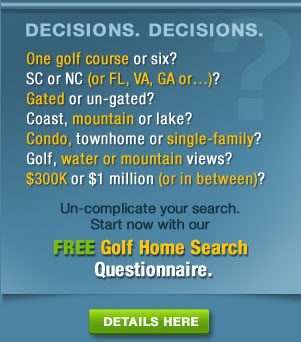

Out of the blue into the black: Zillow colors some price trends darkly

That caveat aside, the Zillow maps provide a colorful glimpse of price trends by major market

Based on the Zillow maps, here are few data points and observations from markets around the country:

- Augusta, GA is up 2% and more, yet just across the river in Aiken, SC, the market is down 7% to 9%. Aiken built more large communities in the late ‘90s and early ‘00s than did Augusta.

- Austin, TX, is going gangbusters, according to Zillow, strongly orange with just a touch of yellow here and there. The University of Texas, state government offices and big companies, like Dell Computer, are providing a stable base of employment. Austin never shows up on lists of cities with foreclosure problems.

- Prices in the Charleston, SC, area are off significantly, with black diamonds on Kiawah and Edisto Islands indicating drops of 20% or more in those upscale environs. Over 20 years, prices on Kiawah have defied any gravitational pull. A correction was inevitable.

- The greater Charlotte area, hit hard by the problems by local companies Bank of America and Wachovia, has gone green (- 3% to -4%) and worse.

- Greenville, SC, is holding its own, up a couple of points, but most communities within a half hour radius are suffering. One exception is Travelers Rest, SC, site of The Cliffs Valley community, which is showing some bright orange.

- Prices in Spartanburg, about a half hour from Greenville and home to America's largest BMW plant, are off about 3%. Once the car industry sorts itself out, look for a more stable local market.

- Jacksonville, FL, and the ocean communities nearby are a dark shade of blue, with prices off 13% and higher. Fewer guests at resorts like Amelia Island mean fewer tours of available homes and way fewer spur-of-the-moment decisions to purchase vacation homes.

- Knoxville, TN, is not doing badly, off 3% or so, with some suburbs up a little. Local community real estate is among the most reasonably priced in the south, and Tennessee has no state income tax.

- Naples, FL, is looking very dark, north and the south of the city. Naples was one of the first to see dramatic price losses, and it could be one of those to lead an overall rebound -- whenever.

- The best colors you see in Orlando, Sarasota, and Tampa are a deeper shade of blue.

- Raleigh, NC, is down 5% to 6% with its nearby suburbs in no better shape. Winston-Salem is down a like amount. Raleigh, with its solid service economy base (Research Triangle Park) has been a stalwart of stability. Its losses signal that the optimistic predictions by many real estate observers about a rebound nationwide are likely to be too rosy.

- Finally, the cities hardest hit in the market collapse, like Phoenix, Miami and Las Vegas, are still showing almost solid black. Only one tiny diamond of orange shows through along the Palm Coast of Florida, in Palm Beach. Such a surprising piece of data implies that Zillow's data is corrupted or that the mainstream media's reports are corrupted: Maybe all those Bernie Madoff clients weren't forced to sell their homes after all.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

The best kept secret in Scottish golf

I attended a wedding over the weekend and met a fellow who has played virtually every top 10 golf course in America, except for Augusta National, and has played most of the great ones overseas as well. When we compared notes on our trips to Scotland -- me once, him multiple times -- I was impressed and happy to hear that he had played the golf course at Scotscraig, about 30 minutes north of St. Andrews, in the blue collar town of Tayport. Like me, he was struck by the simple elegance of the course and the incredibly warm reception of its members and staff. The club has had 190 years to practice -- it is the 13th oldest links in the world -- and it shows.

However, I was shocked when I asked my new golf aficionado friend if he had played either of the terrific courses at the Crail Golfing Society, a mere nine miles south of St. Andrews. He looked at me in puzzlement. He had not heard of Crail.

