Buying a golf vacation home to rent it out

It sounds so simple: Buy a warm weather vacation home in a golf resort community, use it for family vacations a few weeks each year and then rent it out the rest of the time. That extra income will help defray mortgage payments or, if no mortgage, will supply a bit of spending money to put toward the annual vacation.

Although few people ever “pay” for their vacation homes with rental income, the arrangement can work well for those who do approach the idea with a lot of patience and no great expectations. Patience will be a special virtue if, as some economists and realtors in the southeast suggest, we are seeing the bottom of the market for planned development home prices, many of which are at their lowest ever. The real investment payoff could come in price appreciation in the coming years, more so than rental income.

If you are contemplating the purchase of a vacation home you plan to rent out, here are a few things to consider:

Community First

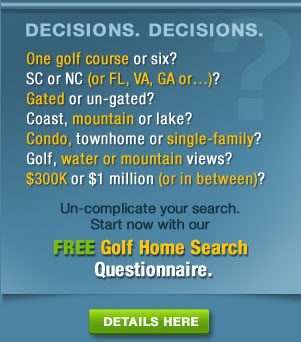

As with any real estate purchase, success is likely to be governed by the three principles of location, location, location. Target a resort community that attracts a consistent flow of vacationers, year-round if possible. Look at a place like Myrtle Beach, for example, where the beaches attract summer crowds and golf attracts the package players the rest of the year (summer is actually non-peak for golf in Myrtle Beach because of the heat). A year-round resort gives you the best opportunity for a higher annual income from rentals. For those who like to ski and golf and are not into sun tan lotion and sand, some of New England’s ski resorts transform into golf resorts a couple of months after the snow melts. We have visited and liked Owl’s Nest in New Hampshire and Stowe and Killington in Vermont.

Don’t Apply Standards of Your Primary Home

Few of us would want to live permanently in a vacation home we purchase to generate income. Communities that lure vacationers –- i.e. transients –- are, by definition, not especially private. Even full-time residents of these communities have to share many of the amenities with “strangers” which sometimes makes for strange bedfellows. In short, do not expect to feel especially “at home” in a place where every week or two, the cast of characters changes substantially and you furnish your home to withstand temporary-bachelor foursomes on a weeklong or weekend lark. You cannot choose your rental guests –- the management company you hire to rent your place does that (see below) –- and most, but not all, visitors will treat your furnishings with respect. But why take the chance? If you have rented one of these units yourself, you know that, after a while, the faux wicker and canvas seating wears on the body and the eyes. But it sure stands up better than mahogany, and is more easily replaced.

Shop for the Management Fee

Managing a property yourself, long distance, could be life-altering, and not for the better. What if a pipe bursts or the toilet leaks? Are you going to hop on the next plane to go rescue your paying customers? The vast

In short, and no matter what management fee you pay, you need to consider that a $1,000 per week rental rate could mean as little as $600 net to you.

The Economy, The Weather, and The IRS

Vacation preferences change all the time, sometimes for unpredictable reasons. Do not purchase a vacation home unless you can afford to pay for it in the lean years. Should we re-enter a recession, for example, you could rue the day you had the crazy idea to buy a vacation home. This is an argument for one other criterion in your search for a vacation home: Identify a place that you would be happy to use multiple weeks each year because if rents are slow, you may be doing just that.

Understand, however, that your personal use of your rental property is governed by IRS rules. Generally speaking, if you claim expenses on the home, you are permitted personal use of it for 14 days annually or 10% of the days it is rented out at fair market value (in other words, not to friends and family at below market rates). You will find a concise explanation of the IRS rules governing vacation rental property by clicking here.

Buy a U.S. Vacation Home; See the World

We have owned our vacation condo in Pawleys Island, SC, for more than 12 years. We made the decision from the gitgo not to rent it out, choosing instead the option to furnish it to our liking (not “vacation proof” it) and to ensure it was available if we decided at the last minute to fly or drive down from Connecticut. We keep enough clothes and other provisions there that we don’t have to worry about packing bags. Was it a sound economic decision? Absolutely not. But from a lifestyle standpoint, we don’t regret it.

