Is new home near Charlotte at $100 a square foot the real deal?

The home will be built adjacent to the Regent Park Golf Club, which features a semi-private course designed by Ron Garl in 1994. Fort Mill is just a 12-mile commute to Charlotte, NC, which, despite the loss of Wachovia Bank (merged into Wells Fargo) and the troubles that beset Bank of America, remains a thriving center of commerce in the southeast, second only to Atlanta.

The two-story brick model is large (nearly 4,000 square feet), with four bedrooms and three baths, a double attached garage and optional third floor. It is slated to be built this year.

According to the scorecard on the Regent Park web site, the men's tees play to 6,337, a rating of 70.7 and a slope of 137. However, other golf related web sites peg the tees at a rating of 70.3 and a more reasonable slope of 130 -- in any case, a nice challenge. Regent Park has earned a number of plaudits from Golf Digest and other magazines as a "course you can play." My email to the listing agent has not yet been answered, but I hope to find out in a conversation with him tomorrow if that is a course you could buy, and at such an impressively low price. I'll report in this space what I learn.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Who do you trust? News media give phony picture of housing market

Media overestimate...again

Like extras in Night of the Living Dead, the hypesters re-emerged from the woods this week to celebrate. Consider this little piece of premature, hyperbolic headlining from USA Today: "More homes get multiple offers; downturn may be nearing end." Actually read the story that follows the headline and you discover that those multiple offers are mostly for homes in foreclosure, essentially speculators bottom-fishing bids, trying to take advantage of those poor banks that are saddled with the white elephants.Adds an official with the California Association of Realtors elsewhere in

Read much about the swine flu "pandemic" the last few days?

Take with a lump of salt anything you read in the mainstream media about housing, and for a few reasons. These are the same folks who totally missed the credit default swaps and sub-prime debacles? They will only report things they understand, and they don't understand much and will not do the necessary research. Like healthcare and any other subject whose complexity requires more than a junior high school education, the big time media missed the roots of the housing mess until they were obvious to everyone on Main Street. Instead, we get sensational faux-disaster scenarios like Y2K and Swine Flu.Newspapers have made themselves irrelevant. If you are a careful reader, many mainstream articles appear to be written by interns, not

The incredible shrinking newspaper

Seasoned, professional journalists are leaving the print media in droves, many on their own, many without a choice. My hometown paper, the Hartford Courant, has fired most of its reporters; the paper I pick up in my driveway every morning has shrunk by more than 50% in the last year. Last week, parentFor the most helpful information on the real estate market, look way beyond the media, to government data and a few blogs you learn to trust over time. Seek out competing points of view, and look to the logic of the arguments, not the conclusions. Look for as many relevant charts as your eyes can handle. Then count on the only person whose judgment you can really trust -- yourself.

Kingsmill course shows its feminine side this weekend...

Fans will gather around the 18th hole at Kingsmill's River Course on Sunday to cheer home the victor at the Michelob Ultra LPGA event. Lorena Ochoa led after yesterday's first round, with a 7-under par 64.

...but real men won't be disappointed in the golf

In the course of a couple of years, the River Course at the Kingsmill Resort in Williamsburg, VA, went from a brawny and difficult layout to one that could be played and enjoyed by virtually ever type of golfer -- high and low handicapper, male and female. Pete Dye, whose difficult Stadium Course at Sawgrass will be featured this weekend at the PGA's Player's Championship, softened up the River Course in 2004. And this weekend also, the course that once hosted an annual tour stop on the PGA is playing host to the LPGA's Michelob Ultra Open.Kingsmill's River Course an ego booster

I played the River Course a year ago, and it appeared to be especially friendly for average male and female golfers and modestly challenging from the men's tees for my 10 handicap. From just 6,300 yards, I can understand why the lady pros tore it up in the first round yesterday, Lorena Ochoa carding a tournament leading 64, 7 under par. Forty-five players finished under par on day one. As I wrote here one year ago, "the River course is not tough but it is thoroughly enjoyable." (You can read my full golf course review by clicking here.) Although plenty of bunkers frame the large Dye greens, thinly struck approach shots still have the chance to bound up and onto the large greens.

greens, thinly struck approach shots still have the chance to bound up and onto the large greens.If I have any criticism of the River Course, the only one of the three at Kingsmill that I had the chance to play, it is that the cart paths come into play on some holes. Of course, Kingsmill is a resort, as well as a residential community, and certain compromises must be made in the name of speedy play. For their $30,000 "deposit" (most of it refundable upon departure), members do not want to endure five-hour rounds behind lollygagging guests who may be playing one of their few rounds of the year. Putting the cart paths closer to the field of play cut some time from a high-handicapper's round, at least in theory.

