Loaded Newsletter Launches Tomorrow

Our April edition of Home On The Course, our monthly newsletter, has something for virtually everyone. Whether you are in full search mode for a golf home or simply contemplating a future search, our advice on how to “Make Sure that Golf Home is Right for You” will come in especially handy when you make your visits to golf communities. If you are just planning a golf trip with family or buddies, the latest rankings from the North Carolina and South Carolina Golf Rating Panels will lead you to the best golf courses “you can play” in each of those golf rich states.

Finally, we show how a vacation or permanent home in a golf rich area of the South can lead you to free lodging in some of the best golfing areas of the world –- or, if you choose, cities like Paris, London and Athens where you won’t need your clubs to have a great time. Our friends at HomeLink, one of the premier home exchange organizations, are offering a special free trial to subscribers of Home on the Course (which, itself, is free for the asking).

There has never been a better time to sign up to receive Home On The Course. It arrives in hundreds of email boxes tomorrow morning; please subscribe today by clicking here. A home exchange via HomeLink led my son and me to a free one-week's stay a mile up the road from the Crail Golfing Society and its 36-holes of splendid links golf beside the North Sea. HomeLink is offering our newsletter subscribers a free three-month trial. Please subscribe today; the newsletter will launch tomorrow morning.

A home exchange via HomeLink led my son and me to a free one-week's stay a mile up the road from the Crail Golfing Society and its 36-holes of splendid links golf beside the North Sea. HomeLink is offering our newsletter subscribers a free three-month trial. Please subscribe today; the newsletter will launch tomorrow morning.

Home On The Course newsletter

Home On The Course newsletter

Click here to sign up for our Free monthly newsletter, loaded with helpful information and observations about golf communities and their golf courses.

Golf Community Homes Still Lag 2007 Values

The other day, I selected at random a bunch of homes currently for sale in top quality golf courses and, using the online real estate service Zillow, checked their sale prices before the 2008 recession against their current list prices. In virtually all cases, values have not rebounded since 2007, in most cases not even close. So while sales seem to be proceeding at a fairly good clip in the better golf communities, sellers are not getting pre-recession values out of their homes. One takeaway: Golf homes in the better golf communities are good investments because in many cases they are well below their historical highs (see below). One home in Wachesaw Plantation, Murrells Inlet, SC, is currently listed at $660,000, $225,000 less than its value 10 years ago.

One home in Wachesaw Plantation, Murrells Inlet, SC, is currently listed at $660,000, $225,000 less than its value 10 years ago.

The reason I embarked on this experiment was because a customer currently living in Pinehurst, NC, on one of the nine, famed Pinehurst courses filled out one of my Golf Homes questionnaires, requesting my assistance in the search for another golf-oriented home. I checked their current address on Zillow to see if their home was currently for sale; it isn’t, but Zillow estimates a current value of $461,000 (what they call a “Zestimate”); in 2007, the house sold for $700,000. Ouch. This caused me to select a number of our favorite communities and pick one home in each currently for sale to compare to its 2007/2008 selling price. The results were pretty startling.

My first stop was our own vacation condo in Pawleys Plantation, Pawleys Island, SC. We purchased the unit in 2000 for a price in the low $200s, and by 2007, it had a value of $377,000. I was feeling my oats back then, but according to Zillow, the condo is now worth just $306,000. The story was the same elsewhere I looked:

Landfall, Wilmington, NC

2007 $725k

2017 $599K

The Landings, Savannah, GA

2007 $807k

2017 $698k*

Cliffs at Walnut Cove, Arden, NC

2007 $1.4m

2017 $1.175m

Wintergreen Resort, Nellysford, VA

2007 not available

2017 $450k

2015 $500k

Reserve at Keowee, Sunset, SC

2007 $680k

2017 $567k

Wachesaw Plantation, Murrells Inlet, SC

2007 $925k

2017 $660k

Palm-Aire, Sarasota, FL

2007 $462k

2017 $425k

Grand Harbor, Vero Beach, FL

2007 $190k

2017 $135k

Imperial Estates, Naples, FL

2007 $307k

2017 $265k

As stock brokerages are required to state, past performance is no indication of future performance. But real estate prices in the U.S. typically return to past high prices. If you believe in the U.S. economy, then you can believe that an investment in a home that lags its historical highest price by double-digit percentages might be a good investment.

These Seniors Are REALLY Super

While doing some online research recently, I came across this notice for a men’s golf group in the Myrtle Beach area.