Six years ago, we found another terrific use for the unit: We swapped it for a two-week stay in Crail, Scotland, less than a mile from two outstanding seaside golf courses and just nine miles from St. Andrews. Owners of the Crail cottage, Glasgow residents George and Dorothy, stayed at our Pawleys Plantation condo in April that year, and my son Tim and I stayed at the Crail cottage in June. We had a great time and it sure beat staying in a sterile hotel. George and Dorothy joined us for round of golf at Balcomie Golf Links, their course in Crail, and at Scottscraig, the seventh oldest course in the world, 15 minutes north of St. Andrews.

George and I facilitated the swap through a group called HomeLink International, and six years later we remain the best of pen pals. I daresay that without our vacation home as “bait,” we could not have generated any interest in a swap for our suburban Connecticut home; although the golf in the Hartford, CT, area is pretty good, it is definitely not Myrtle Beach or Scotland.

Coming Soon: Suggestions for a few golf community vacation homes you can rent out.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Bluffton developer John Reed reaching for new heights at The Cliffs Communities

The Carolina coastal golf community development organization led by John Reed may be going up-country, according to a letter emailed to club members at The Cliffs Communities earlier this week. If negotiations are successful, Reed will manage the lush roster of amenities and own the unsold real estate in the multi-community development. Reed would engage Troon Golf to manage the golf clubs and is pledging to partner with local home builders and focus on constructing houses in the 2,500 to 4,000 square foot range, somewhat smaller than many Cliffs dwellers built before the recession.

“The ClubCo Board has advised that they are now focused on attempting to reach agreement with Reed Development and its unnamed investment fund partner,” the letter indicated, adding that ClubCo had tabled negotiations with two other suitors.

Cliffs founder Jim Anthony owes $64 million to club members and millions more on his real estate holdings. ClubCo, which operates the golf courses, and Cliffs Communities Inc., which controls the real estate, would

“Reed is currently proposing a vesting of old initiation fees over five years, with less than full repayment,” according to the letter, adding that “Noteholders would receive a higher percentage payout and faster vesting than non-Noteholders.” Although vesting rules were not spelled out in the letter, the implication is that everyone will get back less than promised originally, and those who risked their capital in loaning Anthony the money will get it back at a faster rate than others.

On its face, the Reed proposal is good news for Cliffs residents and club members. Developers, even the good ones, are often targets for criticism by residents of their communities. But Mr. Reed has managed to

Noteholders will meet on Wednesday at Furman University in Greenville, SC, to discuss the Reed proposal. The following day, all members will meet for an update on the fast evolving situation at The Cliffs. Stay tuned.

Avoiding home buyer, seller remorse

Second-guessing is peculiar to our species. When a hungry lion sees an appetizing zebra, does he hesitate? Or regret it months later?

But ever since that kerfuffle in the Garden of Eden, we homo-sapiens tend to dither over big decisions and, worse, beat ourselves up about them later. No wonder sleep doctors are so busy. And no decision seems to invoke mind-numbing anxiety like the selling and buying of real estate. Was my list price too low? Did I offer the seller too much? Do I really like the place that much? What will mom and dad think?

I happened upon an article today at Trulia.com that could prove helpful to anyone who buys or sells a home. Trulia is one of those real estate sites where you can search for homes, find an estimate of real estate values by market or even neighborhood, and occasionally read something thought provoking and useful to your personal real estate situation.

Tara Nicholle-Nelson, a San Francisco real estate broker, has posted an article entitled “8 Remedies for Real Estate Remorse.” She makes a strong case that both buyers and sellers feel remorse, and often over the same deal.

“…the night the contract is signed, the buyer lies awake thinking they could have gotten the place for less,” writes Ms. Nicholle-Nelson, “while the seller does the same exact thing across town, thinking they could have gotten more. (Both tend to ring up their agents; that’s how I know this is true!)”

Although I am not sure each of us has the patience to adopt her eight cures, I especially appreciate her first one: “Write out your vision of the life you want to live after you close the deal.” (I know, it can be read two ways, but she means write it out before you close the deal, not after.) Those of us who occasionally read golf instruction pages in magazines or books should understand the concept; imagine in your mind’s eye the arc of the ball and its arrival on the putting green, and you will have a better chance of executing the shot properly –- and not regretting the swing.

Ms. Nicholle-Nelson’s article is available by clicking here.

