Comparing living costs city by city

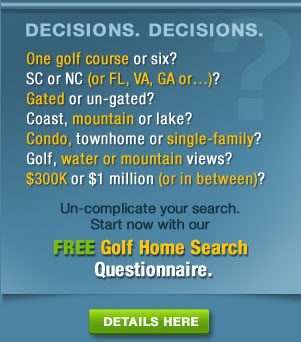

In response to a question at the Carolina Living message board a couple of weeks ago, I suggested that some people focus too much on tax rates when considering where to live. Taxation is just one piece of the cost of living equation, and the most appropriate thing for any of us to do before considering a particular state and town is to assess the entirety of our finances and lifestyles, and then look at the entire cost of living equation.

For example, Tennessee and Florida are no-income-tax states, but if a retiree isn't generating a lot of income, why should he care about a state income tax (especially if she hates traffic jams and wouldn't want to pay higher insurance rates in coastal Florida, for example)? On the other hand, a retired CEO may have large pension and capital gains income and would be foolish not to look seriously at a no- or low-income-tax state.

The point is that total cost of living, or COL, is the more relevant piece of data. There is a particularly helpful chart in the latest issue of Where to Retire magazine, a pleasant surprise since most of the publication reads like a marketing brochure for its advertisers. Page 234/235 of the August issue contains a "Chart of Living Costs," a comparison of 100 cities in the U.S. It is set up like one of those mileage charts on a road map; you find the city you live in currently on the vertical axis, and the one you might move to on the horizontal axis, and the intersection of the two tells you how much higher or lower (by percentage) your cost of living will be. For example, if you are moving from Pittsburgh to Myrtle Beach, your COL will decrease about 5 percent. Move to Wilmington, NC, from Pittsburgh instead, and your COL will increase 5 percent. (Note: Move virtually anywhere from Honolulu and New York City and your COL will drop dramatically.)

The chart was compiled from data supplied by the research firm ACCRA and cross-referenced with chambers of commerce statistics. At ACCRA's web site, you can purchase one single comparison of two cities for $7.95; every comparison after that one, assuming you use the same origination city, is $4.95. The entire August issue of Where to Retire, which includes the chart, is just $4.95 at newsstands (I bought my copy at a Barnes & Noble). The chart is missing some key southern cities for retirement like Savannah (but, oddly, includes Valdosta, GA), and Aiken, SC, but the chart is still a substantial bargain.

Just don't take too seriously the other 260 pages of the magazine. In a few days, I will explain how much of the rest of the August issue of Where to Retire does a disservice to its readers.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Handy(wo)men specials

We read with interest a piece on the Wall Street Journal's web site about a couple in Raleigh, NC, who purchase mostly homes in foreclosure that are in need of updating or repair. The couple has experience with such fixer-uppers; they buy a house at a low price and know how to keep costs low to get the house in shape for a relatively quick sale. Their purchase that was featured in the Journal is a duplex that cost the couple roughly $210,000 - purchase price and rehabilitation costs -- and is likely to fetch about $340,000. The house is near North Carolina State University; purchasing and improving a home in a college town is one of the safer bets in a tough market. College towns are drawing more and more baby boomers, and if you have the stomach for renting to students, you will never run out of a market.

Foreclosures are happening at all levels of the market. Tom Pace, a sales director at Glenmore outside Charlottesville, VA, says a home in that handsome golfing community is in foreclosure now and listed at $899,000. Tom says it would fetch $1 million if it were in better condition.

Restaurant: One Block West, Winchester, VA

So many golf courses, so little time. With a little planning, you can build yourself a pretty nice personal golf trail along virtually any U.S. interstate. Along I-81 from Pennsylvania to Virginia, for example, you will find excellent daily fee courses like Wren Dale in Hershey, PA; Dauphin Highlands, near Harrisburg, PA; and Rock Harbor in Winchester, VA. (We know these by reputation and look forward to trying them on the way to visit our son at college in Virginia over the next four years.) It is fun to explore new golf courses, and equally fun to try interesting restaurants along the way.