SUPER SENIORS

** FLASH ** EFFECTIVE for the event 1/23/17 at ARROWHEAD, the Super Senior criteria has been DROPPED from 95 to 90. **

If you qualify, talk to some of the others who have moved up, and find out if they are enjoying their golf more than they used to!!!!!

-- Grand Strand Senior Men’s Golf Association

Editor’s Note: Although the numbers may have to do with scoring averages, it sure reads as if it is about age. If any of us are still on the golf course at 90, let alone 95, we should be "enjoying" a lot more than golf.

Vacation golf homes hot again?

Just today, two clients contacted me about pursuing the purchase of vacation homes. One was targeting the Myrtle Beach area and the other Reynolds Lake Oconee. It could be confidence in the economy or simply the bubble of baby boomers coming into retirement age, but vacation homes appear to be on many couples’ radars these days.

I have owned a vacation home south of Myrtle Beach for nearly 17 years, and it has been a wonderful experience in all regards except, perhaps, the financial ones. During a career and the raising of children, with all the activities that anchor you to your primary home location, you will not get full use out of a vacation home. As a strictly financial investment, it is not a great deal. In our case, because of a special incentive offered by the developer who sold us our condo, we joined the golf club at Pawleys Plantation; that has had its compensations, but I would have been much better off paying green fees for each round rather than regular dues (see below).

If you are contemplating the purchase of a golf vacation home, here are a few key things to consider on the one hand, and on the other:

The Good

Owning a vacation home is good for the ego. If you have been successful in your career, enough so that you can afford to purchase a condo or patio home in a warm weather location, you’ll feel even better about yourself and your accomplishments. Vacations add to family bonding and if, as was the case in our family, husband and one child love golf and wife and one child love the beach, you can target the vacation home to check both boxes and make everyone happy.

The freedom to decide on a Wednesday to fly or drive down to your vacation home for a long weekend is almost priceless...especially if you don’t rent out your home to other vacationers. My wife and I made the decision not to rent out our condo, opting to furnish it to our own tastes and to protect it from short-stay vacationers who might not treat it as their own. But based on annual rental records in Pawleys Plantation, and our condo’s location at the 15th tee and a short walk to the clubhouse, we probably could have generated $15,000 in revenue annually to offset the club dues and homeowner association fees. This is a decision that should be weighed carefully by any couple considering a vacation home: Freedom to travel to your home whenever you decide and to furnish it for yourselves compared against the extra income rentals can generate. (One word of caution: Research carefully the particular rules on renting and the management fees to market and maintain your home in your absence. Of particular interest should be whether guests in your home have club privileges through your membership.)

Although signing up for a full-time membership connected to a part-time home rarely works out financially, being treated like a member whenever you are in residence has its compensations. Although Pawleys Plantation generates many outside rounds of golf, I love being greeted by name at the bag drop, of getting prompt and serious service when I call the pro shop and the discounts on golf balls and other equipment aren’t bad either. Plus membership conveys some reciprocal arrangements at other clubs, some of them more private than my own (just have your pro make a call).

The Bad

A vacation home, as a financial exercise, is almost always a loser. If you have a mortgage on the home, there is that expense. There are the property taxes which, admittedly, in much of the South are extremely low compared with what many of us are used to up North. And if you join the adjacent golf club, there are the initiation fees and monthly dues. In most years, over the course of our ownership and golf membership at Pawleys Plantation, I probably averaged nearly $200 per round; the public paid an average under $100 per round. But because the developer in 2000 paid half our initiation fee, and because I fully -– and foolishly -– expected to play a couple dozen rounds of golf each year, I joined. Think carefully before you accept such a deal. I would the second time around.

The Bottom Line

Some folks will argue that a vacation home compels you to use it as frequently as possible and denies you, somewhat, the pleasures of seeing the rest of the world. It is true that if you desire to wring every last dollar of investment out of your vacation home, assuming you don't offer it on a rental program, you may very well feel guilty about traveling elsewhere. Don’t. Give the keys to your vacation home to friends and family when you aren’t using it and it will be a priceless source of relaxation, whether you are there or elsewhere, content in the knowledge that at least someone else is getting their moneys worth.

There is one other way to get the most value from your vacation home, and that is by joining a "home exchange" program that essentially facilitates a swap of your vacation home for another couple's home for a week or two. I will be writing in the next few weeks about an organization that manages such exchanges, Homelink International. We used our Pawleys Island condo in exchange for a cottage in the seaside golf village of Crail, Scotland, and it was a wonderful and cost-free experience.