Home prices stabilize in 2012, says forecast

The perfect moment for an investment in a golf community home would be when prices hit absolute bottom nationwide, in every market. But the housing market does not work that way; housing price movements are local, a consequence of many factors, employment levels chief among them. When prices hit bottom in one market, they can be still falling or even rising in others.

Clear Capital, a firm that uses high tech data collection to predict housing market movements, believes that U.S. housing prices will stabilize in 2012, actually rising .2% nationwide, but that individual markets will show marked differences. According to the Clear Capital data, folks currently living in the Washington, D.C. area, for example, might not want to sell their homes and move until later in the year, since D.C. area prices are forecast to increase 8.3% year over year. For D.C. area residents contemplating a move to Atlanta, forecasted for the biggest housing price decreases in 2012 (-14.4%), patience could be rewarded especially.

On the other hand, folks in the Detroit area contemplating a move to Orlando should consider a hasty retreat (if they can sell their home). Detroit’s housing market will continue to erode, according to Clear Capital, with home prices dropping another 5.6% year over year, while Orlando home prices will jump 11.7%.

Note: On Thursday, we will release the January edition of our eNewsletter, Home On The Course, which reaffirms the case for home prices hitting bottom in most southern U.S. areas. We also rate a few of our favorite golf communities for their investment potential. Sign up today at the top of this page and you will receive a copy of this month’s Home On The Course and all future issues (or if you sign up after we send the newsletter, we will make sure you get a copy).

Double-witching hour approaches for Cliffs Communities; suitors lining up

The days are dwindling down to a precious few for The Cliffs Communities founder and mega-landowner Jim Anthony to maintain ownership of his developments. A year ago he formed an entity called ClubCo to accept a $64 million bailout from more than 500 of his 2,000 members; he is now facing a default of an $8 million interest payment on the loan. And, separately, his real estate company, Cliffs Communities Inc., is also facing default, according to some residents who spoke on condition of anonymity. Behind the scenes, John Reed (he developed upscale golf communities in Bluffton, SC, including Colleton River, Berkeley Hall and Belfair) is reportedly bidding to pick up some or all of Anthony’s real estate interests; a second developer is rumored to be making a play for the land as well. Regardless of who winds up bidding successfully for the property, the fetching price will be pennies on the dollar compared to what the lots were valued at just a few years ago. And it is likely to take a bankruptcy proceeding to force Anthony to turn his back on his legacy. His former staffers and residents agree the developer is a stubborn man, not given to accepting distasteful medicine, no matter how good for him.

Cliffs Valley (7th hole shown) is one of the most mature of the Cliffs communities and should be minimally affected by financial issues.

It no longer seems a matter of if Anthony is forced out at The Cliffs, but when. And after he goes, the question is how The Cliffs might reorganize to restore at least part of its lofty reputation and property values. Much will depend on who buys the land and who buys the amenities, which include the six golf clubs (Gary Player’s Mountain Park would be #7). That could be either one group of investors, or separate groups for the land and the amenities. Another possibility is that the communities -– some completed, some hardly formed and some in between –-will be bundled into smaller packages along geographic lines. The communities adjacent to Lake Keowee, for example, might be consolidated into one group, those in the Greenville area (Glassy, Valley, Mountain Park) into another, and Walnut Cove near Asheville, NC, into its own. Way up in the air, figuratively as well as literally, is High Carolina, the undeveloped site of Tiger Woods’ first American golf design and the symbol of Jim Anthony’s over-the-top investments in the Cliffs’ package of amenities; recently, a former Anthony senior staffer told us that the developer paid the unproven, architecturally speaking, Woods a $22 million fee to build the course, considerably higher than most published estimates. Even if that overstates the true figure by, say, $10 million, it may explain why Anthony seemed to stalk the fallen star, showing up at Woods’ press conference confessional after disclosure of the star's adulterous behavior. The religious Anthony may have forgiven Tiger, but he wasn’t about to forget how much he had invested in the golfer.

Cliffs property owners are smart and wealthy folks but they face some daunting and perhaps divisive months ahead. One-quarter of the clubs’ members provided Anthony with the $64 million loan, and there is worry that the interests of those with skin in the game and the 75% who sat on the sidelines may diverge substantially, setting up confrontations that will result in gridlock on some big decisions (an upstate South Carolina version, perhaps, of the U.S. Congress v. White House model). Any differences are likely to be exacerbated by foreclosure proceedings that affect the operations of the clubs, which could close a few days a week or for longer periods; in that case, expect some battles over which clubs close and when. Given the rural locations of some of the clubs, especially in the Keowee area, furloughed Cliffs employees could spike local unemployment numbers; don’t expect any help from the state, which is currently governed by a strong Tea Party supporter.