Sand, sea, a club that was formed a couple of years before the French Revolution: What more could you ask for in Scottish golf than Crail Balcomie Links?

Crail's Balcomie and Craighead Links may be the best-kept secrets in Scottish golf. I have written about Balcomie here before [click to read the review from last summer]. The course may lack the age of the Old Course at St. Andrews -- Crail Golfing Society is only the 7th oldest club in the world (circa 1786) -- but the Old Tom Morris layout does provide splendid views of the Firth of Forth. At St. Andrews' Old Course, you see the water from the practice green but hardly ever again.

Crail Golfing Society offers a limited number of lifetime memberships for overseas golfers that includes four rounds per year on each of the two Crail courses; and half price golf at the aforementioned Scotscraig, at Lundin Golf Club (played it, loved it) and at the well-regarded parkland course, Ladybank. You can also sign up eight friends annually to play Crail at a nominal rate (regular green fees are about $75 during summer months). Trust me, your friends will thank you.

For a copy of the brochure describing the overseas golf membership, click here or go to http://www.crailgolfingsociety.co.uk.

The sod-faced bunkers could make you sad-faced should your ball come to rest in one at Scotscraig.

Big article in NY Times bares Ginn problems

- For Ginn and his partners, the response to questions about their problems seems to be "it's the economy, stupid." If only people had not stopped buying, they imply, then the 30 lawsuits they are fighting for alleged overvaluing of properties and certain other marketing misdeeds would not have been brought.

- Throughout his career, Mr. Ginn seems to have understood well the H.L. Mencken propositionthat, "No one ever went broke underestimating the stupidity of the American people." Reading about his two decades of business problems, it is hard to understand his penchant for selling $500,000 tracts of dirt. Yet since the 1980s, Mr. Ginn has had the uncanny knack of finding organizations to bankroll his big ideas, despite his lack of consistent performance, lawsuits, at least one sizeable settlement and angry customers he left in his wake. ("Honk if Bobby owes you money" was the ubiquitous bumper sticker on Hilton Head Island in the mid 1980s.) And plenty of wined and dined customers fell right in line. Even now, some observers in areas where purchasers have been left with empty lots and empty dreams say things like, "Bobby sure did a great job of building a luxury property." When you read the Ginn saga, you understand that America is indeed the land of the second chance...and the third and the fourth.For Bobby Ginn, America is indeed the land of the second chance...and the third and the fourth...

- Salesmen who can sell coals to Newcastle share one thing in common -- a raging optimism about the future. In the Times article, Mr. Ginn says that, "when the depression ends, there will be a pent-up demand for happiness." Despite the legions of unhappy customers he has left behind, Mr. Ginn expects to be selling happiness again. But even the greatest hitters in baseball never hit a home run when the pitcher was throwing at their heads. With those 30 lawsuits and hundreds of bitter customers to deal with, Mr. Ginn may be ducking for some years to come.

Course corrections: May 24, 2009

A roundup of news from golf communities and courses

Members sell their club. In a move that could signal a trend, members of The Reserve at Litchfield Beach (SC) have voted overwhelmingly to sell their private club to John McConnell, a former software company executive who is gobbling up financially strapped, high-quality golf clubs. Assuming the deal goes through on May 31, as the parties expect, McConnell will close the course for three months and replace the bentgrass greens with a more resilient Bermuda that can withstand the high temperatures of coastal South Carolina summers.

The new owner of the private Reserve at Litchfield Beach will close the course next week and replant all the bentgrass greens with a hardier Bermuda.