Latest price updates on Kingsmill homes

Kingsmill offers an entire range of real estate options, from town homes (villas) and "resort condominiums" to single-family residences, some quaint patio homes on small lots and some of the estate variety. Generally speaking, condos begin in the low to mid $300s, although they can reach the $500s for views of the wide and impressive James River, which gives the River Course its name. Town homes are the most reasonably priced segment of the market at Kingsmill, with prices beginning in the mid $200s (a current listing for an 1,854 square foot 3 BR, 2 ½ BA unit is $240,000). One of the choicest patio homes in the resort, which looks down on the 13th green of the River Course and features more than 2,500 square feet, is listed at $659,900. If you can compromise a little on the view and space, other single-family homes, most on larger lots, start in the mid $300s. Building lots begin in the $300s, prices that would seem to make the re-sale homes particularly good buys (e.g. that $659,000 home cited above would be priced at about $125 per square foot, after subtraction of land costs, comparably low for quality construction).To encourage sales, Kingsmill Realty is offering a 20% discount on club membership if you purchase a home through one of its agents.

More excellent golf at Kingsmill and just outside the gates

The other two courses at Kingsmill, The Plantation (Arnold Palmer) and The Woods (Curtis Strange), provide alternative golfing experiences for club members and resort guests. Reviewers in the latest Zagat's guide to "America's Top Golf Courses" gave The Plantation and Woods coursesThe most highly rated course in Williamsburg, the Gold Course at the multi-layout Golden Horseshoe, is perennially rated one of the best public access courses in the state of Virginia (Zagat surveyors gave it a 28). The Green Course at Golden Horseshoe is also an area favorite. Further afield, fans of the late architect Mike Strantz will find some of his most imaginative work at Royal New Kent and Stonehouse, two courses that golfers seem to either love or hate for their blind shots and golf-on-steroids approach to design. Those unafraid of intimidating layouts should try Colonial Heritage, a difficult Arthur Hills design that, oddly, is smack in the middle of an age-restricted community. I was 60 years old when I played it, and felt 70 by the end.

Governors Land, the private club alternative in Williamsburg

Williamsburg can lay claim to being America's first tourist destination, given both its history and self-awareness of it. The town is set up to accommodate a large influx of those seeking to get inThe Two Rivers course at Governors Land, designed by Tom Fazio, is not unlike the River Course at Kingsmill in that it won't overtax the modestly skilled golfer but will certainly provide a pleasant four hours. A few of its finishing holes almost bump up against the river but are buffered by customary large Fazio bunkers; accept for a touch of the river close by the side of the 18th green, the only hazard the water provides is as a distraction from the swing.

Single-family homes, all that are available at Governors Land, start around $500,000. Homes with views of the river and golf course exceed $1 million. For those few hedge fund managers who exited the market at just the right time, a 22,000 square foot estate home on 10 riverfront acres is currently listed for $8.9 million.

Living in Williamsburg

If you like being on permanent vacation and in touch with history, and don't mind sharing some of your space with tourists or wearing a sweater in winter -- okay, a jacket as well -- Williamsburg is worth considering as a retirement or vacation spot. With many excellent and accessible daily fee golf courses in the area, you will not feel compelled to join any of them to have an active golfing life. Williamsburg is a charming town, with a well-preserved downtown area and small university, William & Mary, at its core (a nice program of courses for post-grads is offered). I was especially impressed with the road system in and around town; as if overly conscious years ago about the possibilities of tourist infestations, the roads are more than ample to handle the significant increase in new homes over recent decades, as well as the tour buses.The Town Center just outside the city not only provides plenty of shopping and dining opportunities, but integrates residences and offices. Golfers inclined to work and/or shop where they live won't burn more than a gallon of gas for access to any of the excellent golf courses just a few miles away.

If Williamsburg sounds like your kind of place, let me know and I will provide you with much more in the way of research and opinion -- at no cost or obligation to you.

The James River comes into play at Tom Fazio's Two Rivers course at Governors Land only on the 18th hole.

Can we talk...

...about the best possible golf community home for you?

If you are reading this, you have an interest in golf communities. The name Golf Community Reviews leaves little room for interpretation of the subject matter here. The web site -- some would call it a "blog" -- is geared to readers actively searching for a dream home on the course as well as to those who may be years away from such a decision but want to learn what's available and what the costs are likely to be.

I have been there and done that. For the last 25 years, I have researched and visited golf community properties, bought a couple of them

I have been witness to good, bad and ugly property searches. The Internet is filled with much hype about golf communities, promotion costumed as information. Some developers on the brink of bankruptcy continue pitching their communities as if all is paradise. The purchase of a vacation or retirement home is a huge investment, one of the largest any of us will make in our lifetimes. It is best approached with an armful of information and eyes wide open.