The Cliffs renowned portfolio of amenities include six golf clubs, wellness and fitness centers and an equestrian center.

Property owners who have waited for things to clarify before building a home at The Cliffs may see clearly that their future is somewhere else, and they may join the numerous other owners who already have their home sites on the market. That, of course, could further depress prices in the unformed communities, although The Cliffs at Glassy, Cliffs Valley, and perhaps Walnut Cove and Keowee Vineyard should remain fairly stable.

Of course, some investors always seem to benefit from carnage in the markets and, at The Cliffs, the big winners could be whatever investor group steps in to buy all the available land and/or amenities at a deep discount, as well as those individuals looking for an upscale place to retire or build a second home at a bargain basement price. Proceed with caution now, but expect some substantial deals in the coming months.

Cliffs developer Jim Anthony took the most beautiful piece of property at his Glassy development and built a chapel on it.

Iconic Virginia golf community sold

Goodwin has close ties to the area, having chaired the board of the Darden School, the nearby University of Virginia’s graduate school of business, as well as having served two terms on the University’s Board of Visitors. His worth is estimated in the hundreds of millions.

I visited Keswick Hall and played its Arnold Palmer golf course almost five years ago. Its homes at the time were selling for $1 million and up. The resort community’s focal point is Keswick Hall, which sits at the highest point in the development and can be seen from most points on the golf course. Of the course, I wrote that it was “a pleasant routing but overwrought in a few places.” You can read my full review by clicking here (apologies for the absence of photos there).

Keswick Hall, the structure for which the golf resort is named, dominates most views from the Arnold Palmer golf course.

Is 2012 the year you buy your dream home in a golf community? Help is on the way

The latest housing reports looked pretty good, and some economists are showing a bit more confidence in the real estate market for the coming year. But the bottom end of the market –- where foreclosures and nagging unemployment will continue to preclude any strong recovery -– and the upscale end, where buyers have adjusted their expectations (Does a 6,000 square foot second vacation home really validate success?) and such former luminaries as The Cliffs Communities and

High-end communities like The Cliffs (Cliffs Valley par 3 shown) and Reynolds Plantation are suffering financial setbacks and will probably say goodbye in 2012 to their visionary developers and hello to more tightly run golf clubs and amenities. Other changes could be in the offing for these and other southern golf communities, all to the likely benefit of buyers. For more, sign up for our free monthly newsletter, Home On The Course, at the top of this page.

We have other reasons to think this just might be the year that the southern U.S. golf community market reheats. If we are right, then prices will begin to rise in the south at a faster rate than homes in the northern tier of the U.S., especially once the comparative cost-of-living ratios in the south become even more evident. (Why golf communities don’t advertise the COL differences is beyond us?) Interest from Europe, where the financial prospects for the continent’s wealthiest citizens are anything but settled, may also goose the U.S. golf community market along, especially in Florida (Europeans love Florida!).

We cite other reasons we think prices will begin to rise in the South’s most stable golf communities, and then tie it all together in the January issue of Home On The Course, our free monthly newsletter. To ensure you receive your copy to your email inbox, sign up now at the top of this column and join the 1,000 others who count on our honest –- sometimes brutally honest -– insights about the current state and future prospects of golf communities.

*

Note: I head south this week to the South Carolina coast and expect to make side trips to the areas between Wilmington and Charleston. If you have serious interest in any communities between Landfall (Wilmington) and Briar's Creek and Daniel Island (near Charleston), let me know and I can arrange an on-site inspection.

Some old acquaintances should never be forgotten; we end our year on classic note

This is the final part of our year-end roundup of the best golf courses and golf communities we visited in 2012. If you see any golf course or golf community that piques your interest, please contact us for more information. Links to our original reviews of these golf courses are highlighted.