The Reserve, whose course was designed by Greg Norman and opened in 1998, is one of just a half dozen strictly private clubs along the 90-mile stretch of Myrtle Beach's Grand Strand, and one of three in the Pawleys Island area (the others are Tom Fazio designed Wachesaw Plantation and Pete Dye's DeBordieu Plantation). The Reserve is a non-equity club whose initiation fee has held steady at around $30,000. In the last half dozen years, McConnell has added to his portfolio such clubs as The Cardinal in Greensboro, NC; Treyburn in Durham; and Old North State Club at Uwharrie Point. The Reserve marks McConnell's first club in a coastal area. The highlight of membership in a McConnell golf club is the access to play at any of the other clubs. I spoke with a Reserve member who indicated more than 90% of his fellow members voted for the sale. The agreement includes a guarantee that the course remains private for at least 10 years.

Ginn sued again, its marketing agency too. Another month, another lawsuit against Bobby Ginn and his real estate empire, this time by a class action group of homeowners. But this latest suit, filed Friday in Florida, is more sweeping and includes as defendants Ginn's financial partner, Lubert-Adler; Fifth Third Bank, Wachovia Bank and Sun Trust Mortgage; and ESI Living, which allegedly orchestrated much of Ginn's marketing strategy. The suit charges the defendants with conspiracy to commit fraud throughout the entire sales and marketing process, and with kickbacks and other activities of collusion at 13 Ginn-developed properties (the only property not on the list is Rivertowne which Ginn purchased after development of the Mt. Pleasant, SC, community was well along). For the long list of charges, check out the web site of Toby Tobin (GoToby.com), a Florida real estate agent who has followed the Ginn saga closely for the last two years.

ESI Living's inclusion in the lawsuit is interesting. ESI specializes in promoting high-end properties, and its roster of clients reads like a who's who of top southeastern golf communities, including these I have personally visited (and can recommend): Champion Hills, The Cliffs, Haig Point, Mountain Air, Taberna, Connestee Falls, St. James Plantation, Governor's Club, Ford's Colony and Albemarle Plantation. A year ago, The Cliffs reportedly signed a marketing agreement with ESI after terminating its association with IMI, a Greenville, SC, based marketing group, although IMI is still promoting its relationship with The Cliffs at the IMI web site (odd that the copyright date on the web site is 2006 and its most recent press releases are circa 2008). It will be interesting to see how this latest imbroglio could affect the ESI/Cliffs arrangement.

Rivertowne in Mt. Pleasant, SC, was one of the few Ginn properties not mentioned in a class action suit against the developer.

To make gulf golf even more appealing, the PGA's Gulf States Section is offering a Golf Pass program with impressive discounts on dozens of golf courses throughout the three states. The program, which includes a free pass to the Zurich Classic in New Orleans and Viking Classic in Annandale, MS, covers such well-regarded tracks as TPC of Louisiana (Pete Dye course and home of the Zurich Classic), Dancing Rabbit Golf Club near Philadelphia, MS, and Pelican Point beside the Mississippi River near Baton Rouge. A 3,350 square foot 5 BR, 4 BA home overlooking one of the two golf courses at Pelican Point is listed for $459,900. Other homes in the community begin in the low $200s. Cost of the annual Golf Pass is $49.

New auction service features top golf community properties

Nature abhors a vacuum, and a new service in the Carolina mountains is counting on sellers of high-end properties abhorring one as well. At the lush and expensive Cliffs Communities in the mountains of North and South Carolina, resale homes are in direct competition with developer Jim Anthony's unsold properties. The Cliffs has one of the most effective marketing machines in the business, and it is sometimes difficult for private sales to get noticed.

Enter UpstateBuyers.com, a unique auction service that will hold its first live auction on June 6 at the Hyatt Regency Hotel in Greenville, SC. Golf community properties at a few of The Cliffs Communities in South Carolina will be first on the block. A second auction of golf course homes and lots in western North Carolina is slated for July 18 and will feature mostly properties at The Cliffs at Walnut Cove, near Asheville, which features a Jack Nicklaus Signature course. Bidders can participate in person or online. (continued below)

Some private owner properties at The Cliffs Valley community near Greenville, SC, will be auctioned off on June 6. The Valley Course, designed by former golf commentator Ben Wright, has a rather straightforward layout and is surrounded by mountains, many the sites of Cliffs properties.

