have visited in the southeast.

Purchase a lot and build within six months, and golf membership is 50% off at Cedar Creek, or a net $2,000. Photo courtesy of Cedar Creek.

Housing data: Cherry on top, but what’s below?

We awoke today to some signs that maybe the housing market is beginning to inch its way back, although the housing stimulus credit expiring in April and the cloudy unemployment picture could prove spoilsports to any significant recovery in 2010. Therefore, although we believe many thousands of couples have the equity to fuel their dreams of a home in a warm weather community, and should consider doing so, we would not advise rushing right out and buying because of one day’s worth of good news.

If you purchased a big allocation of shares of Lennar Corp.’s stock the other day, however, you

Home prices in a number of popular southern towns have stopped wobbling, at least for now. In Charleston, for example, preliminary figures for December indicate median prices increased from $170,000 in November to $193,500 last month, a number just $3,000 shy of the median price in December 08. Average prices were $291,000 last month, $228,000 the month before and $259,000 in December 08. Those impressive comparisons were based on the sales of 541 homes last month compared with 560 in December a year earlier. (Source: Charleston Real Estate Blog).

According to an Asheville, NC, online source, prices in that popular

In the charming town of Aiken, SC, selling prices have appreciated a total of 33% over the last five years. Median sales prices in the three months from September through November, according to the web site Trulia.com, increased nearly 6% compared with the previous three months. Prices year over year, however, were down 7.7%.

The average listing price for Aiken homes for sale, according to Trulia.com, was $336,145 for the week ending December 30, which represents an increase of 0.7%, or $2,237, compared to the prior week and an increase of 3.4%, or $11,193, compared to the week ending Dec 2009.

In my hometown area of Hartford, CT, the local paper’s headline this morning was that “Home Sales Increase(d) 10.6%,” but for those who want to sell their homes and move south, the devil is in the details inside the story. Home prices in 2009 dropped 7.3%, although the November to December decrease was less than 1%. Still, for Hartford area folks and other northerners considering a move to the coast, mountains or inland areas of the south, the glass remains half empty and the encouragement here is not to be piggy about a selling price if you have equity in your home and year round dreams of golf dancing in your head.Dis-Credit Suisse: Bank sued for $24 billion

You just have to shake your head when you read about Credit Suisse, the huge bank that has made some colossally bad real estate loans -– with the emphasis on colossal. These are the folks who thought a nearly $700 million loan to the Ginn Resorts was a smart move. They ate it, and could not even secure the three Ginn communities they had bankrolled. This is the same bank that paid more than $500 million in fines for having abetted a scheme for the Iranian government to secure Western technology.

Now, we learn that Credit Suisse could potentially be put out of our misery via one of the largest court penalties in the history of mankind. The bank, along with real estate service firm Cushman & Wakefield, is being sued for $24 billion (no, that is not a misprint) by property owners and developers at four conspicuously upscale resorts -- Ginn Sur Mer (Bahamas), Lake Las Vegas (Idaho), Tamarac (Idaho) and Yellowstone Club (Montana). The complicated and twisted tale involves forgery, ex-marital loathing, and lots of intrigue.

Florida real estate maven and blogger Toby Tobin has done an outstanding job of chronicling much of the intrigue. You can read his account at GoToby.com.

*

Follow-up: The other day we wrote about the great second baseman, Robbie Alomar, Jr, who most baseball experts thought was a cinch to be elected today to the Baseball Hall of Fame today. We had suggested Alomar's story of redemption after a lapse of judgment could serve as a template for Tiger Woods. Sad to report that Alomar, who many baseball experts believe is among the best to play his position ever, fell eight votes shy of the number necessary for induction. We hope the same experts are correct that he wll be a shoo-in next year. (Personal disclosure: I think I own a couple of his rookie baseball cards. Go Robbie!)

Million-dollar baby at The Landings

Most homes at The Landings at Skidaway Island, near Savannah, GA, are priced under $1 million. Those that top that level typically feature water views of the marsh. The home below was originally priced at $1.7 million but has been reduced to $1.15 million. It features 4 bedrooms, 4 ½ baths and 4,200 square feet. Included in the price is golf membership ($30,000 value) or five years of club dues. The Landings includes six golf courses, two of which I have played and enjoyed. The rear of the house looks out to the eastern marsh.

The Landings offers golf homes for sale that start in the $300s. For a current listing of properties for sale in the community, click here.