I started GolfCommunityReviews three years ago to help others negotiate the choppy waters of the leisure residential real estate market. I try

I am not a non-profit, but I don't charge my customers any fees either. I work with them to find the real estate agents most qualified to help them identify the perfect home on the course. The agents compensate me with referral fees if my customers purchase property. But there is absolutely no obligation or pressure to purchase; the referral fees pay my bills, but what I learn during the process makes me smarter and better able to help other customers.

Here is how I would work for you:

Getting to know you...

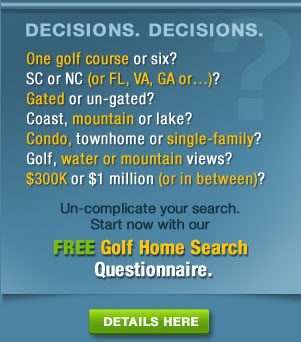

- I take the time to understand what you are looking for. In a phone conversation of about 45 minutes (my dime for the phone call), I take you through a series of questions, at the end of which we both have a good idea of the type of community that will best suit your lifestyle (this interview is best conducted with couples). Within a few days, I submit to you a summary report of our conversation for your review and feedback. We modify as needed.

Matching your needs...

- If you are not set on a particular area, I come back to you in a short time with some idea of what geography will suit you. Most couples know whether they want mountains, coast or an inland area with perhaps a lake. But there are differences in living in Savannah and Charleston, or Asheville and Greenville, and the lifestyle in a community around Lake Keowee in rural South Carolina is going to be decidedly different from one in, say, the Chapel Hill, NC, area. I have researched many of the most popular areas in the southern U.S. and visited the majority.

Giving you a sense of community...

- If you know the area you would like to live in but are unfamiliar with the golf communities there, I look at all those that might suit your lifestyle and your resources, talk with real estate professionals and residents in the area to surface any hidden "issues" about the communities, and then recommend a few you might visit. (Note: As a former communication executive and journalist, I know how the ask the tough questions and use my experience to qualify the answers.) In some cases, based on our interview, I might recommend you consider the purchase of a home outside a gated community and membership in a local private or semi-private club. This works well for couples that do not require many amenities beyond the golf course and clubhouse, and would prefer not to pay for what they don't use.

Teeing up the visits...

- If the timing is right and you are prepared for a visit, I help you make arrangements either directly with the communities or through a qualified local real estate professional. Most communities offer "discovery" packages that typically include lodging, breakfast and golf at a nominal fee. Because of my contacts in the communities, I can often negotiate discounts on these or have the fee waived.

Going for the green...

- If you use an agent whom I pre-qualify for you, he or she will help you negotiate the best possible price on a privately owned home. However, should you be interested in a developer owned property in a community I have visited and can recommend, I will help you negotiate the best possible price. Potentially, this could save you thousands of dollars compared with going it alone.

Contact me via email (click here) or by phone at (860) 675-1491 and I will get to work.

I have visited personally more than 100 golf communities, including Connestee Falls near Brevard, NC.

Price points: North Carolina homes for sale give taste of what's available across South

The Sound Links anchors the community of Albermarle Plantation in Hertford, NC.

The state of North Carolina is something of a microcosm of golf communities in the southern U.S., with a topography that extends from the low-lying Atlantic coast to the Blue Ridge Mountains. Yesterday, we shared a list of current home sites for sale in the state. Today we add a list of homes for sale in those same communities, all with a view of an adjacent golf course.

If anything strikes your fancy or you would like more information on these or the hundreds of other golf communities in the southern states, please let me know (just click the "Contact" button above).

Thanks. Larry

Coastal:

Brunswick Plantation, Calabash, 2,700 sq. ft, 4 BR, 3 BA, pond view, 1997, $399,000

St. James Plantation, Southport, 3,000 sq. ft, 3 BR, 3 ½ BA, 2006, $499,000

Albemarle Plantation, Hertford, 2,800 sq. ft, 3 BR, 2 ½ BA, 2001, $469,000

Landfall, Wilmington, 3,200 sq. ft, 4 BR, 3 ½ BA, 2001, $659,900

Ocean Ridge Plantation, Sunset Beach, 2,800 sq. ft, 3 BR, 3 BA, $549,900

Porters Neck Plantation, Wilmington, 3,320 sq. ft, 4 BR, 2 ½ BA, 2002, $599,900

Mountain:

Reems Creek, Weaverville, 3,370 sq. ft, 5 BR, 3 ½ BA, 2006, $639,900

Laurel Ridge, Waynesville, 3,570 sq. ft, 4 BR, 3 ½ BA, 1969, $550,000

Champion Hills, Hendersonville, 3,847 sq. ft, 3 BR, 3 BA, 1998,

$989,000

Cliffs at Walnut Cove, Asheville, 3,000 sq. ft, 3 BR, 3 ½ BA, 2007, $1.65 million (town home)

The tee shot at the 9th hole at Laurel Ridge may be blind, but the views from many of the homes that dot the mountains surrounding the Waynesville, NC, course are eye-opening.