Some private owner properties at The Cliffs Valley community near Greenville, SC, will be auctioned off on June 6. The Valley Course, designed by former golf commentator Ben Wright, has a rather straightforward layout and is surrounded by mountains, many the sites of Cliffs properties.

Jon Ball, who started the venture, told Golf Community Reviews that UpstateBuyers will charge sellers a flat $1,000 fee to market their properties but will not assess the customary 10% buyer's premium. The fledgling firm is counting on matching pressured owners with buyers looking for bargains. The auction will be of the "reserve" type, with the property owners retaining the option to reject the highest bids. Therefore, according to Ball, the biggest bargains are likely to be among those properties held by banks anxious to eliminate depreciating assets from their books. Overall, though, the top bids should provide some sense of the true current market for homes at The Cliffs and other high-end properties in the area.

UpstateBuyers does not auction homes for sale by owner, only those currently listed by local real

Another home site at Cliffs Valley, on the 16th hole of the Ben Wright golf course, carries an opening bid of $200,000 but includes full golf membership currently priced at $150,000. (Cliffs members have playing privileges at all six current courses, with a seventh course by Gary Player set to open within the year.) Tiger Woods' first American design at The Cliffs at High Carolina will follow in a couple of years.

Online bidding at UpstateBuyers.com begins June 1 and proceeds until the hammer falls on each property on June 6. If you are interested in more information or want to inspect any of the properties to be auctioned, contact me and I will arrange for you to work with a qualified local "buyer's" agent who knows The Cliffs properties. I am familiar with most of the golf communities in the Carolina mountains area and can help you put together a nice itinerary of visits. I will also negotiate the best possible deals for overnight stays and golf at the communities.

Love makes a comeback...and other news

Brunswick Forest, a three-year old, 4,500-acre development in North Carolina, has a couple of things going for it that many communities of recent vintage do not. First, they have a developer with the kind of deep pockets and track record that inspires confidence in would-be purchasers. Lord Baltimore Capital Corporation is a $2 billion private investment firm whose roots go back to the

At Brunswick Forest, whose Tim Cate designed golf course should be ready for play this fall, homes begin in the $200s. The developers have anticipated the needs of the eventual 10,000 families that will populate Brunswick Forest and have signed up for their "town center" such tenants as a regional medical center, BB&T Bank, Hampton Inns, CVS and Lowes Foods. The town center is located at the Highway 17 entrance to the community.

If you want to check out Brunswick Forest for yourself, the community is offering a low-priced "coastal discovery tour" for just $99 that includes two nights in a luxury Wilmington hotel, access to the community's new fitness and wellness center (tennis, indoor and outdoor pools, cardiovascular equipment), a poolside lunch, trolley tour through Wilmington, and a dining certificate for a waterfront café in historic downtown. (I have had some good meals in Wilmington.) If you are interested, contact me and I will help you arrange your visit.

Bold stroke to improve my view of the world...and my putting

I lost a dozen golf balls at Balsam Mountain Preserve's Arnold Palmer course, including one I thought I hit well off the par 4 8th tee. The shot to the fairway below was blind, in more ways than one.

By tomorrow, I hope to see the world in an entirely different light. For the last year, sight in my left eye has gone from bad (about 20/50) to worst, 20/200. If I rub my right eye or close it, I am essentially blind, everything in a virtual fog thanks to cataracts that have marched across the lens of my eye. The Dutch scholar Erasmus thought that, "In the land of the blind, the one-eyed man is king," but I will be glad to give up the throne.

If you are reading this, you have a 50% chance of developing cataracts by the age of 65. They may not require surgery, but if they do, your first self-diagnosis may come on the golf course. It did for me.