Nothing tops off a nice day of golf like an excellent meal. On Wednesday night, on the way to college, my wife, son and I dined at One Block West , one of the most highly regarded restaurants in Winchester, an attractive, bustling town in the northernmost part of Virginia. OBW, as the locals call it, is located in Indian Alley in downtown Winchester. Parking on a quiet weekday night was not a problem; most parking spaces were reserved for office workers who had long since left for the day.

We considered ourselves lucky that Wednesday is Tapas Night at OBW. We love the "little plates" of food that characterize this Spanish-inspired style of dining; they are a fine way to determine a kitchen's range and quality and to give you a hint of what you might order as an entrée on any return visit (for the record, we plan to return). Tapas is also entertaining; the more people around the table, the more fun because of the sharing. Everyone seems to become an instant restaurant critic when the plates are passed around.

One Block West, which is decorated in brick and wood and the dark colonial colors of green and red, is owned by the affable Chef Ed Mathews. On a quiet night, with just a half-dozen tables occupied both inside and in the comfortable outdoor seating area, Chef Mathews greeted us at the door when we arrived and came over to the table at the end of the meal to see how we had liked it. He wasn't disappointed in our responses. He and his restaurant passed with flying colors, on both taste and presentation. Out of the 15 dishes we ordered ($5 to $10 each), only one was less than excellent, the lamb kebabs. Although cooked to a tasty medium rare, the lamb was overly chewy, burdened by too much gristle; however, the Greek tzatziki sauce accompaniment was exceptionally tasty, with just the right yogurt and garlic zing.

My marinated baby grilled fennel shared a long rectangular plate with hamachi seviche. The fennel, served cold atop exceptionally fresh arugula, was a refreshing way to start the meal. Neither the marination nor grilling did a thing to disturb the natural anise taste of the root vegetable, and the perfectly aligned grill marks showed careful attention to detail. The hamachi, which had been steeped in a citrus marinade, was astringent and lustrous at the same time, the just-beyond-raw fish as fresh and sparkling as anything you will find in a sushi palace. My wife and I split the aforementioned lamb, as well as separate dishes of grilled Surry sausage and Basque-style chicken. The locally produced sausage - I assumed from the town of Surry, less than an hour away - was shot through with smoke tempered by a thin maple syrup sauce, the maple syrup also from Virginia. It is always a good sign to see local produce and meats on a menu; you know they are likely to be fresh. The Basque chicken was a good-sized thigh piece simmered in a light-tomato sauce with a hint of green pepper, a faithful rendition of a classic peasant dish.

I glommed a taste of my wife and son's dishes as well, and they were all equally outstanding. The most memorable were the grilled baby eggplant with spicy hummus, a nice marriage of the sweet flesh of the vegetable with the bite of the pureed chick peas; prosciutto-wrapped pork tenderloin with grilled plum, the pork easily the most tender piece of meat of the night (or the month); and the mini Thai-inspired crab cakes, packing more meat than filling and accompanied by a thin, spicy Asian sauce.

OBW offers a wide range of wines by the glass, as well as by the bottle. I went for a couple of glasses of sherry, a good choice with tapas. The slightly nutty taste of the sherry matches well with virtually everything on a tapas menu, and after a seven-hour drive, I just wasn't in the mood to think about which whites and reds matched which dishes (I also didn't want to drink too much). The Lustau oloroso and amontillado I ordered were both fine and reasonably priced, at just $5 per glass. Three other styles of sherry were offered at equally reasonable prices.

If you aren't careful, the final bill for your evening of grazing on a tapas menu can go pretty high, in our case $120 for the 15 dishes we ordered. But I didn't flinch when I opened the leatherette pouch with the bill. Excellent meals seem to crowd out such worldly concerns.

One Block West is located at 25 South Indian Alley in Winchester, VA. Telephone number is (540) 662-1455. Reservations suggested, especially on the weekends. Web site is www.obwrestaurant.com.

{mosmap width='400'|height='300'|lat='39.183653522889077'|lon='-78.16658735275269'|align='center'}

Sorry Portland

Miracle on the 9th green

The time you won your town the race,

We chaired you through the marketplace;

Man and boy stood cheering by,

And home we brought you shoulder-high...