Asked and answered: Choosing the right golf community for you

St. James Plantation near Southport, NC, features four golf courses (The Reserve by Nicklaus Design is pictured) and home site prices that begin in the low $100s.

In the current economy, investing in anything seems something like that game at the state fair where you toss ping pong balls at a bunch of milk bottles and hope one drops. In the wake of bailouts, bank stock prices and Madoff, even "safe" investments don't seem quite the sure things they once were. But one thing we can safely about real estate is that prices will stabilize and trend upward again; it is just a matter of when.

I have been looking at golf-related real estate for dozens of years and have operated the HomeOnTheCourse advisory service for five years. In that time, I have worked with couples to help find them the golf community that best suited their lifestyles and golf game. Along the way, I have encountered many important questions about the golf community market. Here are a few questions -- and my responses -- that seem particularly relevant in the current market.

Q. Is now a good time to invest in property in a golf community?

A. It depends of course on personal circumstances. If you have equity in your primary home, are retired or about to retire, and have planned to move to a warmer climate, there is no reason to wait for the real estate market to

Q. I am 10 years from retirement. Should I consider buying now?

A. Again, it depends on personal circumstances but one thing to consider is a hedge against price rises in warm weather areas by purchasing a home site now, while developers and over-extended private owners are hungry and prices are at their lowest in five years. Last year I helped two customers find and purchase lots in Ocean Ridge Plantation (Sunset Beach, NC) and at the Governor's Club in Chapel Hill. They don't expect to build a home for a few years but they were able to purchase nice home sites for excellent prices. Just be careful about costs of ownership beyond the lot and the taxes on it (for example, some communities make golf membership mandatory at the time of purchase).

Q. Should I buy a developer lot or a re-sale lot?

A. You should buy the lot that best suits your vision for the home you will eventually build. However, here are some rules of the road. First, re-sale lots are generally lower priced than developer lots, although there are exceptions. Developers do not like to lower their prices for fear of alienating other owners who paid more just a few months earlier. However, those same developers are willing to add incentives to sweeten the deal, such as free or reduced-price golf membership or attractive financing terms. Second, some community sales offices won't tell you about re-sale lots; their developers insist that they push the developer lots. In many cases, you will need to engage a local real estate agent to inspect the re-sale lots; and in a few cases, developers make things difficult for the agents to show properties. If a developer prevents you from seeing re-sale lots, move on to the next community.

Q. How do I know if a development is stable?

A. First, consider the developer's track record. Has the organization lived up to its commitments to its property owners over a long period of time (at least more than a decade)? Does the developer have strong

Q. Should I consider a vacation home instead of a lot, even if I won't relocate for some years?

A. Some people do this, but don't expect to defray all the costs of the home by renting it. If you rent the home a week at a time through a local or on-site rental office, you will pay fees up to 40% of the gross rentals (for maintenance, etc.). The benefit is that you will have use of the home for up to 14 days a year (more if you are there to do some maintenance work, according to tax laws). Even at just two weeks a year, you can get a taste of what it is like to live in the community and, over time, either assure yourselves you have made the right choice or determine that another community might suit you better. Some couples, including one who purchased a home with my help in The Landings near Savannah, rent their home out on a long-term basis, which provides a more stable stream of rental income but prevents use of the home during the year.

Q. Okay, let's say I identify a community with a nice golf course and all amenities in place. What can I expect to pay for a lot or a home?

A. Of course, that depends on what community, where it is located, the quality of the amenities, including the golf course, and many other factors. Note below that the difference between a lot at, say, Reems Creek and The Cliffs at Walnut Cove, both featuring mountain views, is about $500,000. The Cliffs, with amenities to beat the band, features seven private golf courses; Reems Creek features just one, and it is open to the public. Since North Carolina includes mountain golf and coastal golf communities, I've listed a few examples from across the state. The following are a sample of current listings for home sites in communities I have personally visited and can recommend, although they vary widely. The prices generally reflect the lower end of the range in each community. All properties feature a view of the golf course. If you would like more information, please do not hesitate to contact me.