I am classically near sighted, and because vision in my right eye has

The first hint was in ball flight. I was losing sight of all shots as the ball reached its maximum height. And if I was hitting tee shots toward a bright sky, or one that was the color of a Titleist, I lost sight of the ball immediately off the tee (especially on those rare occasions when I kept my head down). I tried polarizing sunglasses, but that didn't help and made focusing a camera lens with a polarizing filter an exercise in guesswork.

The game became expensive and frustrating when I played alone because if the ball didn't wind up in the fairway, I had no clue where it was. I relied on the kindness (and sharp eyesight) of others or I flew blind. Courses

I am a decent putter, but as my left eye betrayed me, so too did my putting. Oddly, measuring distance was no problem. My right eye compensated for the left in that regard. Reading breaks was an entirely different matter. I looked at putts from every conceivable angle, but from outside of 15 feet or so, I rarely gave a putt a chance to drop. When I realized I was pulling most of my putts left -- in the direction of my bad eye -- I tried lining the putts up with my bad eye shut. That caused me to push most putts right. A few times I forgot myself and offered advice to a playing partner, until the day one responded, "It goes left? Are you nuts?"

Today I get a new, implanted lens in my left eye which, if all goes well, will give me the ability to toss away the glasses. I am trying out a contact lens in my right eye; combined with my new left eye, I am hoping for near-perfect distant vision. The test will come on the golf course next week, and I will report results here. If I don't break 85, I am asking the eye surgeon for my money back.

Lesson of Yellowstone: Super rich worse investors than the rest of us

A Boston private equity firm purchased the ill-fated Yellowstone Club in Montana yesterday for $115 million, more than five times less than its estimated value just a few years ago. Left with devalued properties after years of wrangling with the profligate owners, Tim and Edra Blixseth, are

As a public service for Mr. Gates and his fellow billionaires, and for the rest of us considering a golf community property, here are some lessons learned from Yellowstone:

- Research the developer's experience. In the case of Yellowstone, it was Tim Blixseth's first community, and it was a whopper. Like the game of golf or writing computer programs, it takes practice to get it right.

- Don't fall for the hype. Developers with lots of money can pay for PR that makes them seem better than they are. Consider this ironic piece of fawning pabulum from Edward Pazdur, publisher of Executive Golfer, at the end of an interview about Yellowstone that he conducted with Tim Blixseth four years ago: "It seems to me, Mr. Blixseth, that your early days of gambling paid off big. And the best is yet to come."

- Beware of highly leveraged properties. When Yellowstone sold yesterday for $115 million, it had an outstanding debt of $375 million to Credit Suisse. Come to think of it, if Credit Suisse is bankrolling the property you are interested in, reconsider. They have bet, and lost big, on such troubled assets as Ginn Resort properties and the deluxe Promontory Club in Utah, recently sold in bankruptcy.

- Super-rich people are not as smart as the rest of us when it comes to buying stuff...because they don't have to be. Just because rich friends have bought into a deal (keyword search "Madoff") doesn't mean it is a good deal.

- Finally, and this goes for any investment, if it sounds too good to be true, it is. Or, in the words of Bob Dylan, "Don't go mistakin' paradise for that home across the road."

Time to buy a vacation home or rent?

Strictly speaking as a financial venture, owning a vacation home makes no sense. But the decision to

Renting year-to-year is of course a viable alternative and provides a measure of flexibility. If you don't like the neighbors, the traffic or the increase in flood insurance, for example, you can simply book a different vacation spot the following year. But somewhere between renting and buying is a demarcation point where it makes one option a better financial play than the other. According to one analysis, at the web site InvestmentNews.com, that point is at six months; that is, if you rent for less than half the year, you will probably make out better than it you buy. If you rent for more than half a year, owning a home (based on a few conservative assumptions) is probably a better deal. The calculations were made using the example of a $300,000 home and rentals of comparable homes for $3,000 per month (although that rental figure seems unrealistically high).