Golf got old for me in September, literally. It started at the circa 1929 Torrington Country Club, which is actually in Goshen, CT, not Torrington, at the beginning of the Labor Day Weekend. Torrington was designed by one of those architects, Orrin Smith, who is largely forgotten by history but respected during his time. I had wanted to play Torrington for 20 years and had high expectations that were met by the sometimes classic, sometimes quirky, but always challenging layout. I won’t soon forget one almost drivable par 4; the back edge of its green disappeared into golfing oblivion and made even a 30-yard pitch shot a knee knocker. A week later, I hosted a couple of contributors to this web site at Yale Golf Club, which opened in 1926 and crams just about every classic element of early golf into one sprawling layout. Doglegs, blind approach shots, false fronts, double-tiered greens…Yale has it all. There is no more truly intimidating golf hole than #9 at Yale, a par 3 total carry over water and a steep face to a green that is about 65 yards(!) front to back with a four-foot deep chasm across its middle. If the pin is at front and your tee shot lands toward the back –- or vice versa -– be grateful for a bogey.

The pin at Yale on the day I played was up front -- and my tee shot came to rest beyond the four-foot deep crevace that runs across the green. It took me three putts to find the hole, including one from the valley. One of the toughest par 3s you will ever be lucky enough to play.

Babe Ruth hit 60 home runs in 1927, and Donald Ross hit a big one that same year when he built Oyster Harbors Golf Club on Cape Cod. The annual golf outing that I attend there every September never gets old. Mother Nature contributes just enough in the way of terrain changes to make the great architect’s tricky green complexes and maddening putting surfaces seem as natural as a Venus flytrap.

I am a bit sheepish about announcing that I played Winged Foot in October since there is no record of that adventure; I decided not to burden my playing partners or play the tacky tourist by carrying a camera. We played the championship course and, suffice to say, the layout, the changing tree colors, the white caddy outfits against the bright green fairways –- it is hard to overstate the experience of such a course, and hard to overstate how proud I was to break 90. I played another tournament golf course a week later, the Thornblade Club in Greer, SC, just outside Greenville and host to the final round of the annual BMW Championship on the Nationwide Tour. Not only is Thornblade a fine example of an early Tom Fazio course, but it is also the breeding ground for such PGA Tour luminaries as Lucas Glover and Bill Haas (the Haas homestead almost hangs over the 5th green). A couple of days later, I revisited Musgrove Mill in rural Clinton, SC, with the SC Golf Rating Panel, a farewell of sorts, we thought at the time, since the McConnell Golf Group had announced it was closing the challenging course for lack of members and play. Thankfully, as the year comes to a close, there is word that some dedicated Musgrove members have found a way (and the funds) to forestall the hangman’s noose.

Greer, SC's Thornblade Club, a Nationwide Tournament venue, may be the most stable private golf club we visited this year, with an involved membership that spans all ages and such golf luminary members as the Haas Family and Lucas Glover.

The next day, the Panel moved on to one of my favorite golf communities, The Reserve at Lake Keowee, whose sleek and pleasurable Jack Nicklaus Signature golf course is but one of the amenities that lure families from Atlanta and the Greenville area. With one of the cleanest lakes in America at its doorstep, a huge community-gathering lawn that sweeps up from the lake to the large and rustic clubhouse (with an excellent Austrian chef at the helm of the restaurant) and the most inclusive club membership available (all direct members of a family have member privileges without fees or dues), there doesn’t seem much reason to leave the enclave. (Good thing since Greenville is an hour away and, frankly, Clemson, 25 minutes away on a winding road, is only mildly attracting.)

I rested up in November for a big ending in December, which began with our first Home On The Course couples event at The Landings, just outside Savannah. Four couples representing Ft. Wayne, IN, Goshen, NY, Atlanta and Boston joined us for a long weekend that was both active and relaxing. Much of the activity was centered on two of The Landings’ golf courses, Oak Ridge and Palmetto, both in fine condition but offering two different playing challenges (the Arthur Hills Palmetto course the tougher of the two, with a few forced carries over marsh). The Landings chefs also strutted their stuff with a special three-course lunch after golf and two sumptuous dinners. Although it was optional, three of the couples opted for multiple visits to homes currently for sale at The Landings. (Note: We hope to repeat the Discovery Weekend in 2012 at two or three golf communities. If any readers have suggestions about where to hold it, please contact us.)

Couples from Ft. Wayne, IN, Atlanta, Goshen, NY, and Boston participated in our first Discovery Weekend, held at The Landings near Savannah. They played the Oak Ridge and Palmetto courses (Palmetto shown here), two of the community's six nicely conditioned and sporting layouts.