-- "To An Athlete Dying Young," A. E. Housman

This year, my 60th in this lifetime, I have gained almost a stroke on my handicap rating. I've played as many rounds over 90 as I have below 80. Maybe it's the aging process. Sometimes I feel pretty good and play badly. Sometimes I feel bad and still play badly. I'm sure some of you are sighing with the sympathy of the familiar.

The worse I play the more my mind drifts back to a few highlight shots of the past, like the hole in one at age 16 on the New Jersey course where I learned to play; the tee shot left hanging over the lip on a par 3 in Rochester, MN; the ball at eye level in a bunker at Pine Valley that I still regret not attempting to hit back over my shoulder, the way Mickelson did in an NCAA tournament round; or the chip shot I hit from behind and right of the 16th green at Augusta to where they put the pin on Sunday at The Masters, a 120-foot, 90-degree left-angle shot that almost went in the cup (I also remember the comeback five-footer I missed for the par).

The memory of one particular shot came rushing back to me a few weeks ago when I stepped onto the 9th tee at Hop Meadow Country Club in Simsbury, CT, my home course. As I looked out 200 yards to the hole a few stories below, I noted that the pin was at the back right of the large green. It took me back 20 years to a golfing moment I will never forget.

It was the club's major three-day member/member tournament, and our flight of eight teams was packed with good golfers, most of them single-digit handicaps. (I was an 11 at the time, my partner Tom one or two strokes better). We had slogged our way to third place through the first six of seven nine-hole matches, with one match to go. As it turned out, we were matched with the first-place team; all they needed to do was halve (tie) their match with us, and they would win.

It came down to the final hole, the signature hole 9th, with the match all square. The tee shot comes out of a chute of trees, over a large pond directly in front of the back-to-front sloping green. Two sand bunkers guard the right side, and the only bailout is left of the green, where thick rough and just a small patch of fairway grass make getting up and down on the tilted green difficult.

My partner Tom hit his ball in the back right bunker, and I left my tee shot at the front left on the green, a good 45 feet from the cup. One of our opponents, Dick McAuliffe, knocked a pure five-iron five feet to the left of the cup. (Baseball fans of a certain vintage might recall Dick, an outstanding infielder for the Boston Red Sox and Detroit Tigers in the ‘60s and ‘70s). It appeared that playing the rest of the hole was a mere formality. We were toast.

Tom blasted his sand shot to 15 feet away and then McAuliffe, a golfer of intense confidence, did a curious thing. Thinking he would two-putt at worst to halve the hole and the match, thereby ensuring his team the victory, he conceded Tom's long par putt. That gave me the proverbial "free ride" for my over-hill-and-dale putt. I felt no pressure because I had putted like a weight-lifter all day; no one, me included, expected I would get it close. But I made a smooth stroke and watched in dumbfounded exhilaration as the ball hit the back of the cup and dropped in.

I invented the Tiger Woods fist pump that day, as well as the accompanying yell. McAuliffe, who had conquered the pressure of playing baseball in front of more than 60,000 people, looked shaken, the realization coming to him that by being a gentleman and conceding my partner's putt, he had set the stage for a putt I could hit any way I wanted. He proceeded to miss his five-footer by six inches on the low side. Five minutes later we found out the second-place team had lost, and that Tom and I had won our flight and the biggest payday of my amateur career.

It was a Bobby Thompson, Franco Harris, Rocky Balboa moment all rolled into one.

The 9th hole at Hop Meadow, a par 3, is the signature hole and was the site of the signature event of a modest golfing career.

More ugliness in housing market

It is hard to see to where a turnaround in housing begins. One independent economist quoted in the Wall Street Journal today said that, "There are going to be no happy endings here [in the housing market]."

In the Case/Shiller survey, which gathers data from 20 metro areas, only four had year-over-year gains in selling prices: Seattle (7.9%), Charlotte (6.8%), and Atlanta and Dallas (both 1.6%). That reflects what real estate agents have been telling us in the southeast, that sales may be slow but prices are generally holding fast. However, it is reasonable to assume that, as inventory builds in the southeast because northerners can't sell their own homes and move south, we will start to see prices erode as well.