One of many "real life" examples is a condo in Pawleys Island, SC, adjacent to the well-regarded True Blue Plantation golf course -- a three-bedroom, two-bath unit currently on the market for $239,900. Nearly identical condos in the same complex are available for rent beginning at around $1,000 per month. In that ratio or rent to list price, renting seems like a pretty good deal.

In the end, each individual or couple will put some additional value on the intangibles of home ownership versus renting. And although the advice here is always to rent for a few months, if possible, in a community in which you are seriously considering a purchase, you will almost always make out better financially by owning a year round home than by renting it for 12 months at a time.

You can read the InvestmentNews.com article by clicking here.

Golf on the rocks in Quincy, MA: Review of Granite Links (part two)

The green at the par 3 7th on the Granite Links Granite course was so firm that a well played shot that landed at middle front rolled past the pin and into the rough behind it, from where par was impossible.

Rock quarry a la Disneyland

Yesterday we explored the history of the unusual Granite Links (see article below) and nine of its 27 holes, the Milton course. Today we finish our round on the Granite nine.

The Milton nine at Granite links compels you to hit the ball straight and, in a few cases, long. But straight and long is a liability on the first hole of the Granite course, a bad piece of golf design if ever there was one. Even with a decent GPS system in our carts, our foursome spent a good 10 minutes on the first tee trying to figure out which of the greens in the distance belonged to our 490-yard par five hole. "Aim for the bunker that looks like Mickey Mouse," said the starter, who had walked down from his perch after spotting our confusion. Mickey Mouse was the perfect metaphor for the hole. "What about the water?" one of our foursome asked, after having a look at the GPS in the cart. "You'd have to be a long hitter to reach it," said the starter.

No more than 220 yards off the tee, roll included, is not my definition of "long hitter," so it was with confidence I pulled out the driver and hit one straight at Mickey Mouse. I hit it well, but little did I realize the fairway sloped like one of those 600-yard long par 4 finishing holes at Kapalua

Plantation. Long story short; the ball was nowhere to be found, probably in one of the hazards on either side of the spit of fairway that was no more than eight yards across. After we gave up, my friend Pete Blais and I agreed on the spot my tee shot must have entered the hazard. I dropped another ball, took a reading on yardage, and realized I was just 138 yards from the green, meaning my drive had traveled about 350 yards and that, even with a penalty stroke, one still has a good chance of making the green in regulation and a par. Bizarre.

Plantation. Long story short; the ball was nowhere to be found, probably in one of the hazards on either side of the spit of fairway that was no more than eight yards across. After we gave up, my friend Pete Blais and I agreed on the spot my tee shot must have entered the hazard. I dropped another ball, took a reading on yardage, and realized I was just 138 yards from the green, meaning my drive had traveled about 350 yards and that, even with a penalty stroke, one still has a good chance of making the green in regulation and a par. Bizarre.The rest of the nine was nowhere as silly, although some repeated designer touches at greenside became annoying after a time. The greens were very firm, and most were bowl shaped, with slopes toward the centers of the greens defining the front and back edges. The ridges at the front of most greens ran down hard, making pins on the front third of the greens impossible to get near, even if you landed short and rolled the ball up. With the greens so hard, figuratively and literally -- no shot made a pitch mark all day -- the slopes made par a possibility only if you were on in regulation or left yourself a chip across the length of the greens.