I could hardly have asked for two better golf courses to end my year than Camden Country Club and Columbia Country Club. Columbia, which is actually in Blythewood, SC, is a 27-hole complex by Ellis Maples, whose fairways are open and fair but whose charms are hidden in the large and subtly undulated greens, which were also in stunningly good condition for so late in the year. Although the course is surrounded by a mature community, I do not recall a single home or out-of-bounds stake intruding on the round. The only thing that intruded on our round at Camden was a freight train that barreled down the tracks that separate the 11th green from the 12th tee, tracks that once brought revelers to the luxury hotel that sat alongside the par 3 12th. Those days sadly ended during World War II but fortunately the Camden golf course is substantially as Walter Travis and Donald Ross intended it –- short and mean in ways that leave you smiling in frustration. (Ross was hired in 1939 to remake the circa 1922 greens and to enhance other aspects of the layout.) As befits a true Ross course, I might have had one or two putts all day that did not break at least a cup’s width –- maybe. I cannot think of a better way to ring in the new year without saying goodbye to the old style of golf.

Donald Ross fairways may be wide, generally speaking, but a pushed tee shot at the par 4 7th at Camden Country Club creates a triple threat for the approach to the green; the fairway bunker, a tree at the fairway's right edge, and a greenside bunker that takes away the "safe" play to the front.

As 2011 ends, there are signs that the housing market may be improving incrementally. This may give some baby boomers the confidence to sell their primary homes and move to a warmer climate where they can indulge their urge to play golf year round and enjoy the benefits of a lower cost of living environment. Still, some high-end and high-profile golf communities like Reynolds Plantation and the Cliffs Communities and their property owners and club members face an uncertain year. Developers of both former high flying communities face financial uncertaintly, and even the recharged Tiger Woods may not complete his golf course deisgn for The Cliffs when the Cliffs' vaunted amenities and seven golf clubs are sold by financially strapped developer Jim Anthony, which seems more and more likely. We will address the year ahead for golf communities in our January issue of Home On The Course, our free monthly newsletter. You can subscribe at the top of this page.

Thank you for your support and continued readership. Happy New Year to all.

Ellis Maples made his large greens at Columbia Country Club tough to access. Here's wishing all our readers a 2012 free of traps.

Long hot summer, some cool golf courses

This is the second of a three-part wrap up of golf courses and communities visited in 2011. Links to original reviews are provided. If you would like to visit any of the golf communities mentioned, please contact the editor and we will be happy to arrange it.

In June, I played golf near my home in Connecticut. One highlight was a charity event played at Shuttle Meadow, a Willie Park Jr layout first opened in 1916, another of the courses from a bygone era whose distance (6,250 yards from the tips) belies the angles into greens that one must set up in order to score well. Park, who designed courses worldwide, may be best known for the Gullane and Gailles golf courses in Scotland and Olympia Fields outside Chicago.

A family vacation in Rehoboth beach in July put us within short driving distance of interesting but dissimilar public layouts inside golf communities. In his review of the Jack Nicklaus designed Bayside Resort near Ocean City, MD, Tim Gavrich wrote that the golf course “is certainly not a place where a beginner will enjoy learning the game.” At 7,500 yards from the tips, and with Nicklaus’ typical hard spots, Bayside is anything but a typical resort course. Baywood Greens wasn’t a walk in the park either, but it looked like a park –- one with a profusion of flowers. Indeed, the Bill Love design seems almost secondary to the 200,000 plants and flowers a zealous owner commanded. Even on the gimmicky par 14th, with two separate water-edged fairways, the flowers that engulf the cart bridge are almost enough to make you forget about the contrived layout. Owners of the $200s+ homes adjoining the course can’t escape the floral views, and why would they want to?

Occasionally, the vistas at Jack Nicklaus' Bayside Resort layout in Maryland are interrupted by condos.