If you would like to discuss your own pursuit of a golf vacation home, I’d be happy to talk with you. Contact me and we will get the ball rolling.

Doom or Gloom or Truth about Golf: Which is it, media?

I noticed a link in a tweet yesterday about golf real estate and followed it to an article sponsored by some outfit called VTS (View the Space), a real estate leasing consulting firm. As I read the piece by a “commercial real estate journalist” –- talk about specialization –- I thought the gloom it covered the golf industry with -- courses being plowed over for housing developments or repurposed for other uses -- was all too familiar. Cover some new ground, I thought –- until I looked back at the byline that indicated it was written last summer. It was old ground.

But is it? If you subscribe to Google’s Daily Alerts, as I do, and use search terms that include golf, golf community, golf real estate and the like, you will be treated to a daily diet of articles detailing fights between homeowners who live adjacent to golf courses and the club operators who want to close the course and sell to a developer; or resorts that are closing down a golf course to make way for an orchard or amusement area. Home with view of green at Savannah Lakes Village in McCormick, SC

Home with view of green at Savannah Lakes Village in McCormick, SC

However, like most news today, the bad stuff tends to throw shade over any good news. And the media, once it chomps down on a tasty chew toy -– in this case, golf –- does not let go easily, even in the face of facts. After spending a dozen paragraphs on why the golf industry is in trouble, the author of the article finally got to the good news in the penultimate paragraph; that “recreational open space” like golf courses “boosts the property value of nearby homes by as much as 20%.” The reference point is a National Association of Realtors study in Portland, OR, which showed that close proximity to a golf course was responsible for an extra $8,849 in home values, second only to “natural areas” and well ahead of “specialty parks” and “urban parks.” (The poorly articulated article doesn’t indicate how nearby homes are valued; if the $8,849 represents an extra 20%, that would imply average home values barely more than $44,000. Surely that is not the case.)

Of more relevance and accuracy is a study conducted by Florida Atlantic University that evaluated 10,000 home sales in three south Florida counties in 2015. Its results were announced this past January. The study found that homes adjacent to a golf course are worth an additional 8% to 12% compared with other comparable homes. This was a scientific endeavor, not the kind of anecdotal (i.e. lazy) efforts by many in the business press that result in an unfair depiction of golf and real estate. Facts do matter, and those considering a golf home who might be intimidated by what they read about golf communities in the press should avert their eyes from alternative facts.

You can read the press release on the Florida Atlantic study here.

The Best 18 Holes in Myrtle Beach, Arguably

I was one of more than 120 members of the South Carolina Golf Rating Panel asked late last year to identify the best par 3s, 4s and 5s among the 100 golf courses open to play for all golfers along the Grand Strand of Myrtle Beach, an area that stretches roughly 90 miles from just below Wilmington, NC, to Georgetown, SC, and through the heart of Myrtle Beach.

It was a daunting task for a number of reasons: First, of course, it is tough to remember with any precision even the best of a total 1,800 golf holes. Frankly, I haven’t managed to quite play all of them since my first trip to Myrtle Beach in the late 1960s; in the years since, a couple dozen of the original courses on the Strand have closed. But still, when you have almost a couple thousand holes to choose among, at least 18 are going to be terrific. Although my fellow SC Golf Rating Panel members anointed the 18th hole at Pawleys Plantation Country Club as one of the top 18 in all of Myrtle Beach, my choice would be the 16th at Pawleys (shown here), where even an excellent drive on the dogleg left par 4 leaves a daunting approach shot.

Although my fellow SC Golf Rating Panel members anointed the 18th hole at Pawleys Plantation Country Club as one of the top 18 in all of Myrtle Beach, my choice would be the 16th at Pawleys (shown here), where even an excellent drive on the dogleg left par 4 leaves a daunting approach shot.

And they are, at least the ones I am familiar with, although one par 4 choice I know well is what I consider the third best choice on its golf course. That would be the finishing hole at Pawleys Plantation Country Club in Pawleys Island, a difficult and scenic Jack Nicklaus layout less than a mile, as the eagle flies, from the ocean. My fellow raters deemed the 18th one of the top courses on the Grand Strand; it is a fine finishing hole that demands a shaped drive on the slight dogleg left, with menacing marsh and bunkers at the crook of the dogleg and a forest to the right of the fairway for drives overcooked in that direction. A lake and bunkers along the left side protect the long, narrow, back-to-front green, and an overhanging tree about 30 yards in front on the right side makes it tempting to hit a faded approach toward the lake side. On any other golf course, #18 might be the best par 4, but strong contenders at Pawleys include #8, with a 160-yard long bunker that runs from mid-fairway to cover the entire right two-thirds of the green; and the 16th, a long hard-dogleg left with a huge live oak guarding the turn, marsh across the fairway beyond it, and a green surrounded by bunkers.