Eventually, of course, there will be happy endings, at least for some. The market will eventually stabilize, as it always does, and people's memories will turn short again, as they always do. I recall back in the early ‘90s, during the last housing disaster, all the experts advised it was foolish to ever again treat housing as an investment. That savvy advice lasted about as long as the next upturn, and many people made impressive money over a half-dozen years or so. But, of course, the folks late to the party, like Miami and Las Vegas condo owners who borrowed at cheap interest rates in anticipation of a quick flip of their investments, are now stuck with a lot of near worthless concrete.

Looking back, it is hard to fathom that merely a year ago, home prices were rising at more than 7 percent annually. Looking ahead, it is hard to see anything like that on the horizon. For those contemplating a relocation that would include the sale of one home and purchase of another, this is a time of extreme caution...especially if a mortgage is involved.

Harm's way: Prepping for coastal disasters

I thought of "On the Beach" as I read an opinion piece on global warming and hurricanes in last Friday's Wall Street Journal. The writer of the article reconciled that ever-increasing numbers of people are moving to coastal areas, willing to face the catastrophic inevitability of hurricanes. Today, he wrote, "more people live in Dade and Broward Counties [Florida] than lived in all 109 coastal counties from Texas through Virginia in 1930." The author, a Danish professor, thinks that if people insist on putting themselves in harm's way, the government should put much more emphasis on hurricane preparedness and pro-active measures, like better construction in low lying areas, even if that means less government spending to reduce carbon emissions.

"Simple, preventive measures," he wrote, "would cost a small fraction of [the cost of adhering to Kyoto Protocol restrictions] but do a hundred times better" at saving lives and property on the coast.

The best way to avoid ever having to deal with the anxiety and eventual consequences of a hurricane is, of course, to live somewhere safely distant from the coast. A second alternative, if you have low country wanderlust and must live near or on the beach, is to narrow your odds by researching which coastal areas have the best hurricane records. Savannah, for example, has suffered just one storm of consequence in 100 years. Jacksonville, FL also has a fairly good record on major hurricane avoidance. The Charleston, SC, and Nags Head, NC areas, on the other hand, are especially vulnerable. You can find a comprehensive list of U.S. hurricanes at the U.S. National Oceanic and Atmospheric Administration site. It is interesting reading for those fascinated by one of Mother Nature's most devastating messages.

If you cannot escape the lure of coastal living, then at least learn how easy or difficult it will be to escape to safety in the event of a major storm. Hurricane evacuation maps and information are available from most state transportation department web sites. (For a sample from South Carolina, click here). It is a good idea to scan these maps before you start looking for property in a populated coastal area that may, for example, have only one potentially congested lane out of harms way.

Your investigation prior to buying into a golf course community should also include the community's own evacuation plans. I know Pawleys Plantation in South Carolina publishes information on its members' web site about what happens in the community before, during and after a hurricane, right down to when and how to retrieve your golf clubs from storage before a storm. To some of us, those clubs are more prized than a place on the beach.

On the market

A sample of homes on the course for sale in Wilmington, North Carolina

The following homes are in the $400,000 to $1 million range in golf course communities in Wilmington, NC (we have added one downtown Wilmington property for those inclined toward a little more history at their doorstep). We pulled these samples from the multiple listing services in the area; there are dozens more homes currently on the market at a wide range of prices. We can vouch for the quality of the golf course communities, having visited (and reviewed) those that are listed. If you are interested in any of these homes, or simply want more information about the best golfing communities in Wilmington, we will be pleased to put you in touch with a real estate agent we have personally qualified. There is no cost or obligation to you. Simply contact us (see the button at right), and we will email the agent's name and contact information to you. We will not furnish your name or contact information to the agent or anyone without your written approval.