Fountain of sorrow

Those quibbles aside, the Granite nine presents some sparkling holes and views, most notably #5, a short dogleg right that features a string of granite rock outcroppings framing the left side of the fairway and a water hazard along the right. A conservative fairway wood is the play on the 353-yard hole; a slightly pulled tee shot may avoid the rocks but will leave a blind approach over trees that guard the left third of the elevated green. Anything but an approach that stays on the green is a guaranteed bogey, or worse. The 6th is another one of the short par 4s at Granite Links that dare you to drive the ball to a narrow strip of fairway, a short wedge distance from the green. The 7th is a glitzy par 3 over a water hazard to a wide green framed in the back with three round, identically sized bunkers. With the wind blowing right to left, the proper play seemed a lofted ball toward the right side of the green. That accomplished, my tee shot landed at the front middle of the green and rolled right past the pin at left rear, and then into the thick rough just short of one of the bunkers. The severe slope down to the pin made bogey a good score.

glitzy par 3 over a water hazard to a wide green framed in the back with three round, identically sized bunkers. With the wind blowing right to left, the proper play seemed a lofted ball toward the right side of the green. That accomplished, my tee shot landed at the front middle of the green and rolled right past the pin at left rear, and then into the thick rough just short of one of the bunkers. The severe slope down to the pin made bogey a good score.The 8th hole is one of the few where the fairway is elevated and the tee shot is up, not down. At under 500 yards, the par 5 is not difficult, but it does provide an intimidating contrast to other tee shots during the day. The round ends on the Granite nine with another one of those short par 4s with lots of bunkering to catch any but the most unerring tee shots. Actually a play into one of the large bunkers on the left leaves only a wedge shot into a green set way below the fairway, only the flag on the pin visible. The deep pond that guards the right edge of the narrow green is also hidden from view. Although you can see it clearly on the GPS, it encroaches more than it appears once you come over the rise and see the results of a blind approach shot. The fountain at the pond's center will seem like a warm greeting only to those who find their blind approach on dry land.

Sum of the parts

Course conditions at Granite Links were quite nice, especially for a mid-May day. This is still early in the season in New England. In fact I had to remind Pete, my partner and cart chauffeur for the day, that carts could enter the fairways. "Sorry," said the resident of North Yarmouth, ME, "we can't do that in Maine yet." The fairways were dry, well mown and very green, and not a single lie needed to be "rolled over." The putting surfaces were medium to medium fast and quite smooth but a bit inconsistent in terms of speed one green to the next. Some of the contours were obvious but many were subtle, making judgment on breaks a challenge.

The ultimate scorecard for any golf course is whether one would return to play it again. The answer from this corner is "Yes." Purists will find the course a bit "tricked up," and some online reviews have hammered Granite Links for its quirky layout, some poorly designed holes that seem more about eye appeal than shot values, and the difficulty in figuring where to aim blind tee shots. We encountered all of that, but in small doses, not enough to diminish the outstanding views, the challenging approach shots and the expansive but puttable greens. As Pete said in response to my comment about two many blind shots, "If this were Vermont or Maine, we wouldn't be complaining."

True. You don't expect a course just six miles from Boston to have such dramatic ups and downs, literally, but Granite Links occupies the highest ground in Quincy, albeit at just 300 feet. Everything being relative, Granite Links seemed like up to me.

Granite Links Golf Club, Quincy, MA, 27 holes in three 18-hole combinations.

Back tees range from 6,735 yards to 6,873 yards, with course ratings of 73.3 to 73.9 and slopes from 137 to 141. Men's (blue) tees from 6,247 to 6,379 yards, 71.3 to 72.1 and 130 to 134. Women's tees at 4,980 yards, 68.4 to 70.6 and 118 to 124.

Green fees, $125 peak.

Phone: 617-689-1900; Web: http://www.granitelinksgolfclub.com.

Membership plans available.

The popular Tavern Restaurant, at the highest point in Quincy, has an active bar scene; the views back across the harbor to Boston are especially intoxicating.

Real estate: Modern apartments for rent across the street from the club start around $1.500 per month. Housing is out of view from the course, as are the cars and bodies below.

With the Granite Clubhouse and popular Tavern Restaurant (top photo) lurking beyond, as well as a hidden pond (note the fountain), a tee shot on the finishing hole of the Granite nine must stay on the top of the fairway on the right. A shot from the bunkers at left (bottom photo) will leave a mostly blind shot to the green.