For a rundown of the other 17 best holes in Myrtle Beach, see the article at CrossRoadsToday.com.

Mother Nature Fools Again

As I write this, our deck is covered in about 16 inches of snow where it hasn’t drifted, thanks to high winds, to over 2 ½ feet. Just one week ago, some of the Hartford, CT, area golf courses announced they would be opening in a few days. The day before opening, it snowed about two inches, certainly enough to dash the plans of even the most serious and sturdy of golfers (the latter is not me anymore). Yesterday, the snow had melted almost to the point of playability. But today, blizzard conditions not only put a blanket of deep snow over the area, but it also put a damper on any possibility of the golf season in southern New England starting before April 1.

This is why so many of us long for a vacation home or permanent home in a warm weather area. (A friend told me on the phone that it was 85 today outside her home in Las Vegas.) It is also why I have seen an uptick in the number of questionnaires readers of my web site and newsletter have filled out in the last two weeks, about three times the typical rate this time of year. Snow is good for the guy who plows my driveway, for supermarkets and for me.

But that doesn’t mean I like it. We golfers have an internal clock, and when Daylight Savings Time kicks in, it is natural to think the golf season should as well. For all you fellow New Englanders -– and this applies to everyone north of the Mason-Dixon line -– here is tomorrow’s weather forecast in selected cities of the Southeast. According to weather.com, there is a 0% chance of rain in every one of these locations tomorrow. Perfect sweater weather golf.

Amelia Island, FL 59 degrees and sunny

Sarasota, FL 63 degrees and sunny

Pawleys Island, SC 47 degrees and windy;

Hilton Head Island, SC 52 degrees and sunny

Lake Oconee, GA 49 degrees and sunny

Aiken, SC 48 degrees and sunny

Greenville, SC 45 degrees and sunny

The scene on the back deck of our home, and it is still snowing (and blowing). It will be a while before we can use the grill.

The scene on the back deck of our home, and it is still snowing (and blowing). It will be a while before we can use the grill.

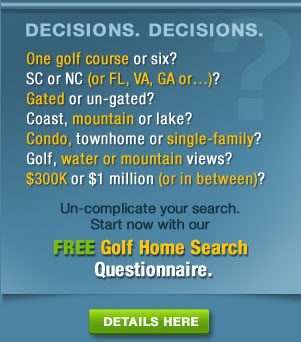

How to Find a Golf Home This Year

All sorts of conditions are conspiring to make this a good year for those considering purchase of a golf home to get it done. Interest rates are still low, if you plan to borrow money; home prices have firmed up in many markets in the North, making it easier to sell a home and move on; home prices in many good golf communities were up even more last year, and as the baby boomer wave continues to move South, they should remain strong for the foreseeable future; and the cost of living differences between North and South means many couples will almost pay for their moves within a year or two with a much lower expense level. With a disciplined approach to a search, you could be playing on your new golf course within a year, in a community like Tidewater, just north of Myrtle Beach, SC

With a disciplined approach to a search, you could be playing on your new golf course within a year, in a community like Tidewater, just north of Myrtle Beach, SC

We are dedicating the March issue of our Home On The Course newsletter to finding a home within a year. Subscribe now to make sure you don’t miss this informative discussion of how to conduct the most effective search, one that will result not only in a new golf community home but one that matches all your requirements. The newsletter is free of charge. Subscribe here.

Cheap airfares put Scottish club membership within reach

Those inveterate golfers who love links golf in Scotland probably understand that many of the best golf courses on the Old Sod offer overseas memberships that are inexpensively priced. But for many of us who do not live near major city airports in the US, getting to Scotland (or Ireland) have made such memberships impractical, not to mention “expensive” given the cost of international air fares.

But now, those cheap airfares characterized by Ryan Air and Easy Jet in Europe have crossed the Atlantic in the form of Norwegian and WOW Airlines and made membership in a Scottish or Irish club much more practical, even if you make just one golfing pilgrimage there each year. Old Tom Morris used all the elements at his disposal -- the sea, the beach and the natural links land -- to fashion a long par four on the front nine of Balcomie Links at Crail.