Castle Bay

The Castle Bay golf course was designed and built by the community's developer, Randy Blanton, after an architect he had hired didn't give him what he wanted. What he wanted was a Scottish links course. I played it on a cold and windy day, and it sure seemed like a links course, although the high-tension wires and rows of tidy brick houses alongside some holes were a bit of a distraction. But if you can put your blinders on and keep your head down, the rolling terrain and heather framing do provide some echoes of Scotland. Because of the limited acreage for the homes, and their generally modest sizes, you can't spend much more than $500,000 for a house in Castle Bay. One new home with 4 bedrooms and 3 baths on 1/3 of an acre is currently on the market for $449,000. Membership in the semi-private club is just a few thousand dollars. Most other homes in the community are listed at under $500,000.

played it on a cold and windy day, and it sure seemed like a links course, although the high-tension wires and rows of tidy brick houses alongside some holes were a bit of a distraction. But if you can put your blinders on and keep your head down, the rolling terrain and heather framing do provide some echoes of Scotland. Because of the limited acreage for the homes, and their generally modest sizes, you can't spend much more than $500,000 for a house in Castle Bay. One new home with 4 bedrooms and 3 baths on 1/3 of an acre is currently on the market for $449,000. Membership in the semi-private club is just a few thousand dollars. Most other homes in the community are listed at under $500,000.

Porters Neck Plantation

Porters Neck is a mature community with a terrific Tom Fazio golf course that was recently renovated at a cost to members in the seven figures. The club is in transition from semi-private to fully private, and greens frees for outsiders currently top $100. Membership initiation fees are $30,000. Porters Neck, which is about a 25-minute drive into the city, is a gated community lined with live oaks and nice landscaping touches. A home on the 7th green of the course features high-end kitchen appliances, custom cabinetry and extra touches, such as remote controlled window blinds. Dramatic, large windows provide nice views of the golf course. The home, with a Fazio Drive address, is available for $985,000.

Porters Neck is a mature community with a terrific Tom Fazio golf course that was recently renovated at a cost to members in the seven figures. The club is in transition from semi-private to fully private, and greens frees for outsiders currently top $100. Membership initiation fees are $30,000. Porters Neck, which is about a 25-minute drive into the city, is a gated community lined with live oaks and nice landscaping touches. A home on the 7th green of the course features high-end kitchen appliances, custom cabinetry and extra touches, such as remote controlled window blinds. Dramatic, large windows provide nice views of the golf course. The home, with a Fazio Drive address, is available for $985,000.

Landfall

Landfall, which sports two excellent courses, one by Dye and one by Nicklaus (27 holes), is conveniently located just eight miles from the city of Wilmington. Although we found the folks at the golf course a little snooty - they declined to let us play and review the course initially - our Wilmington real estate agent's friend who snuck us on could not have been nicer. A home on Arboretum drive that was built in 1995 on more than a half acre is currently listed at $733,500. Many other homes priced lower and higher are available in Landfall, and one huge house with killer views of the ocean is currently on the market for more than $7 million. Membership in the two courses, whose clubhouses are about a mile apart, is $55,000. We played the Nicklaus course on a cold, windy day and found it difficult. The Dye course is supposed to be just as challenging, but with a variety of tees on both tracks, you can play to your comfort level.

Downtown Wilmington

The Wilmington area offers some nice daily fee courses for those who either don't play enough golf to justify private club membership or would prefer a less restrictive arrangement. Wilmington's own municipal golf course, for example, is a Donald Ross design. The Wilmington Historic District is emerging quite nicely - we stayed at a bed and breakfast there a year ago - and would be an interesting alternative for those who prefer older homes with character to newer construction inside a community. And the costs per square foot downtown are certainly competitive: One particular Victorian on North 7th Street for $699,900 was built 100 years ago and features six bedrooms and six baths. The river, restaurants and shops are a short walk away.

Our complete, nine-page review of the top Wilmington golfing communities is available free with a $39 annual subscription to the HomeOnTheCourse community guide, published six times a year. Each issue of HomeOnTheCourse includes our objective, unbiased comments about the quality of golf and living in the southern U.S.'s top golfing communities, as well as some communities you may not know but should. For more information, go to HomeOnTheCourse.com.

Around the communities

Membership in Cedar Creek's open-to-the-public Arthur Hills course and club is a bargain, at membership fees below $2,000.

Foreclosures not an issue yet in golf communities

Although some doomsday pundits believe as many as seven million Americans face foreclosure on their homes, no such threat is imminent in two quite different but established golf course communities we surveyed in recent days.