Coastal:

Brunswick Plantation, Calabash, acreage n/a, 27 holes (Willard Byrd) $94,900

St. James Plantation, Southport, 1/3 acre, 4 courses (P.B. Dye, Nicklaus Design, Tim Cate, Hale Irwin), $125,900

Albemarle Plantation, Hertford, ½ acre, Dan Maples golf, $135,000

Landfall, Wilmington, ¼ acre, 2 courses (Nicklaus & Dye), $175,000

Ocean Ridge Plantation, Sunset Beach, 1/3 acre, 4 golf courses (Byrd and Cate), $179,000

Porters Neck Plantation, Wilmington, acreage n/a, Fazio golf, $199,900

Mountain:

Reems Creek, Weaverville, 2/3 acre, Hawtree & Sons golf, $99,000

Laurel Ridge, Waynesville, ½ acre, Bob Cupp golf, $139,000

Champion Hills, Hendersonville, 1.6 acres, Fazio golf, $160,000

Cliffs at Walnut Cove, Asheville, 1¼ acres, Nicklaus golf, $595,000

Tomorrow: Examples of homes for sale in North Carolna golf communities.

Real estate prices: The South will rise again...perhaps soon

Those who want to avoid a state income tax could live and play at The Ridges in Jonesborough, TN.

No one can predict with certainty what is going to happen to southern golf community real estate prices in the coming months. But over time, prices -- like the South itself -- will rise again. They always do. Indeed, there are signs that in the most stable golf communities, prices may be leveling off and preparing for a return trip upward.

With the recent rebound in the stock market and a bit more consumer confidence, the large numbers of Baby Boomers who have been on the sidelines will pursue their dreams of a home on the course. If that happens, prices in

In the most popular and stable southern communities, and across all price ranges, the upward trend in pricing could be swift, and some who wait too long could be priced out of the market or have to settle for a smaller piece of property or home. Boomers with equity in their primary homes are in the best positions to make a move soon, and for a few good reasons:

1) They are likely to downsize anyway, what with their children grown and off on their own. The value of their 3,000 square foot home, say, in suburban Boston, will translate into a nice 2,300 square foot residence in a prime golf community. The lower price for less real estate could more than pay for golf club membership.

2) In all but a few cases, the cost of living in the south will be lower -- in some cases significantly lower -- than in the town they are leaving in the north. Southern property taxes are lower, and Boomers with retirement income to protect will flock to states like Florida, Tennessee and Texas, which have no state income tax. A move from Boston to Knoxville, TN, for example, will result in a cost of living improvement of 34%, according to Where to Retire magazine. That same move to Asheville, NC, which does have an income tax, will still result in a 25% COL improvement. A couple could give themselves a healthy raise simply by moving to their dream home. (Contact me if you would like other cost of living comparisons.)

3) When the real estate market nationally turns around, as it always does eventually, sheer demographics will increase prices faster in the south than in the north for comparable properties. That great whooshing sound we hear will be all those Boomers heading south. Those on the leading edge will get the best selection of properties at the best prices; those on the trailing edge will pay more for less. Again, supply and demand rules the market.

4) I am not an economist, and this is not a political statement, but it does strike me that, with all the money the nation is borrowing, inflation is a big risk. In that case, prices of properties will rise even faster than their natural inclination to do so, making any real estate purchased prior to inflation a pretty good deal.

Those who are not ready to retire but have the same dream of a home in the southern U.S. should keep a close eye on the market. One hedge against the scenario of higher prices described above is to consider purchasing a home

The notion of hedging against faster price appreciation in the south than in the north seems even more appropriate now that the market appears to be at or near its bottom, and poised for possibly dramatic price increases in the coming months.

Tomorrow: Preparing to purchase property in a golf community

Work and play: Some Connecticut homeowners steps from jobs and first tee

Before renovations, the extraordinarily hard-to-hit 3rd green at Gillette Ridge actually featured a large bunker directly in front. Such sadism had earned the course criticism from those who played it.

Golf Course Review: Gillette Ridge Golf Club, Bloomfield, CT

When Bloomfield, CT's Gillette Ridge Golf Club opened in 2004, players and other reviewers savaged it for its degree of difficulty and iffy conditions. The Arnold Palmer designed course, which threads its way among gleaming corporate offices and recently constructed villas, was unfriendly for any but the straightest-, longest-hitting players. Course managers decided that Gillette Ridge's survival was a matter largely of removing some of the treachery around the greens, specifically the parade of bunkers that made greens in regulation nearly impossible for most.