Old Tom Morris used all the elements at his disposal -- the sea, the beach and the natural links land -- to fashion a long par four on the front nine of Balcomie Links at Crail.

In fact, I just applied for membership at the 7th oldest golf club in the world, Crail Golfing Society on the North Sea in the Kingdom of Fife, just 80 minutes north of Edinburgh and a mere eight miles from St. Andrews. By American standards, even for a semi-private club, membership at Crail is a steal and includes eight rounds of golf annually, four on each of Crail’s two courses (see below); free golf at Blairgowrie Golf Club’s three courses; deeply discounted rounds at Scottscraig, Ladybank and Lundin Links courses; and access to the Royal Overseas League club in Edinburgh, whose accommodations are reasonably priced (starting around $80 per night). The North Sea is in view from most holes on Balcomie Links.

The North Sea is in view from most holes on Balcomie Links.

The initiation fee for an Overseas Membership at Crail, at today’s exchange rate, is about $209 and annual dues just $161, or about $20 per round if you were to play all your eight rounds on an annual trip over to Crail. For those who like to plan ahead, tee times for members can be made up to a year in advance.

The two golf courses, Balcomie Links and Craigshead, make the most of the links land beside the sea. Balcomie, the old one designed by Old Tom Morris and opened in 1895, is buffeted almost constantly by winds off the water, and perfecting the knockdown shot is essential to a good score. As on most links courses, the fairways are only faintly more hairy than the greens, and putting from as far as 20 yards off the green often seems a better option than trying a sharp strike off the closely mown and hard turf. Craigshead, which was designed by Gil Hanse in 1998, is the perfect companion to Balcomie because there is no mistaking its links orientation yet some greens are receptive to more traditional approaches, especially if the pin placement is toward the back of the green. Hanse certainly bowed to a kind of quirky traditionalism by building a par 4 with a native stone wall sitting just beyond the range of a three wood, and creating a green that is bordered at its back edge by another wall. Gil Hanse's Craigshead Links might be 100 years more modern than Balcomie, but it still shows flourishes of tradition, including a wall behind a par 3 green.

Gil Hanse's Craigshead Links might be 100 years more modern than Balcomie, but it still shows flourishes of tradition, including a wall behind a par 3 green.

For those seeking a more permanent vacation in Crail, cottages in the postcard perfect seacoast fishing village start around $250,000 US. Besides a "free" eight rounds per year on the Crail courses, Overseas members receive deeply discounted green fees at other local courses, including the fine Lundin Links.

Besides a "free" eight rounds per year on the Crail courses, Overseas members receive deeply discounted green fees at other local courses, including the fine Lundin Links.

Fill your tank in SC, not in NC and FL...and certainly not in PA

Baby boomers in search of reducing their expenses across the board may want to look beyond North Carolina to its neighbor immediately to the South. A recent Wall Street Journal article, citing The Tax Foundation, indicates that state taxes on gasoline at the pump are twice as high in North Carolina as they are in South Carolina. North Carolina charges motorists 34.6 cents for every gallon of gas, second only to Florida among Southern states; the Sunshine State pumps 36.8 cents from every gallon of gas. South Carolina, on the other hand, assesses motorists just 16.8 cents per gallon, the second lowest in the nation after Alaska (12.3 cents).

The differences in gas tax assessments certainly are not reflected in the differences in the prices of a gallon of gas. But there is a correlation between states with the highest taxes and the overall prices per gallon. The gas companies, after all, must have their profits.

Put in real terms, if you burn through a tank of gas each week and fill up with 15 gallons 52 times annually, here is what you are paying in taxes to the three Southern states, respectively:

South Carolina -- $ 873.60

North Carolina -- $1,799.20

Florida -- $1,913.60

According to AAA, the current prices of a gallon of gas in the three states is $2.03 in South Carolina, $2.19 in North Carolina and $2.28 in Florida. The differences certainly aren’t enough to swing a decision one way or another on which state is the best for relocation. But one thing is for sure; moving from a high gas tax state like Pennsylvania, where the gas tax will amount to $3,026.40 annually on the same basis as above, will help save serious dollars for those who burn a lot of gas. The cost of a gallon of gas today in Pennsylvania averages $2.53. Moving to South Carolina from Pennsylvania will save 50 cents per gallon, or roughly $390 a year in gasoline (based on one fill-up per week), enough to pay for golf club dues for a month, a few great meals in Charleston, or a brand new Titleist driver.

The full article in the WSJ can be accessed here. If that doesn't work, just send me an email and I will forward it to you.