"We have a few foreclosures," said Mike Burch, sales executive for The Landings at Skidaway Island, near Savannah, GA. "But with about 3,900 homes [in The Landings], that is no more than usual."

Mike adds that all the foreclosures are at the low end of The Landings' market, or homes with values of less than $400,000. These are typically purchased by younger couples "who have been caught up in the variable rate mess," says Mike.

Dick Salsitz, a selling agent at Cedar Creek in Aiken, SC, says his community hasn't seen a single foreclosure action since the lending crisis began.

"I don't expect any [foreclosures]," Dick says. "We've had one in 15 years...and that was many years ago."

Most of the residents of The Landings and Cedar Creek are either retirees or empty nesters, and the majority of them have paid cash for their homes. Mike says that The Landings owners of the more expensive homes, in the high six-figures, tend to pay all cash.

"A few do finance just to get some tax write-offs," he adds. At Cedar Creek, Dick estimates, 60 percent pay cash and the rest finance at least part of the home's cost.

At the large Landings property, which encompasses six private golf courses for one membership fee, home prices haven't eroded in the recent market pullback, says Mike, "but they have not risen either." He has noted that people are more cautious lately about owning two homes, so interest in a Landings property isn't turning into a sale as quickly as when the real estate markets elsewhere were stronger. At Cedar Creek, which is about one third the size of The Landings, prices have held steady as well.

Mike says he has seen some recent price concessions by those trying to sell their homes in The Landings. Sellers who maintain the full-family $50,000 golf memberships are lowering their asking prices for purchasers who pay the initiation fees and assume the membership. In that case, the seller doesn't have to go on a waiting list for the return of his equity stake in the club. He can be a little more flexible, therefore, with the price of the house.

We were curious if some residents were canceling their club memberships to conserve cash. Neither Mike nor Dick have seen much of that.

"A few of our 70-year-old members do resign each year," Mike says. "Some of this is due to cash flow, but some of it is due to not being able to play as much as they used to."

Dick says no one has resigned at his community's public accessible club, whose membership fees are less than $2,000 for a nice Arthur Hills layout, "and I don't think that will happen at Cedar Creek."

Purchasers of the larger homes at The Landings, near Savannah, typically pay all cash. Just a few of the community's lower-priced homes are in foreclosure.

Go with the flow in your next home

No matter where your next home is located, someday you or your heirs will sell it (unless you do something in your lifetime that warrants a museum after you are gone). "Flow" will be important in making the house as saleable as possible.

Flow is the term real estate agents and interior design experts use to describe how traffic moves through the home, from outside in, inside out and from one room to the next. A home with bad flow might, for example, force guests to walk through your study or, worse, a bedroom, to get to a bathroom. (Don't laugh; I've been in houses that quirky although, come to think of it, they were all in California.)

A home with good flow means rooms are allocated based on most people's normal movements and lifestyle. For example, folks in their 60s or older shouldn't have to walk a flight of stairs each evening to get to their bedrooms; you leave that for the kids and grandkids. Indeed, the trend in many new homes in the southeastern U.S. is for a master bedroom suite at ground level, with an additional master upstairs (or downstairs, in some designs) for the visiting kids and their families. Yet because many new, healthy homeowners in golfing communities strive to maximize the view of the golf course or water, they build their own bedrooms upstairs, often with a walkout deck. That's fine for now, but such a design will make the market for the house much narrower later on (and, ultimately, you may wish that you had let Otis put that elevator in when you built the house).

Few of us spend most of our waking hours in our bedrooms (I'm resisting the Viagra joke here). Studies show we spend most of our in-house time in kitchens, family rooms and studies, and these rooms should be adjacent to each other to maximize flow. You shouldn't have to walk down a long hall or through another room with a hot coffee or cocoa in hand to cozy up to the fireplace, television set or PC. And for those who will "work" in retirement, experts suggest the work desk be as far away from the bedroom as possible, sound advice in my own experience. You will sleep better, especially knowing that you are widening the market for your home years from now.

Sometimes the view from a property cries out for two-story or higher construction. Other times, flood plain issues dictate that living space be at least one floor above ground, as at this home in DeBordieu Colony in Georgetown, SC, less than a quarter mile from the ocean.