Today, less is definitely more at Gillette Ridge, with the removal of bunkers that were just too penal. Some resentment lingers, though; contributors to the latest Zagat "America's Top Golf Courses" rating guide call some holes "over-demanding" and "not very playable." Based on a round there recently, I can stipulate that Gillette Ridge is challenging but that it can take its place among the most imaginative of the upscale daily fee courses in the Hartford/Springfield area. And for those looking for a New England home on a course for the warm weather months, the reasonably priced adjacent residential community would pair up nicely with a winter home in the southern U.S. Best of all, for anyone who works in one of the nearby corporate offices, a home in Gillette Ridge puts them literally steps from both work and play.

holes "over-demanding" and "not very playable." Based on a round there recently, I can stipulate that Gillette Ridge is challenging but that it can take its place among the most imaginative of the upscale daily fee courses in the Hartford/Springfield area. And for those looking for a New England home on a course for the warm weather months, the reasonably priced adjacent residential community would pair up nicely with a winter home in the southern U.S. Best of all, for anyone who works in one of the nearby corporate offices, a home in Gillette Ridge puts them literally steps from both work and play.

Bloomfield has become something of a daily-fee golf destination in recent years, what with Gillette Ridge and Wintonbury Hills, one of the best municipal courses in the land, opening earlier this decade. Designed by Pete Dye for a mere $1, Wintonbury Hills, like Gillette Ridge, is just 15 minutes from Bradley International Airport and an equal distance from insurance center Hartford. Visiting corporate managers have been known to disembark at Bradley and sneak in a round at Wintonbury before heading for a meeting.

Wintonbury had the clear bragging rights until Gillette Ridge's recent renovation; but with the softening at Gillette Ridge, including the elimination of severely sloped bunkers that made rollups to most of the firm greens impossible, the mid-teen to high-teen handicapper can enjoy some of the satisfaction single-digit players enjoy. Gillette Ridge is by no means a tiger turned pussycat; after a round there, I'd say it is more a puma or mountain lion or something like that. It rewards good shots, punishes bad and provides some unusual visual notes.

First, as mentioned, are the office buildings. The 1st and 10th tees are a few strides from one of the worker cafeterias, and it can be a bit daunting to look back before you strike your tee shot and see dozens of eyes peering out at you (or at least you think they are peering out at you). Nowhere do the buildings come anywhere near the field of play, but they do occasionally provide some distant aiming lines; if the angle of the sun is just so, they can also affect your eyesight as much as your line of sight, what with the glare off the glass windows.

peering out at you (or at least you think they are peering out at you). Nowhere do the buildings come anywhere near the field of play, but they do occasionally provide some distant aiming lines; if the angle of the sun is just so, they can also affect your eyesight as much as your line of sight, what with the glare off the glass windows.

Local heavily trafficked roads surround the periphery of the course, and traffic noise is occasionally distracting. But the encroachment of civilization can work to the advantage of a coffee drinker who, after putting out on the 8th hole, can steer the cart toward an adjacent strip mall and Starbucks, before heading for the 9th tee. On the back part of the course, the tower of St. Thomas Seminary looms large beyond a grove of trees, and as you come up the 17th hole, a troika of monolithic stone structures clustered at the right edge of the fairway bears witness to a difficult approach to the toughest green on the course.

The pleasantly designed townhouses only come close to the course along the tee boxes at the 17th. Otherwise the real estate is a couple of hundred yards away at its nearest point. GDC Homes, which has been in business for 45 years, developed The Greens at Gillette Ridge, a group of town homes with prices beginning in the mid $300s, and single-family homes that begin in the $500s. Amenities include a clubhouse with fitness center, lounge and outdoor heated swimming pool.

Besides the proximity to the airport and Hartford, Gillette Ridge is just up the street from the University of Hartford, which offers some interesting courses for non-students, as well as a Division I sports program. The school's womens basketball team, coached by former University of Connecticut star Jen Rizzoti, has made it to the NCAA championships in recent years. The town of West Hartford, less than 10 minutes away, boasts a thriving entertainment and shopping scene, including many restaurants that could hold their own against big city establishments.

Hartford, which offers some interesting courses for non-students, as well as a Division I sports program. The school's womens basketball team, coached by former University of Connecticut star Jen Rizzoti, has made it to the NCAA championships in recent years. The town of West Hartford, less than 10 minutes away, boasts a thriving entertainment and shopping scene, including many restaurants that could hold their own against big city establishments.

The golf course was a surprise to me after all the early bad notices and my own impressions. I had followed a high school golf tournament there before the renovations, and I vowed never to play it. Coincidentally, when I did play it two weeks ago with my son, we were matched with two juniors who were practicing for a tournament that began at Gillette Ridge the following day. They showed no signs of the same frustration the high school golfers experienced a few years earlier.

From the tips, Gillette Ridge plays to a robust 7,191 yards, a stout rating of 75.4 and slope of 141 (you can imagine what it was like before). From the shortest "men's" tees at just 6,133, but with a slope of 134 (70.0 rating), double-digit handicappers will get all they can handle. Reference to the yardage book, which shows the original, pre-renovation layout, demonstrates just how difficult the prior design was. The par 4 3rd hole is long at 431 from the tips, 380 from my shorter tees. A long drive must avoid two bunkers at mid fairway left in order to have any go at the green. The green is narrow and is protected on the right by a yawning bunker and on the left by a steep drop off to water literally below the green's edge. The yardage book indicates that a large bunker directly in front of the green has been removed. You wonder what Arnie was thinking, or wasn't, when he designed the hole originally (see photo at top).