August began with a meet up with my friend Bob for a round at Pinecrest Golf Club in Lumberton, NC, a golf course whose one nine dates to the early 20th Century and whose greens were attributed to Donald Ross circa 1940 but whose history and layout imply it’s not pure Ross. Dick Wilson was hired a couple of decades after Ross’ work and asked to harmonize the two nines, giving the course a somewhat patchwork feel. A few holes were interesting but, for the most part, the layout was straightforward and the putting greens in the heat of the summer were too slow to appreciate. (Mr. Ross would not be happy.) That night we stayed on site at the Country Club of South Carolina, in Florence and then played the course the following day. On perhaps the hottest day of the summer, with the thermometer over 100, we had the course to ourselves. In heat like that, every distant green seemed like an oasis, and the libation in the club’s modest bar and grill was like nectar of the gods. The course wasn’t bad either, but the highlight of the stay was a huge three-bedroom condo we stayed in; one just like it down the block was listed for $225,000, which seemed like an extreme bargain (especially if the air conditioning worked).

Despite temperatures over 100 degrees, my playing partner and I could still appreciate the go and no-go options of a 316 yard par 4 at Country Club of South Carolina in Florence. No-go will almost certainly yield a conservative par; go will yield something else.

A few days later I made a revisit to Haig Point for a South Carolina Golf Rating Panel outing on 18 of Rees Jones’ 29 holes on Daufuskie Island, SC. (No typo there: The club members commissioned two extra holes to take advantage of some scenic and challenging routings over marsh.) I had played Haig years earlier, before an impressive renovation that now makes the course play more like a famous layout across the Calibogue Sound, Harbour Town. You won’t find many more courses that put sprawling live oak trees to better advantage as backdrop and, occasionally, living hazards. Invest the time to take the ferry over to Daufuskie, the only way you can get there short of a helicopter, and check out the environmentally pure and socially engaged community there. (I would be happy to make arrangements for you to visit the private community and golf course.)

The marsh comes into play often at Rees Jones' Haig Point.

The South Carolina Golf Rating Panel, which holds a handful of outings for its members each year, moved back to the mainland and Callawassie Country Club the following day. Callawassie, though an island, does not require a ferry to reach it. The golf community is near Okatie, about midway between Hilton Head and Beaufort, and it too had undergone a renovation of its Tom Fazio 27-hole layout. The golf course may not have the drama of Haig Point, but its marshy spots provide plenty of challenges and visual delights. And its community is tight knit and its residents involved with the life of the golf club.

Next: Classic end to the yearGreat golf courses, new and old, in 2011

This is the first of three parts to run over the next few days. Links to original reviews of golf courses and golf communities visited are provided.

Like the economy, my travel schedule slowed down and then picked up a little this past year. I played a choice few outstanding golf courses, all east of the Mississippi, and started and ended the year with just about the same handicap index rating (9.2, for those who care, or want to give me a few strokes). In other words, I have nothing to complain about. Here’s hoping we all encounter a better economy and more rounds of golf in the coming year.

My year started in the early days of January at the heralded and private Bull’s Bay Golf Club in Awendaw, SC, just off highway 17 and a few miles north of Charleston. Bull’s Bay is one of those clubs that has mostly skated by the recession because its deep-pocketed owner considers it more important to collect friends and fellow golfers than to obsess about

Awendaw, SC's Bulls Bay Golf Club winds its way through coastal marshland, aided and abetted by the late architect Mike Strantz, who addes sweeping waste areas, huge fairways and well-protected greens into the mix. It is one of the most playable (i.e. fun and challenging) courses on the east coast.

Weather dogged me the rest of January as I made my way upstate in South Carolina, where a few patches of snow that lingered after a freak storm kept me from playing the golf courses at Savannah Lakes in McCormick and Timberlake on Lake Murray, 30 minutes from the state capital of Columbia. My trip up north from the Myrtle Beach area, however, was not for naught as I made a slight detour to stop Holly Hill, SC, and Sweatman’s, a plain but legendary barbecue palace that is only open Fridays and Saturdays. This is one legend that lives up to its billing, the pork unadulterated by anything but smoke, slow cooking and natural moisture. I have eaten barbecue all over the south, and I have not had it any better than at Sweatmans.

I did get in nine later that January week at the recently renovated Orangeburg Country Club in the South Carolina town of the same name; state golfers put Orangeburg near the top of their lists, its flat and classic Ellis Maples layout a great walk and a lot trickier than it looks. At just $119 per month in dues for those who live 30 miles or greater from the club, it is worth the trek a few days each month.