The front nine, which I found the harder of the two nines, presented other difficult approaches. The second shot on the short par 4 5th must carry water and a stone wall before coming to rest on a green that slopes back to front and, naturally, toward the water. The three shot par 5 7th, one of the longest in the state of Connecticut at 612 yards from the back tees, demands that the second shot negotiate a narrow spit of land between an ugly bunker on the right and rough and trees on the left. The shot to the green then must carry a stream and ravine.

Large, undulating greens are challenge enough, but the King was not content to give Gillette Ridge players a putting challenge alone; no, he has to front such greens with a string of menacing bunkers, as he does at #10, making it an all-carry affair, and again at #16, a sizeable par 4 with grass at greenside only occasionally interrupting large and amoebic shaped bunkers. Just when you think Arnie is really messing with you, he gives you a reachable par 4 at #13 (242 yards from my tees, 294 from the back), where a shot shaped right to left actually can result in a putt for eagle. Too far left and you have to bring the rake with you to the middle of the huge bunker and then figure out where to aim your shot to the steeply two-tiered green. The round ends on a classic note; the 18th is one of the best designed on the course, with a reachable bunker at fairway right. Another bunker at the right front of the green actually offers a little protection from the water that borders the entire right side and rear of the green.

interrupting large and amoebic shaped bunkers. Just when you think Arnie is really messing with you, he gives you a reachable par 4 at #13 (242 yards from my tees, 294 from the back), where a shot shaped right to left actually can result in a putt for eagle. Too far left and you have to bring the rake with you to the middle of the huge bunker and then figure out where to aim your shot to the steeply two-tiered green. The round ends on a classic note; the 18th is one of the best designed on the course, with a reachable bunker at fairway right. Another bunker at the right front of the green actually offers a little protection from the water that borders the entire right side and rear of the green.

You have to bring your ‘A' game to Gillette Ridge. Scoring well there takes some work. I suppose that is only fitting in such a corporate setting.

Gillette Ridge, whose green fees range from $65 to $80, offers two levels of membership. Platinum membership includes unlimited play and cart for $3,000 annually, an additional $1,200 for spouse and $300 for each child under 17. Gold membership, at $1,800 ($900 additional for spouse), offers unlimited play with a cart fee of $25. Members can call for a tee time 14 days ahead. I don't typically quote a corporate fee, but it seems fitting for the surroundings. Corporate memberships are $7,000 per year for four designated employees and provide the same features as the Platinum Membership. The Gillette Ridge Golf Club can be reached at (860) 726-1430; the website is GilletteRidgeGolf.com.

For more on real estate opportunities at Gillette Ridge, please contact me.

The green at the short par 4 13th at Gillette Ridge is driveable, but a tee shot that finds the bunker short and left of the green could just as easily result in bogey as birdie.

A moving dilemma: Put lipstick on the pig or buy a new pig?

Paul Stepka, the real estate broker I work for in Connecticut, says it is less about the cost of the remodel than it is the ease with which our house will sell. Prospective buyers will look at the gourmet kitchen we built a couple of years ago, which opens up to a huge sunroom area surrounded by glass, and think "Wow!" according to Paul. Then they will see the modestly accoutered bathroom and say one of two things to their real estate agent: "Next house, please," or "How much to renovate the bathroom?" That is especially true in the currently strong buyers market.

Mrs. and I will have some intense conversations today before we render our decision to the bathroom contractors. I think we are going to tell them to go ahead. It may be the wrong decision financially, but we will never know. Ignorance is bliss, especially if it comes with a fancy new showerhead.

Grand buffets: How to gorge on golf without exploding your budget

The six courses at The Landings combine the water, sand and marshland that are characteristic of Low Country layouts.

Yesterday, we discussed two of the best multi-golf course communities in the eastern U.S., the ultra-luxe Cliffs Communities and Reynolds Plantation (see article immediately below). Their golf courses –- soon six at Reynolds and eventually eight at The Cliffs -– are superbly conditioned and laid out, but at $100,000+ for membership, they will appeal primarily to those whose substantial portfolios were not ravaged by the economy. The rest of us with big golfing appetites will have to look elsewhere, but with some small compromises here and there, the menu is large and tasty.

The Landings on Skidaway Island

At a relatively mild $50,000, membership in the six private golf clubs at The Landings on Skidaway Island in Georgia is one-third the tariff at The Cliffs. And because some homes in the 25 year old community require a little bit of updating, real estate prices are quite reasonable. (Note: I helped a couple find a handsome home on a green at The Landings last year and am working with another couple who plan a second visit to the community later this summer). The six courses at the 4,500-acre Landings are of a totally different character than The Cliffs and Reynolds, playing through forests of live oaks and along sweeping marshland. But they are no less well conditioned, despite their popularity with more than 1,000 golf hungry members.

community later this summer). The six courses at the 4,500-acre Landings are of a totally different character than The Cliffs and Reynolds, playing through forests of live oaks and along sweeping marshland. But they are no less well conditioned, despite their popularity with more than 1,000 golf hungry members.

The Arthur Hills Palmetto course, for example, is as finely tuned a Low Country layout as you will find, and acknowledged by most club members and independent raters as the toughest course of The Landings’ half dozen. Tom Fazio’s pleasant routing at Deer Creek is a favorite among golfing couples –- eminently fair from the women’s tees but just enough of a challenge for hubby that a good golfing pair can have an engaging match without one having to spot the other too many strokes. The other courses at The Landings include another by Hills, one by southern designer Willard Byrd, and two early examples of Arnold Palmer’s handiwork; taken together, they all provide as much variety inside the gates as you will find anywhere. One modest caveat to those who just like to walk up to the first tee of their private club and play: Because of the popularity of The Landings courses and the consequently higher volume of play, a little planning –- say a day or two ahead –- is wise.

LandMar Communities

The golf courses in LandMar communities may lack some of the panache of exclusivity at The Cliffs and Reynolds Plantation, but they more than make up for it in comparative savings. For a modest initiation fee and reasonable dues, members of one LandMar club can expand their club membership to multiple other high-quality courses (only a few, though, are private). For example, membership in the private Osprey Cove Club, in the St. Marys, GA, community of the same name, opens up for play a number of other clubs managed by Hampton Golf, a Jacksonville, FL company with which LandMar (and Crescent Communities) maintain an affiliation. Full golf membership at Osprey Cove is just $15,000 for the nice Mark McCumber designed course, with dues an ultra reasonable $4,000 per year.

Although LandMar’s other private courses are a couple of hours or longer drive from Osprey Cove, some outstanding public play courses are within a half hour, in the Jacksonville area. They include the Arnold Palmer designed North Hampton golf course, which many believe to be one of the best in the golf course laden state of Florida (I played it and loved it); South Hampton Golf Club, another Mark McCumber design in St. Augustine; and Eagle Harbor Golf Club, designed by Clyde Johnston. LandMar members pay only a $25 cart fee to play.

The Barefoot Resort

You won’t find the designs of Greg Norman, Davis Love III, Tom Fazio and Pete Dye clustered inside any community but one, the Barefoot Resort in Myrtle Beach. The resort has been in the news the last week, and not because it wanted to be –- brushfires consumed some parts of the courses and more than 60 homes at Barefoot. According to Barefoot officials, however, the only damage to the courses, other than a few burned spots, were the wooden bridges that traversed some of the layouts’ marshland. Things are returning to normal now, normal being an active set of resort courses open to most anyone staying on premises or in local hotels. Only the Pete Dye course, which requires a separate membership ($60,000) from the other three courses’ $20,000 fee, pretends to any kind of privacy (the club refers to itself as “semi-private”). To join Barefoot, which boasts about 1,250 members, just 200 of them full-time residents, you must be a property owner. For the time being, the developer is waiving any initiation fee with the purchase of a new property. The only requirement is $125 in monthly dues, which is rather modest for such name designer golf.

Myrtle Beach and Robert Trent Jones Golf Trail

Of course, the most reasonable approach to buffet golf would be to buy a home in a golf rich area -– say Pinehurst, Myrtle Beach or along the Robert Trent Jones Trail in Alabama –- and pay as you go. By taking the “supermarket” approach to golf, you skip initiation fees and dues and get to play as many as 110 courses, as is the case along the 90-mile stretch of Myrtle Beach. That works out to a different course every day for about four months. And with the purchase of one of those ubiquitous golf passes, like the Myrtle Beach Passport ($39) or the Robert Trent Jones Trail Card ($39.95), the discounts are substantial. By my rough calculations, you could play 120 rounds per year along the Jones Trail for the cost of the annual $6,000 dues at The Cliffs.

And by the end of the year, you would have also saved the $150,000 in initiation fees, which you could apply to the gas you will need to drive the Jones Trail...as well as annual jaunts to Pebble Beach, Bandon Dunes or St. Andrews –- and still have enough left over to dine at the best buffet restaurants.

Members of any LandMar community golf club in the Jacksonville area can play the splendid, links-like Palmer designed North Hampton for just a $25 cart fee.