The Golf Industry Show in Orlando in February was an eye opener for me, my first trade show. I listened to a lot of complaints by golf club owners about how certain online tee-time consolidators were ruining their businesses by driving prices down. Having visited scores of public golf courses in the last few years and noted that their own first instincts in the recession were to cut their green fee prices, the wounds seemed self-inflicted. The rest of the show was rather light on excitement and vendors.

National Golf Club's Jack Nicklaus greens are currently undergoing renovation, the result of which will be to soften the severe sloping but to pull the surrounding bunkers closer to the putting surface. The Southern Pines golf community should have its golf course back by March.

One of our dedicated readers invited me to visit The National Golf Club in Southern Pines, and I was eager to take him up on it since, like Myrtle Beach, which I know very well, Pinehurst is synonymous with both buddy golf vacations and golf retirement homes. I’m glad I went; the National Club golf course, by Jack Nicklaus, displayed some of the largest, most multi-level greens I have played, and the spanking new cottage I stayed in was a study in well-furnished comfort. As the year ended, National began a renovation to restore the 20-year old greens to their original glory and to soften some of the slopes. We look forward to the results next spring. For those looking to embed themselves in the classiest golfing mecca east of the Mississippi, the National community will fill the bill.

My month of March ended with a round of golf at one of the premiere courses in the southeast, the Secession Golf Club near Beaufort. A Connecticut friend, Larry –- love that name -– is a national member at Secession and invited me to join him and a few of his buddies for a round. Former PGA star Bruce Devlin designed the course for walkers only, and Secession boasts one of the rare caddy programs in the Carolinas. The golf course is pure delight, not a clunker hole among the 18 and a few that are memorable (including a par 3 with a waste area just below the four-foot high bulk head that keeps the green from falling into the marsh; I stubbornly tried to play a lob wedge out of the waste, and wasted a shot).

The green at the 2nd hole at Philadelphia Cricket Club is surrounded by bunkers and a clubhouse, which comes into play.

I was mostly a golf spectator in April, following my son around two entirely different golf courses during the final leg of his college golf career. The Philadelphia Cricket Club was a stark reminder of the way golf used to be played, on courses not brutally long but certainly brutal at times. At the par 4 2nd hole, for example, the stream that bisects the fairway at midpoint is the least of the challenges. The pin on the day of the college tournament was a mere 30 feet from the edge of the clubhouse; I cannot say that, in 50 years of golf, the clubhouse has ever come into play. Later in April, my son’s career-ending tournament was held at Bay Creek Golf Resort on the Delmarva Peninsula, home to two smashing golf courses, one by Jack Nicklaus and one by Arnold Palmer, the first golf community in which the two legends each contributed a design. Bay Creek, which is about 45 minutes from Norfolk over the impressive Chesapeake Bay Bridge-Tunnel, is something of a bargain for those seeking a high-quality weeklong golf vacation as well as those looking for a lifelong golf vacation (i.e. retirement home). You can leave New York City, for example, at 6 a.m. and get in 18 before the sun goes down on a summer day at Bay Creek. Prices for condos start in the $200s but a nice array of single-family homes are also reasonably priced, and within mere strides of the Chesapeake Bay.

A few of the holes on the Jack Nicklaus course at Bay Creek bump up against the Chesapeake Bay, including the par 3 4th.

After my son’s graduation from college in Virginia, our peripatetic family (San Francisco, Oakland, London) celebrated at the Wintergreen Resort in the Blue Ridge Mountains, just 45 minutes from Charlottesville. Wintergreen’s two golf courses, one by Rees Jones (27 holes) and one by Ellis Maples, could not be more different. Maples’ Devil’s Knob runs along the very top of the 3,850-foot mountain, a couple of hundred yards from where the chair lifts deposit skiers for their long runs downhill in winter. Balls fly farther up there, which is to say that stray shots can more easily stray off the edge of the mountain. Jones’ Stoney Creek layout plays out along the valley floor but, nevertheless, features enough changes in elevation, and plenty of water and sand, to make it the slightly more challenging of Wintergreen’s designs. Like Bay Creek, condos and single-family homes at Wintergreen are reasonably priced and suitable as either vacation or permanent residence. Come to think of it, for those seeking one coastal and one mountain home within 4 ½ hours driving distance of each other, Bay Creek and Wintergreen would make for an ideal combination -– from a golf and cost perspective.

Next: Classic golf courses crammed into seven months